https://www.youtube.com/watch?v=uLn7m6-UFg4

Modelo 130 IRPF - tutorial con pantallazos 2024

Hello, entrepreneurs.

Today we are going to see how to prepare the one hundred and thirty model that many self-employed workers have to submit every quarter and which is used to make payments on account of personal income tax.

I will explain the main boxes to you and we will make a statement step by step, with prepared screenshots.

Let's go there.

Structured the video in three parts.

If you want to go directly to the presentation example of the one hundred and thirty model, you can skip to the corresponding minute.

First let's see what the model is.

One hundred and thirty, how it works and who has to submit it.

I think it's important to explain it so you know what you're doing.

When you fill out the quarterly model, then we'll get into the subject with the screenshots and an example of presenting the model.

One hundred and thirty.

Finally, I will reflect on the limits of this model.

So let's see what the model is.

One hundred and thirty and what is it for.

You already know that in Spain all workers have to advance personal income tax or personal income taxes.

Employees have withholding on their payroll and some freelancers, those who bill primarily to companies, have withholding on their invoices.

It is your clients who make the personal income tax payments corresponding to these withholding taxes on your behalf.

Then there are those freelancers who bill individuals.

They cannot apply a withholding on their bills because their private customers are not going to manage the money with the Treasury.

The solution is simple: those freelancers have to make quarterly on-account payments and that's where the model appears.

One hundred and thirty.

If a self-employed person has less than seventy percent of their income subject to withholding on the bill, they must submit the one hundred and thirty model.

This means that not only self-employed entrepreneurs who do not have personal income tax withholding on their invoices present the model.

So must self-employed workers who have withholding on their invoices, but have had more than thirty percent of their sales without withholding during the previous year.

If they have just started the activity, the percentage of the period to which the declaration refers must be taken into account.

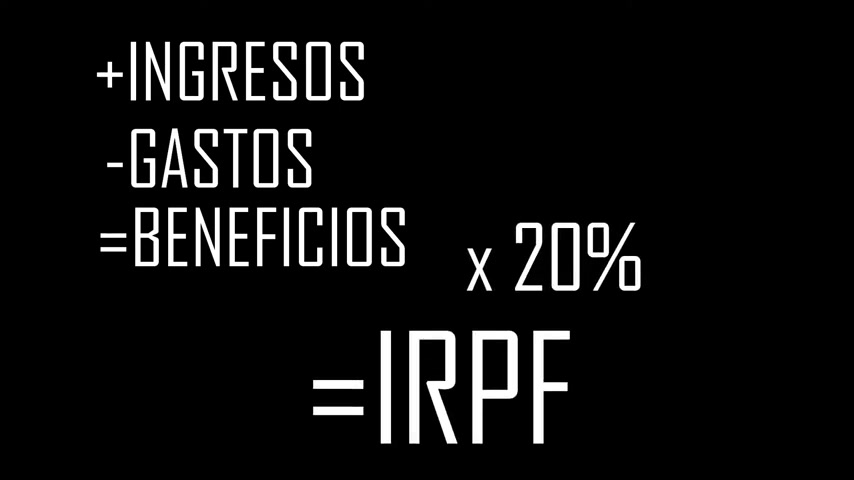

The down payment for the one hundred and thirty model is made based on profits for the quarter.

In other words, the difference is made between the income and the deductible expenses of the self-employed person.

And twenty percent is paid on that result.

I repeat, this is only an account payment during the income campaign, the final calculation will be made and it will be determined if you have to overpay or if the Treasury has to return part of the CPI collected.

If that part is clear to you, we can move on to the detail of the model and its statement.

Before we begin.

I want to stress that this video is just an illustrative example.

It's not about advice.

If you are going to file the one hundred and thirty model on your own, you have to check with the administration and make sure that you know what you are doing because you are responsible for your quarterly returns.

In the description I give you a link to the instructions for the one hundred and thirty model.

Let's now go step by step.

