https://youtube.com/watch?v=UQdJPy7IJO4

Як легалізувати та оптимізувати доходи в Іспанії

we talked about autonomous driving , about various issues related to autonomous driving , how to open , what to do .

there were a lot of questions that we could not answer ourselves we decided to talk with the hector and ask him to answer some of the questions .

i will say that a lot of questions were asked in the blog , where there was a registration , and i answered some questions , i did not have time to answer some questions .

we will try to answer some questions during our meeting , but i can't guarantee that we have enough time to answer all questions .

and there are a lot of questions that i have read .

there are many specific questions for a certain person .

if we talk about general cases , general cases , then each case may have its own nuances .

therefore , we will talk in general , say , the average in the hospital , we will discuss the general , the average , but we will look at each case separately .

this is not the topic of our meeting .

if someone needs to consult or have a discussion with the historians , nelly will be able to tell us a little about herself , about the campaign .

we will talk about nelly today .

nelly works in the global god is with us , and the editor is with nelly .

so , can you tell us a few words about the campaign , what services you provide to people who are watching this video , so that they know if they come back , what questions you support in spain ?

first of all , we are in madrid , we have three offices in madrid , but most of our clients are in the countryside of valencia , malaga , all our people , ukrainian , russian .

what does the company do ?

the company belongs to a man , a man from the lawyer , where we have a status in the legal department .

specifically , i can call myself christo , i am self-employed , i am a lawyer .

our company is based on the 30-year market , we have a man .

when i came to spain , i left my husband's company and i did my degree in accounting .

i paid for it and i have been working in this field for 13 years .

i got my bachelor's degree in accounting , so i worked there for 13 years .

what does the company do ?

it deals with legal issues , communication issues , this is the introduction of the company , the introduction of autonomy , the presentation of declarations , and the full spectrum of services related to the introduction of business in the spanish territory .

well , that's all .

thank you .

okay , let's move on to the topic of our meeting .

we have planned to meet for one hour tomorrow .

we will see how much we can cover .

we will make a webinar recording anyway .

if you could not connect now , you can look around .

if you have any questions , please write in the chat .

i will try to answer these questions .

if there is any discussion , then we will be able to talk about the voice .

the topics we want to touch on today are topics related to the discovery of a legal person in spain .

the most important topics related to the declaration of the 22nd year .

the topic is very extensive and we will not talk about it now .

okay , let's move on to our questions .

we have already discussed them .

the first question i would like to talk about was not much , but there were no questions .

some people asked about the production of seashells .

i want to quickly close this question .

maybe someone will be interested and then we will move on to other questions .

the next topic is if sailors have been sailing in the mountains for more than 183 days , and i am in spain , what taxes should be paid ?

maybe , nelly , you can say a few words .

yes , well , it's a very delicate topic , even today , the speakers had questions .

first , about the third spain , there is a certain eichmann-stophian-marinil , this is a special regime , this is a special regime of the young people , and it consists of the young people who work in the border areas of spain .

this should be made clear .

our young people , that is , people who are living in the temporary housing , who work in international cities , will depend on your income , on the amount of your services .

this country , this company , the country you are in , we must always pay attention to the right to the right to the right to the right to the right to the right .

we talked about it , for example , in the report , which was published in singapore .

they say it should not be treated as a crime .

for example , we have a story about a man who was paid in singapore .

he was paid there .

he was not paid in the capital , but he was paid in the capital .

he was paid in the capital .

in singapore , there are up to 60,000 people who have been paid .

of course , this is a kind of payment , but if you take a personal approach , then each person , each person has a different opinion .

because if you pay taxes , you need to take the evidence to them , and they need to do it personally .

these people are not registered in the territory of spain , they are obliged to look at the situation .

the additional residence is actually 183 days in spain .

moriarty is located more than 183 days abroad , but his family is in spain .

his family is located in spain .

this means that he is also the resident of spain and must pay the taxes .

i will say it again with my words , but if it is a question of speech , there are a lot of nuances .

if , for example , the sailor sails in the territorial waters of spain , this is one case .

if there are international waters , if there is a contract with , for example , singaporean companies , then in this case up to 60 thousand is not covered by tax .

that is , if it is obtained up to 60 thousand , a declaration is simply submitted and there are no taxes at all .

the key point is that it is necessary to understand very well a specific case , understand what contract , with which company , with which country , and then understand what taxes are paid or not paid in spain .

therefore , if we talk about sailors , we should just turn to the history , show the contract that exists , what the contract is about , and then , accordingly , clarify how to proceed .

and then we will explain how to proceed .

i don't know if you can hear me better now .

much better now , nelly .

great .

i apologize to everyone , i had a problem , i don't know why we have such stories today .

i suggest we move on to the next topic .

the next topic we would like to talk about is autonomous .

there are many questions about autonomous .

one of the questions is , i will not tell about autonomous at the beginning , how it is created , if you have not seen the previous webinar , i will send an email to the previous video , you can watch it there , i will explain further , there are different emails on different sites .

if the autonomous works , if the autonomous is registered in spain , then all documents , not documents , but the relevant invoices must be , the invoices are taken into account by the money , then the declaration is given , and the labor camp is counted accordingly .

the question that nelly asked is whether it is possible to get money for some account , for example , for a one-hryvnia account , or for a revolute , vice or something else .

nelly , can you comment on this ?

there are no restrictions .

yes , look , the main position is that if we have a tax check , it works like this .

you will always be asked about the invoices , that is , the spanish invoice , and you will be asked about the payment .

so , in principle , if you are paid for the vesa , if you are paid for the payoneer , if you are paid for the piner , if you are paid for the revolut , and you have the opportunity to actually withdraw the confirmation of this payment , that is , the confirmation of the payment , there will never be any problems .

that is , you can , for example , take the payment for any account and transfer it to spanish .

there will be no problems .

the only thing to keep in mind , i already mentioned it in several videos , is that you can get your money in ukrainian .

the only thing you should keep in mind is whether you will have problems with ukrainian tax ?

do you have questions about where the money comes from ?

although ukrainian tax does not have direct access to the accounts .

in order for the ukrainian tax service to check your accounts , you need to make a decision .

keep this in mind , because this information is closed .

do you see spanish tax accounts ?

yes , there are certain cases when banks transfer direct information to the tax office .

that is , if the payment is high enough or you are constantly paying cash , without stopping for your spanish account .

in this case , they can pass on information to you .

why ?

remember that the banking system , that is , all banks , in general , all of europe , they are in the system where the bank is , where the capitalist is .

what kind of system is it ?

it is a system in which the bank is forced to inform the tax office about the suspected operations and , of course , some constant contribution of the production costs can cause you problems .

if it is a transaction , that is , a transfer between the costs , between the accounts , even if they are foreign accounts , then there is no problem .

you will not have a problem .

you can get money for any account .

and if , for example , money comes to ukraine , you do not transfer it from ukraine here , take off the cash and put it on the spanish account .

will there be problems ?

there will be problems with the bank .

because you will constantly have to confirm where you have these invoices , or , for example , that you work independently , or that you work legally .

it's very difficult for the spanish to understand this .

it's just very difficult to understand that there is such a traffic , there is such a number of traffic jams .

because they don't really operate here .

in some exceptional cases , yes .

we are used to the cash and it is normal for ukraine .

absolutely .

will you have any problems with the banks ?

because before the tax office , i can defend your position and say that i received this from the ukrainian resident .

i paid taxes for this .

here is my bank statement , here are my fees .

this company paid me and i declared the money .

so , in principle , there will definitely be no problems with the tax .

i have come across such a problem .

it was solved only when , first , they asked for all the visas from the ukrainian tax office .

and secondly , when you take out all the checks from the atm , you always have to take ...

to save .

yes , to save .

only thanks to these checks and the tax evasion from ukraine , we managed to solve this problem .

if there were no checks , there would be a problem with the bank .

but most likely you would still work as a ukrainian fob at the moment .

of course .

so , if you work as a spanish fob , you understand that as a spanish one , it's a very different situation .

of course , it's for the past years .

because now the situation is that you cannot transfer money from ukraine , you just need to withdraw it from the bank .

and along with the ukrainian tax issue , i submit it to the bank .

they know that i have paid taxes from these funds and that i have removed them from my ukrainian card .

that is their authority .

without this , they will have problems , they will block the accounts .

maxim , i'm sorry , i'm forced to interrupt a little .

of course , i'm sorry .

thank you .

yes , indeed , there are some nuances in the bank , you can check them , but let's move on .

the question that is often asked is whether it is necessary to open an autonomous company in the first place .