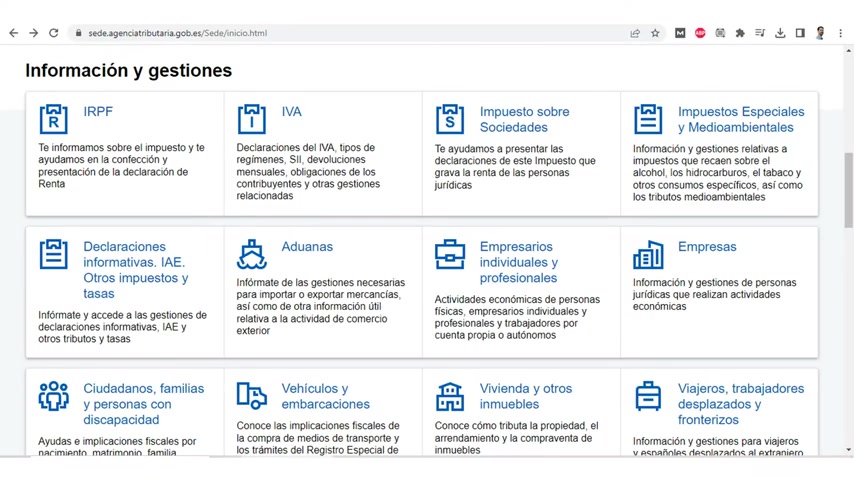

We are going to the main page of the Tax Agency's electronic office.

I will put a link in the description, we go down to the Information and Management Section and enter the Individual and Professional Entrepreneurs section already in the section.

Let's go there.

Personal income taxes Bottom line.

We are going to installment payments.

In the highlighted steps section.

We go to all the steps and that's it.

We select the model.

One hundred and thirty presentation.

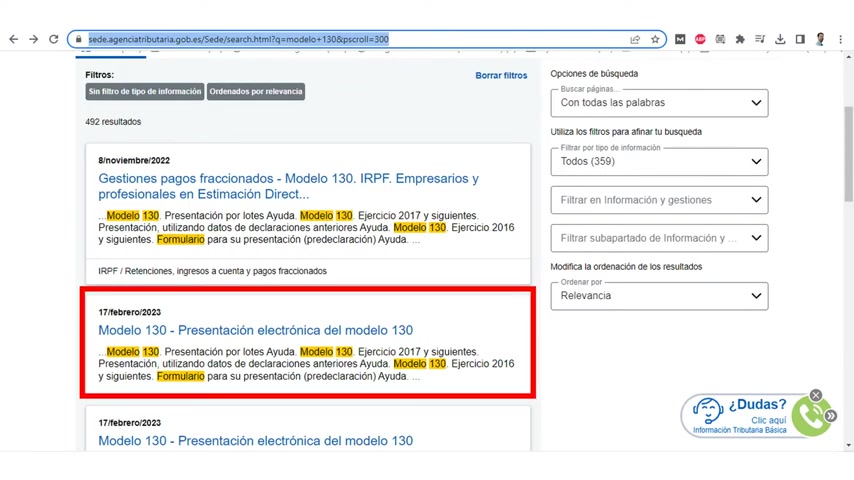

Alternatively, you can search for model one hundred and thirty in the search engine.

It will take you to a results page, which in turn will link to the model page.

One hundred and thirty.

The search engine can be useful to you when you want to access a model declaration.

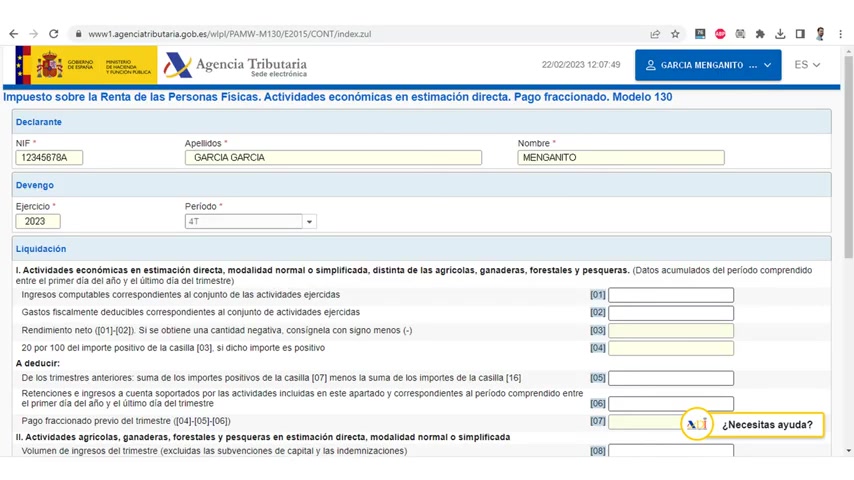

Specifically, when we click on the model one hundred and thirty, the first thing that appears to us is an identification screen.

We're going to do it with a digital certificate, but you have other alternatives.

We click on the digital certificate that we want to use.

It takes us to a screen of identifying data.

We will have to enter the year, the period, the name of the self-employed person, their last name and their name.