what to do if people work there as a fob or work in some american companies , get money for revolutions , for vice , or do you need to stay in fob ?

the main thing is , i will say my opinion , and then nelly will add .

here , the main thing for you is to understand what is your further goal , the goal of staying in spain .

if you plan to stay in spain for six months , then return to ukraine or go to another country , then it's one thing .

if you plan to get a patent here and then apply to the wnj , then we wish to somehow open up an autonomous or osl or something else .

in any case , it will be easier to apply for a residence .

you can apply if you have half a year of work , as far as i know .

you can apply for a residence under what is called another residence of another type .

it can be like the person who is most busy or , for example , on the contact .

so the first question for yourself is just to give an answer to the question what is your further goal .

and accordingly to this , it is necessary to understand and open an autonomous housing estate , or maybe not do anything , but just submit or not submit a declaration .

i don't know , anelia , will you add something ?

yes , i completely agree .

i always say that for starters you have to set a goal for yourself .

if the goal is set and i want to stay in spain , i want to change my residence to some type , either as a self-employed person or by contract , then of course you need to show that you are interested in spain , that you can provide for yourself , because the ukrainian autonomy , of course , which we earn in the territory of ukraine , is not entirely interesting to spain .

well , i understand that .

if we talk about autonomy again , if we open autonomy , now autonomy pays social succeed , social fear , pays about 80 euros a month , is the salary paid by the autonomous .

and you know , these decreases will continue later , if people ask how it will be later , if we talk about the general system of fear control , then not very good amounts come out .

well , there will be no decrease there .

accordingly , you already have to understand who starts who , for example , started the activity back in 2022 , for him there will be two years of in 2022 , he will have two years of pension , as planned .

today , we have 12 months , that is 80 euro of pension .

then we will have a similar scale to the progressive scale of the profit tax .

there is a certain table , you can see it on the internet , there are many of them .

if i earn less than 600 euros a month , my salary will be 200 euros .

if i earn more than 6,000 euros a month , it will be 530 euros .

the rest will be proportional .

is it a separate fear , or is it separate income ?

no , no , no .

we are talking about separate fear .

but , so that you understand , i will ask you why i pay for it .

please understand that social insurance is your social insurance .

since alexey and i have been together for a while , he knows .

yes , it is social insurance .

i am sick , i am paid by the doctors .

i have a child , i am paid by my parents for six months .

i get a pension .

it's not just money you throw away for a visa .

i think that most ukrainians here , for example , we can legalize our pension tax that we earned in ukraine .

our pension tax that we got in spain can be legalized in ukraine if i come back .

it's not about the money being spent .

it's the tax we pay .

we minus it when we pay the tax .

so don't think that the money will be spent .

it's not like that .

there are benefits from these payments .

thank you .

another question was , what kind of activities can be done through the optician ?

is there a list of activities ?

look , activities are not important here .

if you worked as a ukrainian fob , it's almost the same story as the loans .

the loans in ukraine that you had , you had to join some kind of a loan , so why don't you do the same in spain ?

you have to join a kind of activity during registration .

you are showing what you do .

in fact , for most of our ukrainians , this iae , in spanish it is called , it does not have much significance .

why ?

because all our invoices that we issue go beyond spain .

but if we work in spain , this type of activity is very influential .

why ?

because it influences taxes .

it's the work of the empresarial or professional .

in other words , invoices are issued there .

we are talking about the territory of spain .

if , for example , i , as a professional , i issue invoices on the territory of spain , it will be very different from the invoice you will put on the word american or ukrainian client .

it will be very different .

even the taxes will be different .

as a result , your annual declaration will be almost identical , that is , you will still have to pay to pay .

but the invoice itself will be very different .

very .

that's why they created ...

there is one difference between the credit and the spanish .

in that case , if you exceeded one million euros during the year , but in any case , this tax is very little for anyone .

thank you .

i have a question .

what does the owner of a club in ukraine do ?

i work in ukraine , but now i'm in spain and i want to work , i'll give you a contract , for example , as an it employee .

can i agree that i have a club in ukraine , i have an owner here , and here , for example , i can pay taxes , or what should i do with the fact that i have a farm in ukraine ?

if you are in spain , you are a resident of spain , and you have an online activity , that is , you work as an it worker in this context .

you are forced to pay taxes here and register your own name here .

if we are talking about some physical business , that is , if my physical store is located in ukraine , it is a completely different situation .

of course , you have to show these revenues here , but you can support the ukrainian fop in ukraine .

because it is a completely different activity .

and then you have to figure out how to pay , where to pay , how to pay .

so the question is , can the fop work here like this ?

how to pay ?

this is a separate question , you need to sit down and analyze it in detail .

yes , of course , you understand .

well , we will forget about 2022 , because it is so incomprehensible .

it is blurred and incomprehensible whether i am a resident or not , but when you're in 2023 , you have a family , you have children going to school , you're all people , you're residents .

if you're a resident , you have to work officially in spain .

there are people who , for example , i have had so many accidents with ukrainians in the last six months , everyone has their own story .

there are people who do not rent an apartment , do not have accounts , they just have ukrainian fop , they get income in ukraine .

i doubt if they will see the spanish tax .

i doubt it a lot .

thank you .

i have a lot of doubts .

thank you .

and one more question about autonomous .

there are not even one question about psychologists .

if a person works as a psychologist , a psychotherapist , in ukraine , this activity is practically not licensed .

that is , a person has a diploma , but in the ukrainian license , this activity is not licensed .

in spain , if you say a psychologist's diploma , it must be done in a small amount .

in spain , if you want to get a phd in psychology , you have to do it in malaga .

are there any options that you can open up a store as a consultant and provide some services here ?

and provide some services , can you recommend ?

yes , it's ideal .

you have no right to practice in spain , even if your clients are outside the borders of spain .

you have no right to practice as a psychologist .

first , you need to be registered in the official colleges .

of course , if you do not have a certified diploma , you cannot give such consultations .

will you be checked there ?

well , probably not .

if you , for example , are registered under some kind of activity like coaching , some kind of consultation , you can work in this way .

the advantage is that psychologists in spain don't pay for the pda .

for example , they are not pda payers .

and if you , as a consultant , are going to pay the physical person , you will be forced to pay for the goods .

this means that you have already lost 17 euros from the 100 euros you have paid .

because you have to give them to the state .

you said that you can only give services to people who are in the territory of spain .

if i give a service online , how can i check if a person is on the other side of the road ?

no , you can't check .

you just can't practice as a psychologist in spain .

if i have a diploma , i can apply for it .

if you have a diploma , of course .

there is no problem .

you can apply for it .

you can give your services .

you save your money and work .

the only thing you should keep in mind is that the diploma is quite expensive and it took a long time to get it .

you need to have a language to get the diploma .

it seems that the ukrainians were a little bit confused , but in any case , you will have to learn the language to do the homologation .

there is a similar question about lawyers .

if a lawyer in ukraine wants to give some power to a spanish woman , she also needs to do the homologation to a in order to become a spanish , you need to have a self-reliant life or even get a spanish education .

it's the same as the official college of the law .

if you are a lawyer , you need to have this license .

can you practice ?

you are ukrainians , we can practice everything .

you know , to have a desire .

the question is whether it is legal , correct , right or you will be caught .

well , you can do everything you want .

understood .

let's move on to the next topic , because time flies very fast .

the next topic we want to talk about is autonomous .

again , if there is a question how to open an autonomous , what to open .

in the previous webinar , we wrote a letter of advice , we showed the time , how much time it takes to see it .

the next question i would like to look at is the question of family autonomy .

because a lot of people do not know what it is , what it is for , what it is for , and what we are actually doing with it .

an interesting question , anelida , can you explain in a few words what family autonomy is , what it is for ?

look , i'll tell you this on my example .

for example , 80 shares of the company belong to my husband .

as a wife , i cannot work in a company on a contract .

this is prohibited .

i work in my company as a family self-employed .

what is a family self-employed ?

we work in some family company , that is , i perform some work , i help my man , i work , i perform some work and receive my salary .

this is not quite a salary as per contract , although you will have a accounting agency , you can give it to the bank , that is , officially .

the only thing , for example , we have a family , we have a leader , a leader who takes care of himself , he puts out invoices , takes care of himself , pays .

his wife helps him .

okay , what happens ?

as a leader , i pay taxes , i give my id and i pay the salary .

if the wife helps me , she pays the same social contribution , but the man pays her for her salary .

it is necessary that the accounts are separate .

for example , i am constantly checking in advance whether the salary of the salary is really made .

that is , it must be made from the man's account to the account of the wife .

if the salary is there , the accounting agency is there , super .

the salary will differ from the previous one .

for example , the new autonomous driver will pay 80 euros per year .

for the family driver , for the family autonomous driver , it's 153 euros per year .

the leading autonomous will pay 80 euros for the family , family autonomous , the family , the wife .

this is the first year 153 euros .

i'm sorry , 18 months , 153 euros .

next will be 225 .

after 24 months , it will be 306 euros .

a stable rate .

keep in mind that every year the rate of this contribution to the sostrak has increased a little , always .

so , for example , what do we want to achieve with these actions ?

our wife legally receives a salary , socially protected because she got sick , received medical treatment , gave birth to a child , received maternity leave .

we reduce our tax burden .

that is , we have a cost .