Let's assume that we do it for the fourth quarter of the year two thousand twenty-three, so we'll put in exercise two thousand twenty-three and period four T and we're already at the heart of the matter.

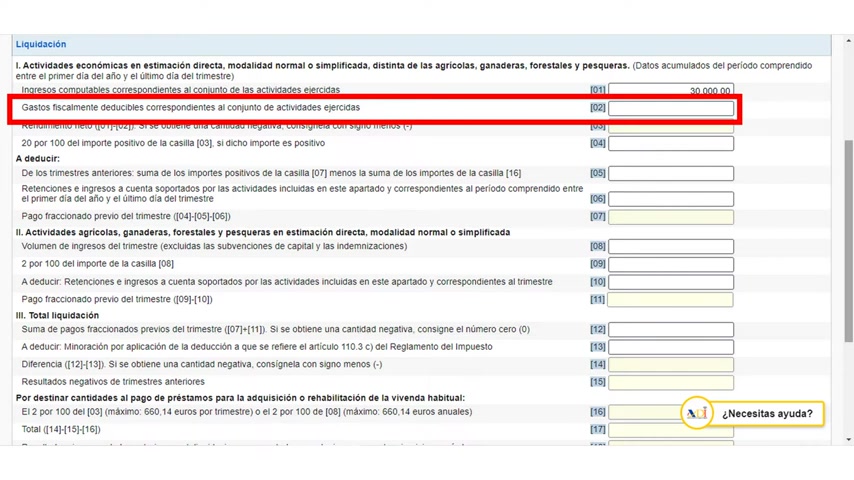

Let's see what is filled in those boxes.

First, keep in mind that the one hundred and thirty model is always filled in using accumulated amounts corresponding to the period between the first day of the year and the last day of the quarter for which the self-assessment is submitted.

In other words, for the first quarter you fill in the data for the quarter for the second quarter you indicate the amounts for the semester and for the fourth quarter you put the amounts for the whole year in box one.

The Treasury says that it is necessary to record all tax-computable income from the economic activities referred to in this section and that correspond to the period between the first day of the year and the last day of the quarter.

Simply put, that corresponds to your taxable sales.

In other words, if you bill thirty thousand euros plus VAT throughout the year, your income will be those thirty thousand euros in box two.

The Treasury indicates that it is necessary to record the amount of expenses that, considering them to be tax-deductible, are attributable to the economic activities referred to in this section and correspond to the time period indicated above.

In addition, tax deductible amortizations and provisions are included for activities in simplified direct estimation.

Also included are expenses that are difficult to justify for the period.

Simply put, that corresponds to your deductible expenses for the period.

Suppose that during the year you paid four thousand euros in Social Security contributions and six thousand euros between office rent, services and other deductible expenses.

You get a total of ten thousand euros in expenses.

Remember that we usually talk about taxable expenses, without VAT.

There are exceptions, such as activities that are exempt from VAT and that, therefore, VAT can be deducted from your purchases.

But that's not the general case.

The rest of the self-employed usually file VAT returns, in addition to personal income tax returns.