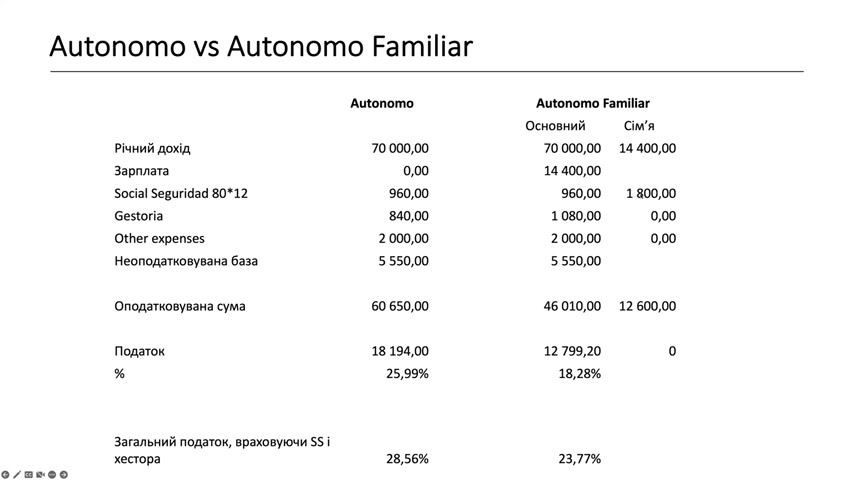

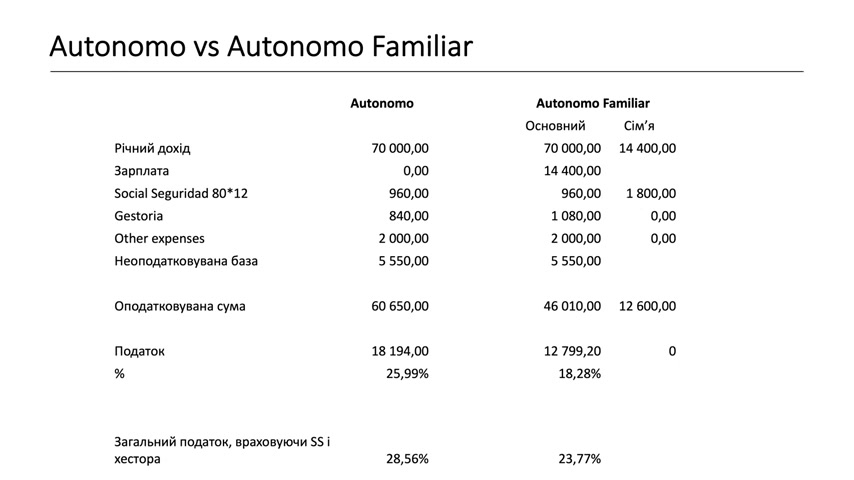

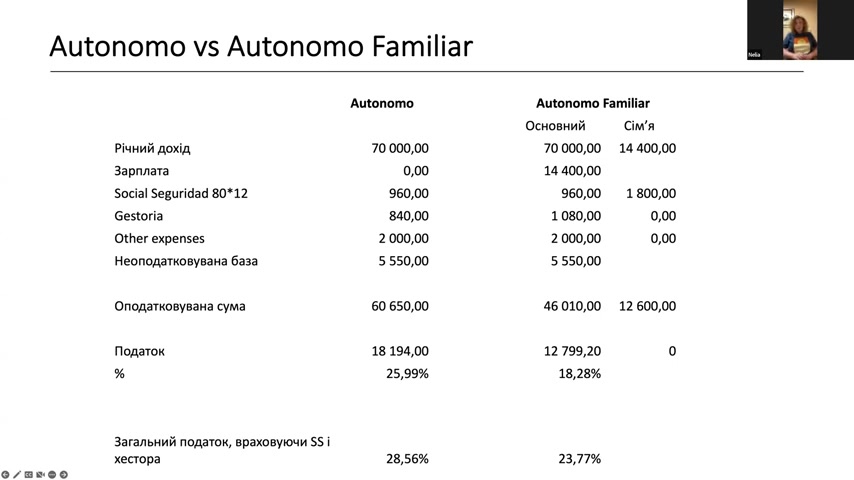

i want to show you a slide .

now , an example of calculation on the autonomous and family autonomous ?

this is one of the questions .

how can we reduce taxes ?

if you actually have a wife or husband , and it's supposed to be an official marriage , is that correct ?

yes , correct .

if you didn't ask for anything before , the question will be confirmed .

it must be an official wedding and translated into spanish .