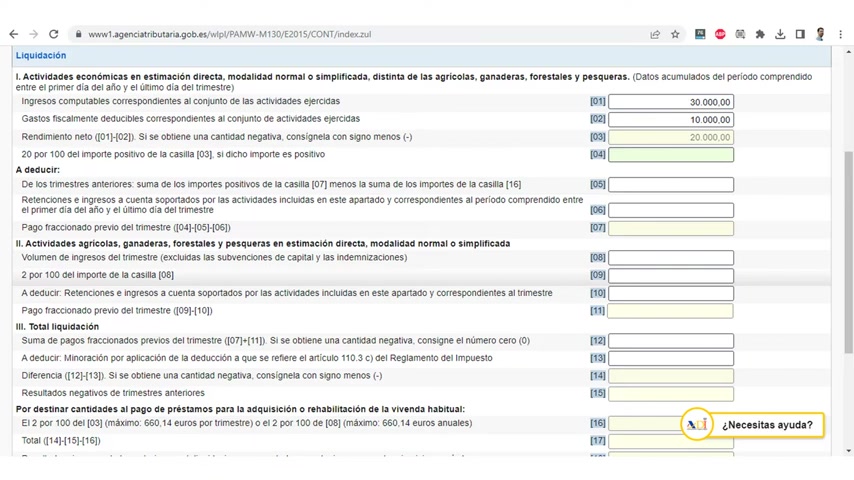

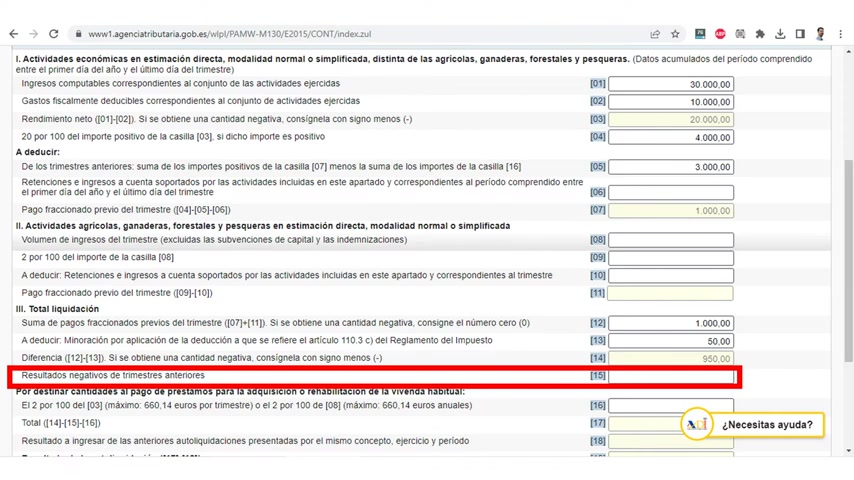

As you can see, box three, which is the difference between one and two, has been calculated automatically and an amount of twenty thousand euros appears in box four.

If the amount is positive.

In other words, if your activity has had a profit over the period, twenty percent of the value of box three is set.

In that case, it is not calculated automatically.

You have to put it by hand, so we put in four thousand euros, which is twenty percent of twenty thousand.

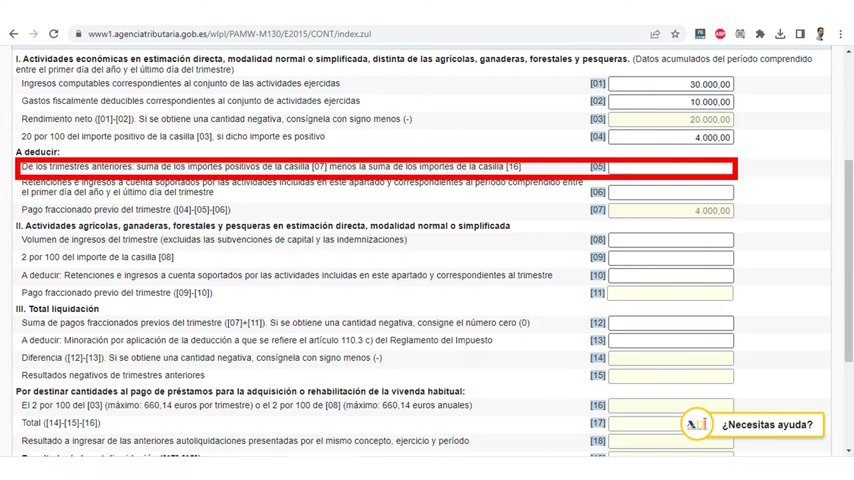

In box five we are going to put the sum of the installment payments that were already made during the same year, because how is the benefit of twenty thousand euros for the whole year?

It includes benefits from previous quarters for which we have already paid taxes.

Obviously, if the return corresponds to the first quarter, nothing is put in that box.

To simplify, I ignore the part about box sixteen that has to do with renovations in the house.

You'll need to see if your case applies to you.

Let's say that in previous quarters we paid a thousand euros each time, that is, three thousand euros in total.

And we indicated it in box five.

We see how the difference between cells four and five has been calculated in box seven, which now shows an amount of one thousand in box six.

Indicate the withholding you may have had in the period from the beginning of the year to the end of the reporting quarter.

In that section for the example I am not going to put anything because I am taking as an example a self-employed person in business activity.

But if you withhold your bills and those withholding bills don't exceed seventy percent of your income, this is where you indicate the total amount you already withheld in the year so you don't pay twice for the same thing.

For simplicity, I'm going to ignore the boxes eight to eleven that correspond to agricultural, livestock, forestry and fishing activities.