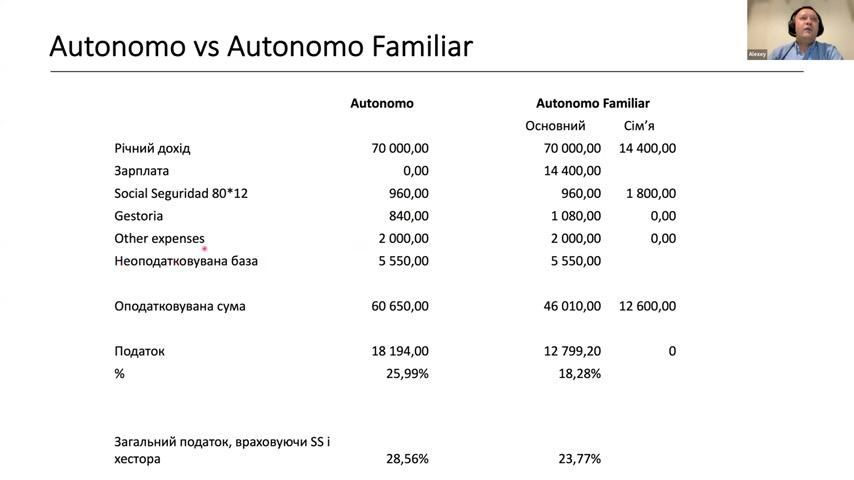

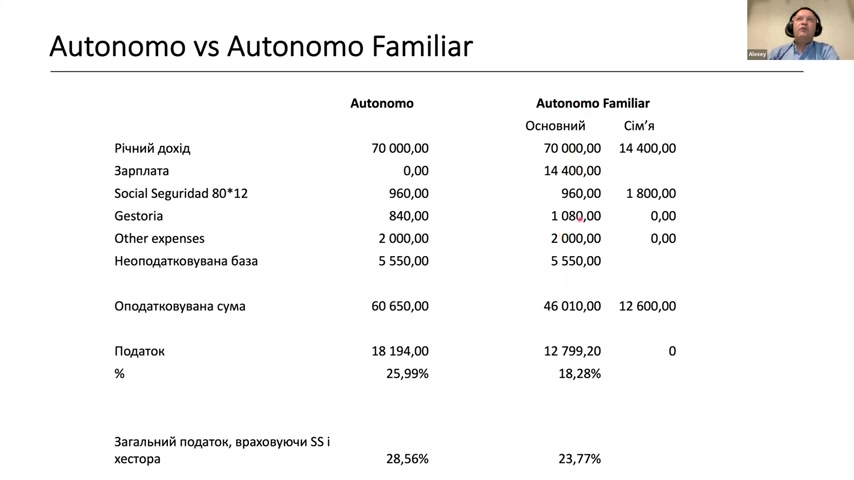

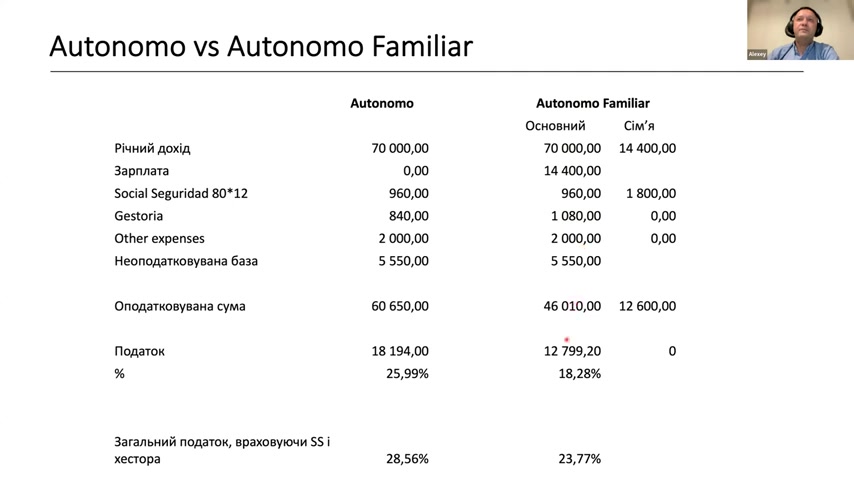

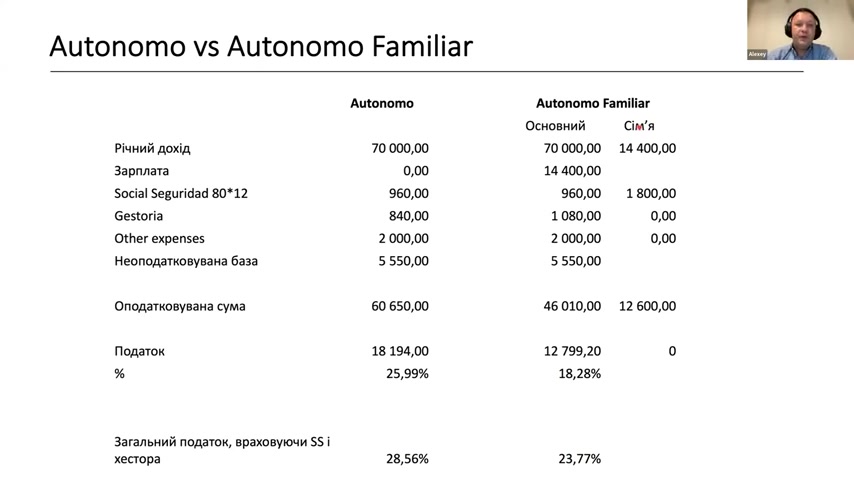

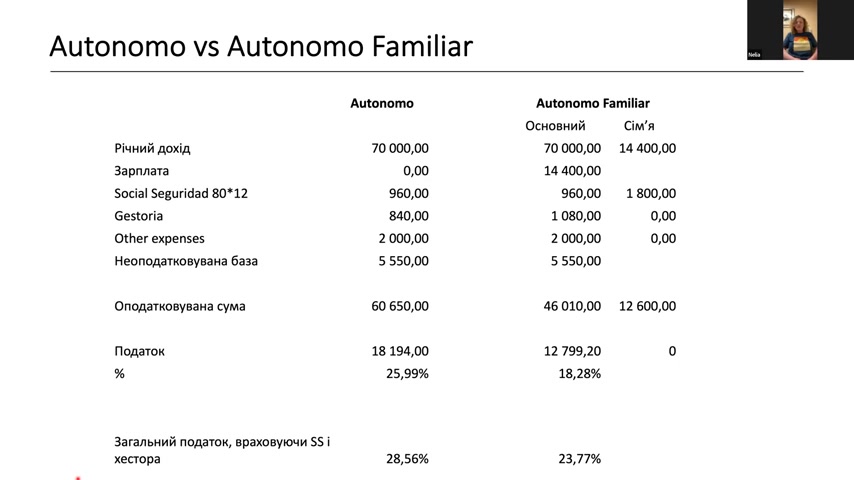

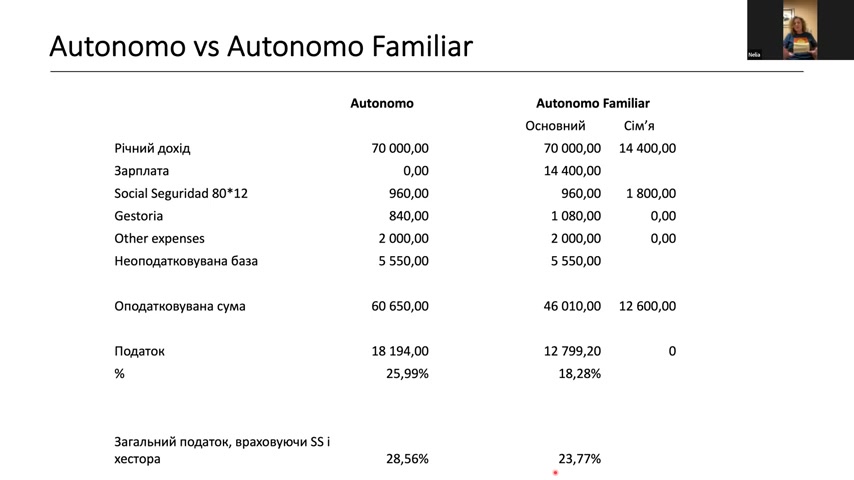

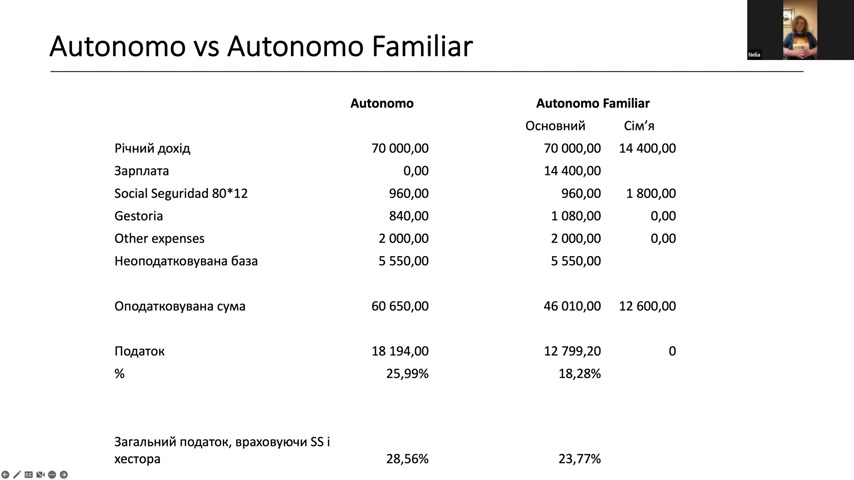

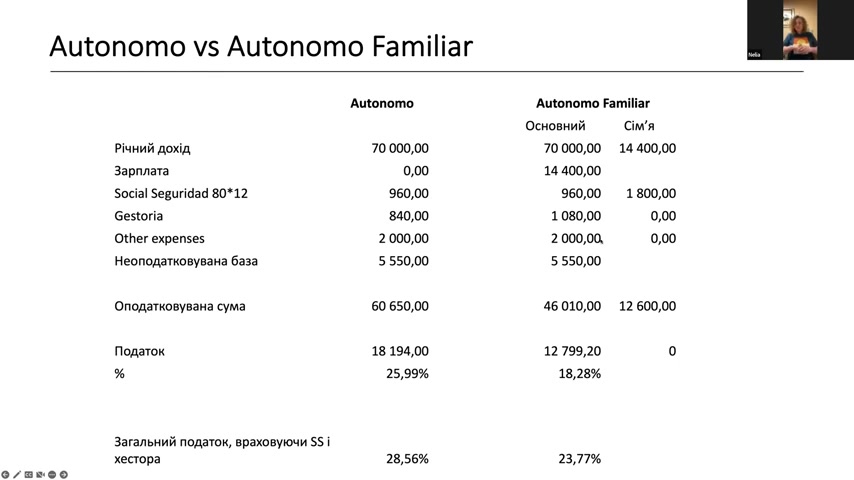

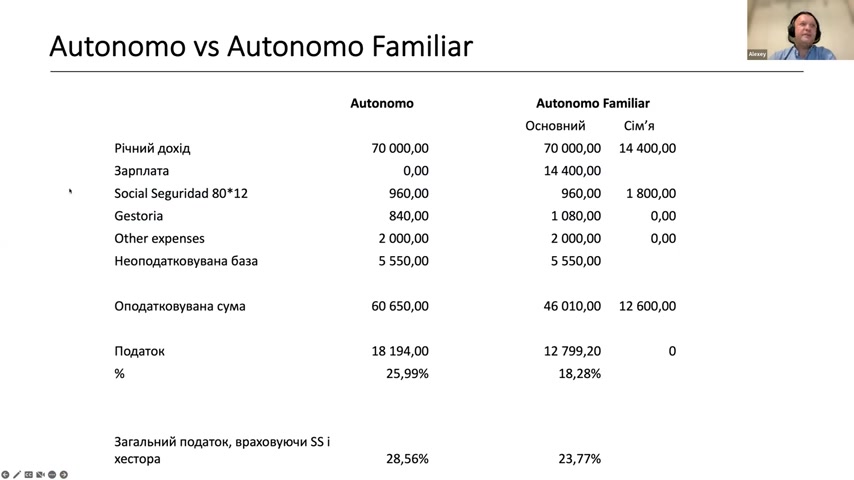

so , look , there are slides in my book on the definition of tax on the autonomous and family autonomous .