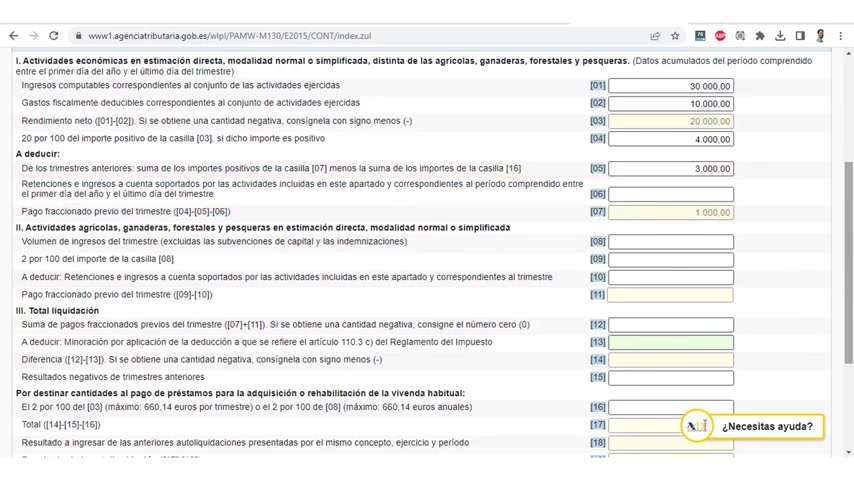

Box twelve simply indicates the sum of cells seven and eleven.

Like in eleven we haven't put anything in.

We put the same amount as in box seven, that is, one thousand euros.

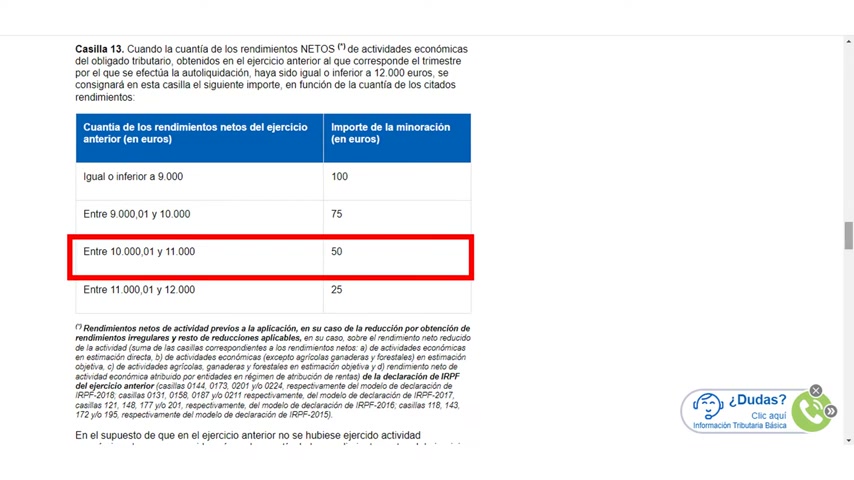

Box thirteen is important because it allows people who had a previous year with low benefits to reduce their IPF account payment.

For practical purposes, it is considered that if you were not active in the previous year, your returns were zero.

If your income or benefits from the previous year were less than nine thousand euros, you can put one hundred in box thirteen.

Throughout the year you can deduct a total of four hundred euros one hundred.

In each quarterly return there are several amounts of deductions, but if your income exceeded twelve thousand euros you cannot deduct anything.

Let's suppose for this example that this is our second year of activity and that the previous year we had returns of ten thousand one euros, so we are entitled to a deduction of fifty euros.

We see how box fourteen changes to nine hundred and fifty euros in box fifteen.

Negative results from the previous quarters indicates to us that only if a positive quantity had been obtained in box fourteen above, we must record the unsigned amount of the negative results that, if any, would have been in box nineteen of any of the previous self-assessments model one hundred and thirty of the same financial year and that had not been deducted previously, taking into account that in no case can an amount greater than the positive amount entered in the box be deducted before, taking into account that in no case may an amount greater than the positive amount entered in the box fourteen.

In our example, it doesn't apply because we assumed that we had profits in the previous quarters, but if you start the year with quarters that show losses, when you finally have benefits, you can reduce the negative results of previous statements.

I already said that I was going to ignore the box.

Box eighteen is in case you have already made a declaration for this same concept, year and period, that is, that you have already paid and that you only submit an additional return to correct an error, so as not to pay everything again, the amount you already paid is deducted.

If you are going to make a supplementary one, you will have to check the box and indicate the identification number of the previous declaration.

And it's already in box nineteen you have the result of the declaration, that is, what you have to pay to the Treasury.

In this case nine hundred and fifty euros.