so , look , there are such slides in my , on tax return for self-employed and family self-employed .

if you take , for example , 70,000 , the next income that the self-employed can receive , if we take the example of 70,000 , this is the final income that the autonomous can receive .

i've been asking you to give me a list of social security .

i've included 80 euros for 12 months , 80 euros for social security , 70 euros per month , 840 euros per month .

what other expenses can be written off for autonomous driving , for example , if you buy an it , you can buy computers , some courses , maybe a vehicle , travel , 2000 euros per year .

the amount that is reduced , the amount that is reduced , the tax is not paid .

that is , we have 60.5 thousand left , which is what we have a tax on this amount .

the tax on this amount is 18.194 thousand , which is about 26 hundred thousand .

that is , if i made 70 thousand , i have to pay the tax on this amount .

so , if i earn 70 thousand as an autonomous income , i will pay a tax of 26 hundred .

if i just calculate social security and history payment , then it's actually 28.5% .

this is for self-employed people .

now let's see what we can do with family autonomy .

there is a family autonomy .

i pay , for example , my wife at least 1200 euros a month , this is 14400 a year .

for example , the amount can be different .

if we talk about the main autonomous , i have a slightly higher cost of living on the highway , because the family living on the highway has higher costs , and the highway takes more money for this .

but i reduce the amount of tax on 14,000 .

my tax rate is accordingly decreasing .

my tax is 12,700 .

if my wife has an income of 14,400 , and the social security pays what was said to be 150 euros per month for 1,800 , the income of a wife of 12,600 .

this is a sum that can not be paid by date .

she earned less than 22,000 a year .

and you can not even submit a declaration .

that's what we were talking about today .

and what do we get ?

from the same 75 thousand that i earned a year , i will pay a tax of 18.5% .

if you count even the number of if we take into account the number of married couples , the number of married couples and the number of married couples , it is 23.77 , compared to 28 .

in fact , 5% can be reduced if we open a family autonomous .

and the plus is that when you open a family self-employed company , the person actually has a fear , there is a hard work experience , and again , when we sell , if there is a desire to go to the wnz in the future , it is a big plus that the person will show that he has a salary , that he gets , there is a labor tax that is counted in the social service , and it will be easier to go there .

i saw the question here , so i smiled , and now i will review a little .

i don't want to offend men that a wife will take the salary anyway , because he earned it and she earned it , but in fact there are no limits .

but there are no limits .

use logic .

if a man earned 6,000 and 5,000 rubles and paid his wife , it's probably not very logical , because the wife might help you with advertising , with some documents , etc .

that's one thing .

if you paid her half , well , okay , great .

but take into account the fact that all the money you pay your wife , any income you get in spain , is paid with a profit tax .

because it makes sense to pay a reasonable salary to your wife so that she doesn't have a very high income tax .

because you , as a man , will still pay the salary of your wife every three months .

so you have to look for a golden mean .

what i transferred to my wife will not pay much , but it will reduce my tax base .

so , you can approach this question like this .

one month we can pay , the other we can not pay .

i can get one month from the company 5,000 , i can get one month from the company 1,000 .

there is no such stable criterion .

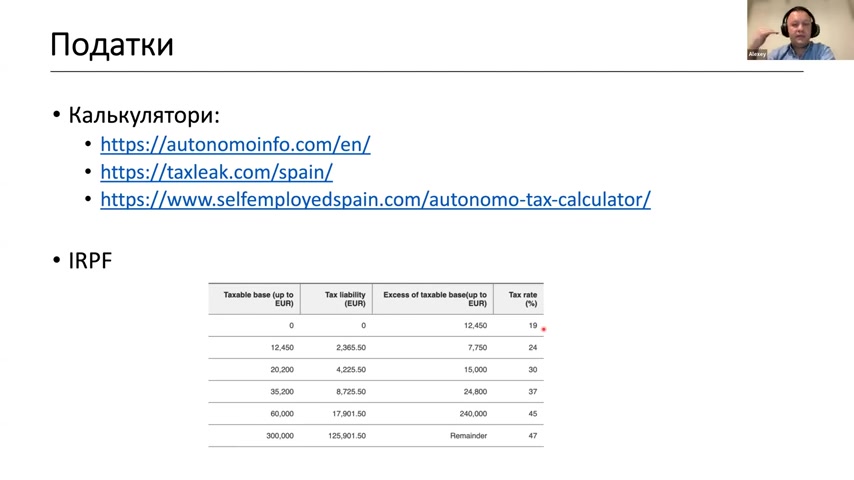

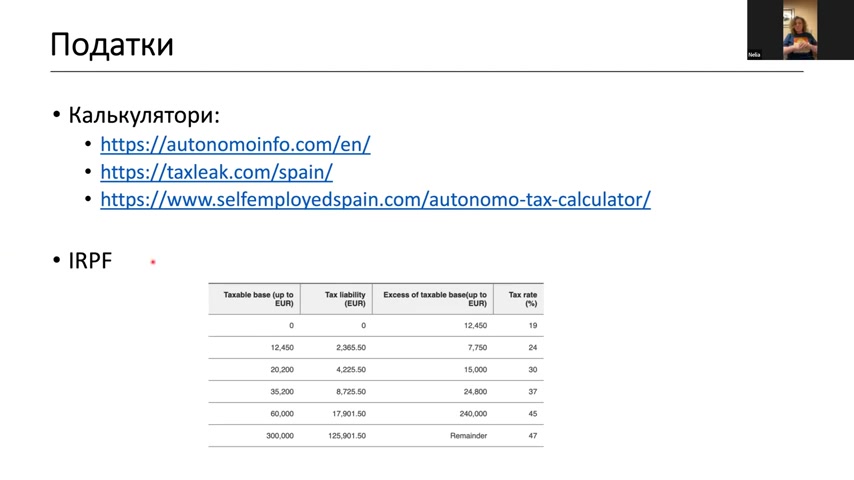

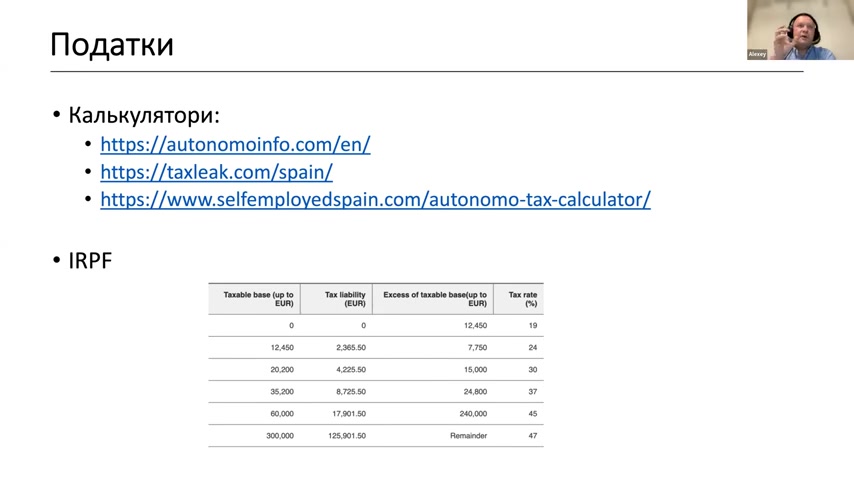

regarding the base , if you look at this table , it turns out that if i have an income of 35,000 to 60,000 , i will actually pay 37% tax .

if i transfer money from this base to my wife , even if she pays , she will not pay 37 , but 19% .

in any case , the percentage paid by the state is reduced , if we consider the family budget .

so , this is a question about family autonomy .

again , if there is a man and a woman officially registered , i would say if one man and woman work and the other does not work , then this can be done and this reduces tax burden .

one works and the other doesn't , then you can do this and it reduces the tax burden .

well , why can a wife work ?

yes , of course , it can be called plurial income , that is , you can combine the help of your husband with official work .

just keep in mind that your official work , your official income , will be summed up in the end result with your salary .

your income will increase and you will pay the total amount you receive .

thank you .

do you have any questions about the tax evasion ?

or do you have to confirm that your wife is doing something ?

or do you have to collect the paperwork and show that she did this particular job for the salary ?

well , collecting papers , she works with documents , some papers can be collected here .

will there be confirmation ?

i have been working for quite a long time , i have never been asked for confirmation .

what do i do ?

well , i have a slightly simpler situation , i work with emails , i answer the phone and so on , and i work with people .

but in any case , the only thing i was asked , i tell you every year when i submit an additional declaration , is to confirm that this real salary has really gone to my account .

that is , that this is not some kind of a fake , that i just have some kind of accounting agency and there were no moves between the funds .

i am asked this every year .

i withdraw all the money i received from the salary and confirm it in this way .

i have never had or seen any special confirmation in my practice .

it is a bit different from ukraine .

in ukraine , you need to do some work , to draw some kind of a trace on the internet .

there is no such thing here .

they have something to do in the tax office .

what is the total account ?

no , i do not recommend the total account .

you will have problems later with the tax declaration ?

at least with your wife .

i will add that tyshinella recommended me to do this .

there is a bill that i made under the name of autonomous , where all my income comes from .

and i transfer all the money from it .

i have a history payment , and then i transfer everything that remains to my own account , which is already there in the stores , in the transfers , and then i do more work with it .

and the same thing i did for my wife .

that is , i did that there is a wife account , and the salary comes there , there is such a calculation from it , and then the transfer to another account , so as not to get confused .

i will show you the account and there will be just a plus or minus and that's it .

definitely .

i think it will be better .

this is my personal point of view .

although from the point of view of legislation , i understand that there is no requirement that this is some kind of account .

to say an autonomous account is the same account as the account of these individuals .

because in ukraine , the pop account is a separate account , which has a separate code .

so there is no such thing here .

here , of course , the account is just when you open the account and the pop account , it is important to give all the documents to the bank so that they do not have to pay for the payment .

this is in case we do not talk about the bank account , which has a website or a website where you need a specific account .

or if you have a tpu , that is , you will pay with a card , you still need another account , a different type of account , let's say .

okay .

and if you are autonomous , family-owned , autonomous , here the question is whether you can divide 50-50 between husband and wife .

in principle , yes , you can , but you just have to calculate , and from what i calculated for myself , the best result is 60-40 .

because the man still has more taxes , and therefore you just have to calculate how to divide the money between the autonomous and the family autonomous .

just a financial calculator and calculate .

the next question , where do i want to go , and there are a lot of questions about sl .

if we open this analogue of our talk , what is it when you can open sl , when you can't open sl , what are the requirements for sl ?

and then we will talk separately about the sl calculations .

can you tell us about sl ?

yes , well , in fact , you understand , i think that most of the entrepreneurs who worked here are actually shareholders .

i wanted to say it in russian .

yes , that is fob .

what is sl ?

it is a private enterprise with shareholders and each shareholder has a certain share .

previously , when we created sl , there was a requirement for the statute fund to be at least 3000 .

to have at least 3,000 euro in the statutory fund .

you can also spend 800 euro , which will be the notary , registration , registration in the chamber of commerce , and so on .

now you can create an sel for one euro .

there is such a new law .

i don't really like creating an sel for one euro .

why ?

because when we create an sel with a minimum of 3,000 euros , you don't actually have to be responsible for your property .

if you create an sel for one euro , you automatically become almost the same autonomous person who is responsible for your property and so on .

since most of the people here are probably programmers , it specialists and so on , you have a service , so basically what responsibility do you have for your own property ?

we can talk here .

you provide services and perform the work .

you have a service , so we can talk about the responsibility of the war .

you give the service and perform the work .

if , for example , a company that is engaged in buying goods , the goods have been lost , has been damaged , and has not reached the target , or if there are some damage , you will be responsible for the property .

the product , the product has been lost , damaged , and therefore has not arrived , or for example , some damage and so on , there , of course , responsibility will be carried over to the property , and this is not very interesting .

look , we have been for a long time , i , in principle , always when i meet with clients , new clients , old principles , i tell them that esl is interesting , but esl is interesting in the case when you earn certain money .

office , not structures , then in principle , it is necessary if you check , i always say that i am a practitioner , i always say that this is from the practical side , if you have ever checked a tax , then it can incriminate you that this is , for example , an instrument sl , that is , that you created it to pay less taxes .

does esl pay less taxes ?

this needs to be approached very personally .

we will now show a certain scheme that we have prepared .

this is a very general scheme .

he is a lawyer and he cannot get a salary from the company .

he also has to pay the invoice for his company .

he also pays taxes , so he is also an autonomous person , even though he owns the company .

these are professional sls .

we will now talk about a general type of esl , and we will see what is the difference between taxes , whether it is cheaper or not .

in some way , yes , you can save money in some way .

now alexey will tell you what we have prepared for this comparison .

i ask you , when you turn to any person , let them think about the situation , ask for explanations , i ask you to ask any person , any history , to ask them to calculate the situation .

ask them to calculate the situation .

or maybe it's better to do it this way , and i'll earn so much .

or maybe it will be much easier to create an autonomous vehicle than to spend money on creating an esl .

because esl introduction is more expensive .

esl appearance is much more expensive than autonomous vehicles .

so , in principle , closing sl is much more difficult than opening the car .

you opened the car in five minutes , you didn't close it in five minutes .

so , in principle , come to this , really , very much with your head .

as far as i understand , it is interesting for the historians to sell sl , because then they will earn more money from the client .

yes , i told alexei today , i have a girl who is doing manicure .

she went to the historians in barcelona , he said , no , here is sl .

i mean , there is a history in barcelona , they don't say , no , there is an esl .

people , what kind of esl for a girl who does manicure ?

she has 70-80% of the time .

she has shown it or not .

there is no such thing as a big amount of cash machines .

why esl ?

of course , i will earn twice as much as the history .

definitely .

but you need to have some kind of conscience .