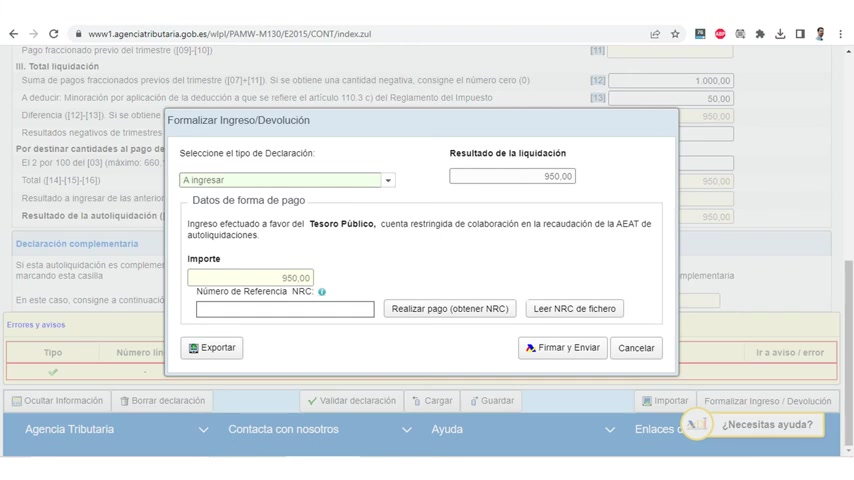

We give it to validate to verify that there are no errors.

Now we are going to formalize admission.

A screen appears with the amount resulting from the declaration.

We give you to make payment and get NRC.

We select payment on account and a screen appears with our data, information about the model, the period and the amount to be paid.

We indicate our bank account and we accept data and continue.

A screen will appear to confirm and sign the payment.

The payment to our current account will be made immediately.

If you make the declaration in advance, you can direct debit the payment to be charged on the last day.

You can also pay by card.

I have given the example of charge to account.

For example, it allows us to return later to the previous screen, automatically copying the NRC number that was generated for payment.

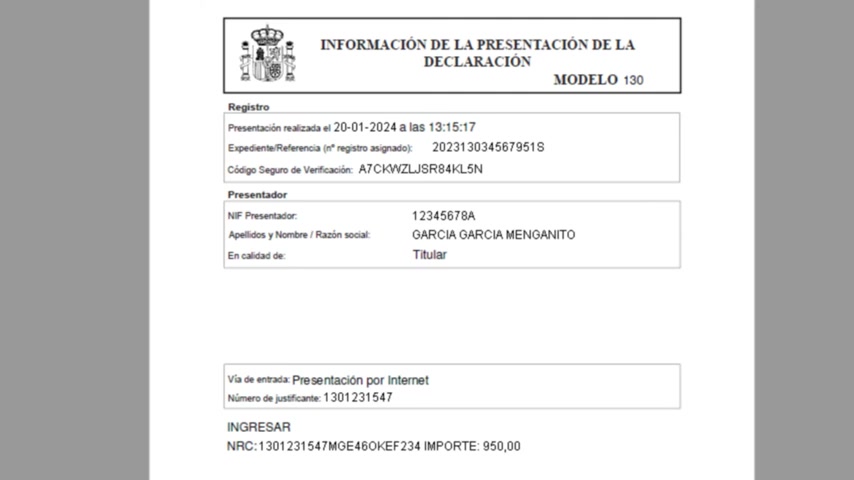

We give him to sign and send and then we sign the statement, not without first verifying that everything is fine.

Below is a PDF with the information from the declaration, on the first page there is a summary that indicates the reference numbers and the amount paid.

In the following is a declaration form with all the boxes that you can save or print and that's it.

The declaration of the One Hundred Thirty model has now been presented, as I told you at the beginning of the video, I want to reflect on the One Hundred and Thirty model.

It seems to me that making an account payment of twenty percent of the benefits is too vast a calculation.

Those with low incomes advance too much and RPC, even taking into account the deductions from box thirteen that I mentioned before and those with high incomes have to pay a very large supplement in the income campaign.

I think a variable percentage based on the estimated profit for the year would be more appropriate.

Or if you don't trust the forecasts, you can build on the results of the previous year.

At least that is my opinion to try to adjust the on-account payments with the actual amount that is paid in the end.

What do you think and that's it?

If you liked the video, I have others that explain important steps for the self-employed, for example, how to register step by step in Social Security and the Treasury.

Like the video and don't hesitate to subscribe to keep up to date with my next posts.

I also invite you to participate in the comment section.

I say goodbye for today.

Have a great week.

See you soon.

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.