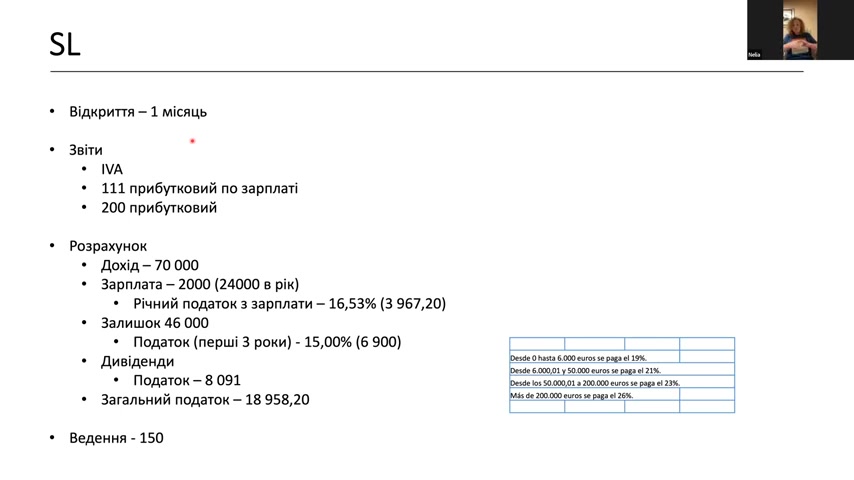

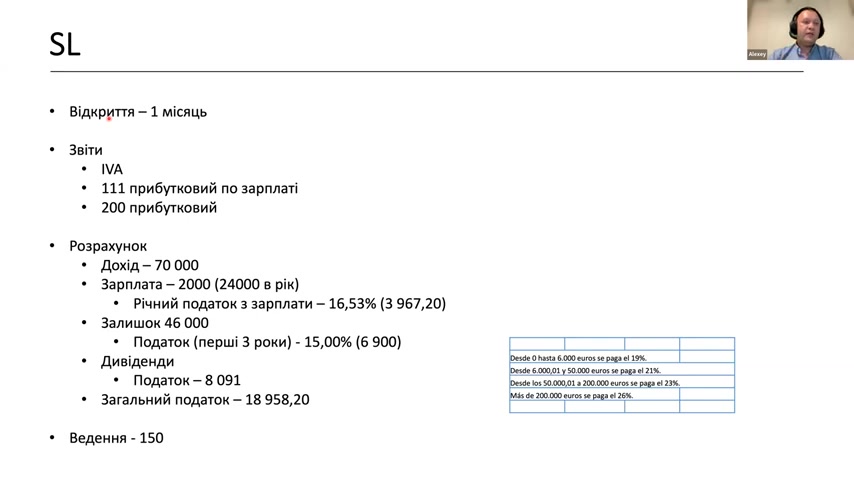

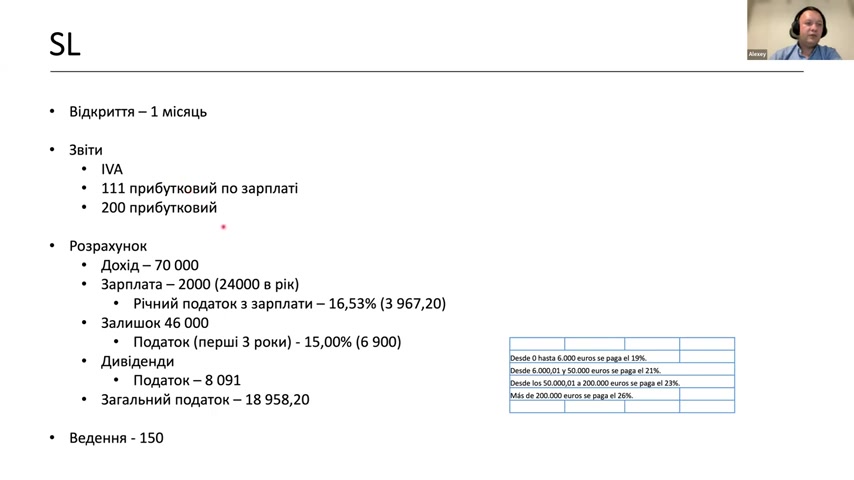

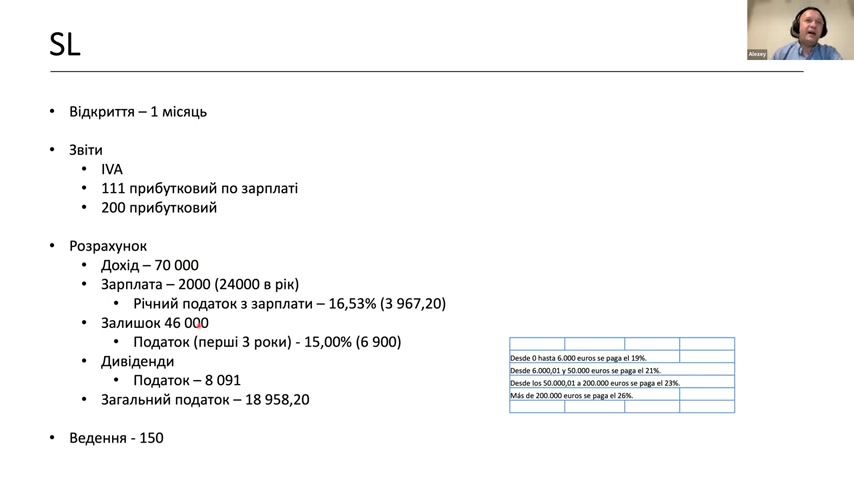

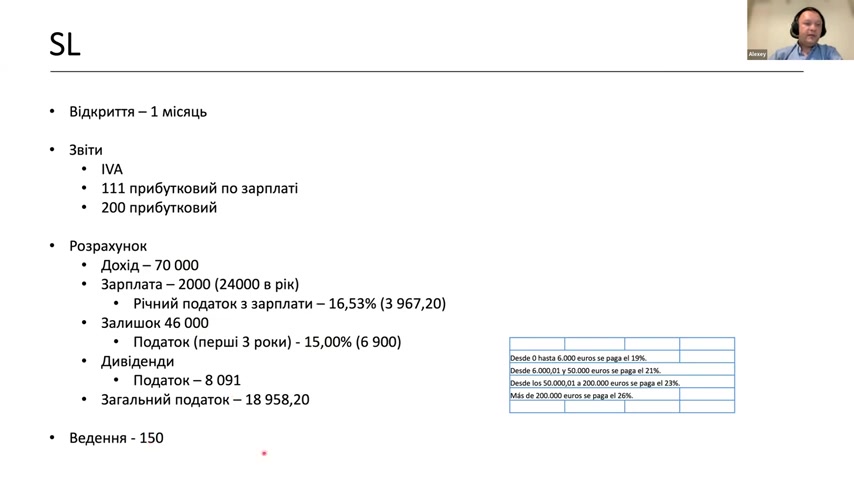

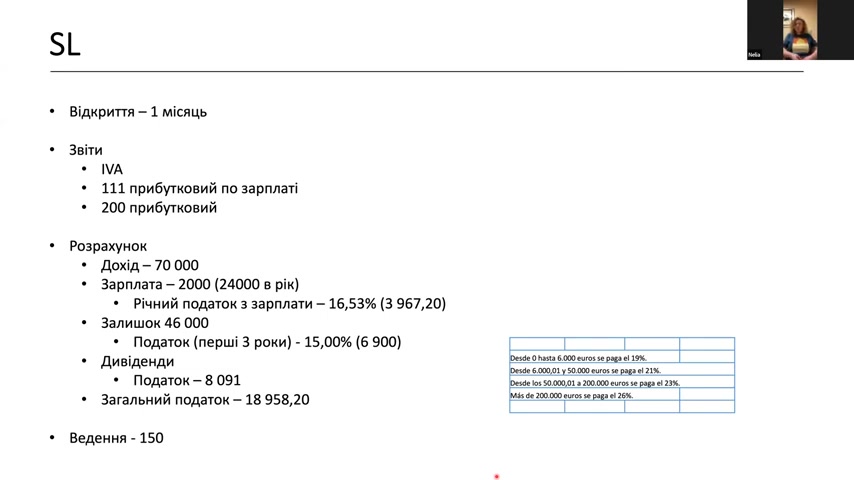

okay , let me tell you a little bit about the differences between the sl and the autonomous .

this is a general calculation , we included various costs here , costs on social security , just to show from the point of view of the taxes .

the opening of the sl is much longer .

if the autonomous open is open for one day , the esl opens for a few months .

yes , there are 20 days in the chamber of commerce .

the registration in the chamber of commerce is 20 days .

between the signing and so on and so forth , it will be about a month .

it is possible to calculate for a month .

accordingly , the sl is receiving reports on iwa , 111 income , on salary received by the director , and 200 income is received by the company , by the income of the company .

iva is the 111st in the salary that the director receives , and the 200th in the company's income .

let's take the income , 70,000 , which we took in the previous example .

we pay the director 2,000 .

for example , i open a dsl and pay 2,000 , respectively , i earn 24,000 a year .

i earn 24,000 a year , and i pay 16.5% tax .

this is the amount of taxes , 3,967 , which i will pay .

we have a balance between the income of 70,000 and 46,000 , and the salary is left with a balance of 46,000 .

from this balance , again , for example , they took potential expenses that the company can bear .

from this surplus , 46 thousand , i pay 15% tax .

this is the first three years , i paid 15% .

and all this 15% is why i think it is profitable to say that the tax is not 25% , not 30% , but 15% .

that is , the number of 15% that paid the tax .

okay .

we have to pay the dividend tax again .

it is a table up to 6,019% from 6 to 1021% .

it is not very high , we can say , the tax is up to 200,000 , 19 , 21 , 23 , but still it is there .

that is , we paid the tax by 15% and we will pay another tax on the dividend return .

and in fact , what do we get ?

from these 70 thousand we pay a tax of almost 19 thousand .

plus the introduction of 150 euros per month is the average price , if we talk about s&l .

now we will go back to the question .

yes , and remind that you , as your own company , will pay the entire fee .

yes , if i pay the entire fee , and in the company , if i am right , then the fee is higher than in the aftonov .

you pay more for the car than for the car .

look , there is a new law , you know that it was introduced on january 1 .

previously , for example , if it was a newly created company , then the company also had a one-year pension and paid 377.84 .

but there is a slightly different system , it also depends on the income and so on .

but for comparison , previously , the autonomous , normal , paid $293 , and the autonomous , own company , paid $377.84 .

so the difference is already there .

one more interesting point .

as far as i understand , these dividends that i paid , i do not pay for myself , for which i will pay a percentage , but you pay as dividends , then a smaller percentage , i cannot take them out immediately .

it has to be passed , as long as the year has passed , when i submit a year's declaration , it shows that i have dividends left , after all the expenses , the income minus the expenses .

there are dividends and then i can only take them out .

that is , if you get some income and you want it in fact , the money you need to live on , then you will not be able to get this money right away .

well , in fact , they do manipulations there , that is , they take the bones , the body from the mine , there are variations .

yes , there are variations , but if you take the general scheme , yes .

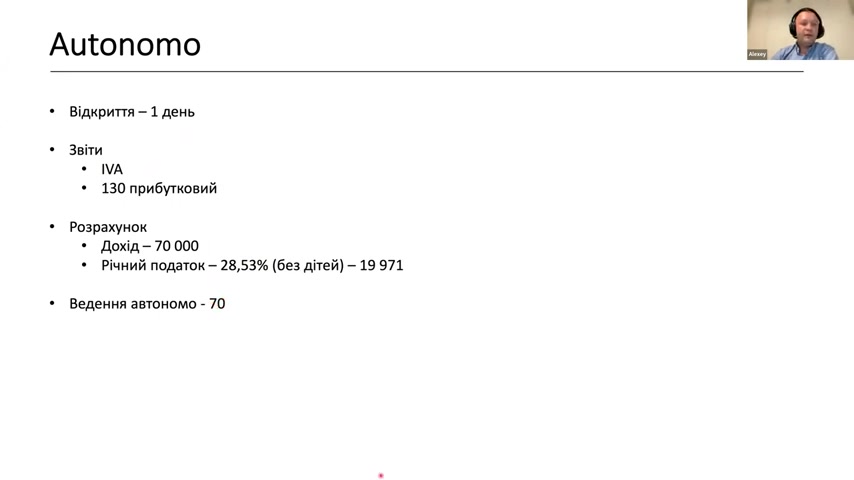

if we talk about autonomous , again , another slide .

again , autonomous .

we take just ordinary autonomous .

it can be opened in 1-2 days .

in social networks , literally 1-2 days and literally 15 minutes , additionally , autonomous opens .

in the past , only iva and 130th revenue are provided .

if the income is 70,000 , we do not count all the costs that are shown in the previous slide , so on average , 28.5% is 19.9% .

the introduction of the autonomous vehicle costs 70 euros .

in other words , if we say in numbers , then in principle , the autonomous vehicle , sl , with a salary of 70 thousand , will be equal .

but with sl , it is much more humor , which can potentially be , and more , what i described , more risks .

and from what i calculated for myself , just for understanding , and from what i have encountered with nella , then in sl there is a sense to think , if , for example , the income is already more , i think , more than 80 , there was a 80 , especially if there is no housing , even a family autonomous can be opened .

if there is an autonomous and a family autonomous can be opened , then i think we can reach this percentage , as sl comes even with a income of 130 thousand .

here is a question , if both family members are it people and each income is higher than 70,000 .

so this is exactly the case when the sl can make sense , right ?

yes , 100% .

even if it were bis , i would definitely recommend the sl in this case .

if i may , i have one more question .

i guess the sl has a point .

i'm curious if you don't issue a dividend , but rather buy some kind of real estate or something like that for the sl .

because it's the same as the other news .

yes , i understand .

buy real estate , in what sense ?

to buy an apartment .

you have no right to buy an apartment .

please tell me how real estate is bought , and how does it relate to your estate ?

everyone does it , i tell you , everyone does it .

what will happen if you have a check ?

they will just take all your expenses , that is , everything you have spent on your apartment , they will cancel your apartment , they will make you two autonomous and in four years they will transfer all your income .

the ssl cannot do this .

i am not talking about the flat , i am talking about the office .

yes , yes , yes , of course .

if it's a commercial location .

i said about the apartment .

there were questions like that .

no , no , the apartment , i understand .

on my part , i understand that you cannot buy an apartment .

you can buy a commercial real estate .

100% .

it will be a great idea .

you earn enough money , you do not bring them out , you invest them in commercial real estate .

even if you rent it out and add other types of activities to your slk , it's great .

there is only one open question .

when i sell commercial real estate , i think i will pay about 10% only .

when i sell this commercial property , i think i will pay something more than 10% only .

well , in general , if you sell property , then it will be a responsible income for you and it will return to the same , you will pay profit and so on .

yes , it's 10% .

if we are talking about contract purchase and sale of commercial locations and so on .

yes , that's right .

thank you .

can i ask a question in the chat ?

if my son and i work in an american company , we receive commissions from there , we provide consulting services , then we can form a family autonomous in such relationships .

yes , of course you can .

the only thing you have is one question .

can your company pay for the leading autonomous ?

yes , it can pay for everything .

in principle , the company does this .

the son is not autonomous , but everything is paid for by the son .

super .

i heard for the first time about family and perhaps about what documents the upcoming solution will be necessary .

the only thing you have to live in one apartment .

you have to have one apartment .

you have to confirm , for example , if it's a family , you have to confirm your marriage certificate .

in your case , you have to confirm that you are your son's birth certificate .

it's a great idea .

if there is such a possibility , super .

hello , good .

excuse me , what should i do to the sailors ?

go to the local hester or what should i do ?

you , well , i understand , of course , you need to call , even probably not to hester , in this case you need to contact what should we do ?

i understand that you need to turn to the person who has a legal knowledge .

why ?

because it needs to be studied specifically , the law of double taxation and so on .

yes , please come to the cool story that is being discussed a little bit there .

sailors do not really like it , they do not really like it in the sense that you are difficult , unfortunately .

you are difficult because you have to pay for your declaration , you have to pay for your situation , day or two .

because not only the law affects your declaration , but also all the decisions of the tribunal that were made after that .

i would recommend you to call a professional lawyer , to have your account .

we have such a group , there are sailors , two groups in the telegram , we can't find a good hestra .

can you somehow help us with this question ?

we don't know who to contact anymore .

i know that they don't want to take me , because the sea urchins are coming back .

we can learn this question .

the only thing that my husband will deal with is that he is a lawyer .

we will study every single person's situation and we will show each person how to do it better , how much it will cost you , your declaration , etc .

the only thing i understand that there is a language barrier here , because in spanish and english it did not work at all .

so , i will be the first to give you information .

i will have to translate all the information , then it will be in spanish , then in ukrainian , russian , whatever you like .

of course , you can contact us .

it would be good to know the name of your company and how to contact you .

i will send you all the information later , if you return via the telegram bot , and we will send you all the information , contact us , and you can see it .

i will wait for you .

you will send it all to everyone .

i think there are a lot of people here .

yes , it's difficult .

i can feel it .

because here in ukraine , you get your money as a sailor .

and here in spain , you get money that you have to pay for .

you get money 35 times a year .

i'm sorry , can you hear me ?

yes , i can hear you .

please tell me , muriaki , what are these groups called ?

thank you .

chat , because i want to know .

okay , we have a chat , i can write a few .

okay , okay , thank you .

alexey , please , in your case , when you showed the comparison of your personal and family autonomy , don't you pay for your wife's insurance tax ?

is it possible to pay for your wife's insurance tax ?

no , unfortunately , there is no such thing .

do you have the opportunity to pay for your wife ?

no , unfortunately , i don't have the opportunity .

it's a personal tax .

i pay my own tax in social security .

as a family autonomous person , i have to pay .

it's a personal tax , because it's your social insurance .

you can't pay for your family's rent , unfortunately .

you said that you have to somehow choose this salary to be profitable .

please tell me , alexey said that 22,000 is the amount that is not taxed .

is it true ?

yes , it is .

in spain , up to 22,000 families are not obliged to submit a tax declaration .

that's one thing .

but even if you receive 18,000 or 20,000 , you may still receive a small amount of tax .

you may still receive it .

it may be a small amount , but you may not submit it .

yes , you may not submit it , but when you see that your wife didn't submit a declaration , and she had to pay , you will be blamed for not receiving this profit tax , because you are the one who must receive it correctly .

i understand .

in what case can you give an example ?

look , for example , let me try to explain .

for example , i get 2000 , let me call you specifically , 2000 euros .

from 2000 euro salary , my company should officially receive 18% from me .

so , it's two thousand euros , and my company is supposed to get 18 percent of the money .

she didn't get 18 percent and she didn't pay the state .

because this is how everything works .

and now i'm reporting this to your wife .

you're telling me to get any profit from her .

i tell you it can be a problem .

she says no , i don't get it .

okay , we counted 2000 , she got 2000 .

let's take less so that it was up to 22000 .

okay , so when we closed the quarter we didn't pay for her income , we didn't get anything .

and in fact , she doesn't submit her declaration .

what will happen ?

will the tax collector call you ?

she was not obliged to submit her declaration .

she didn't submit it .

but the tax collector will call you and say where to pay the 2,000 euro interest tax that is legally responsible for it .

so you have to pay a sum where the interest tax is not paid , for example , 1300 euros , it depends on the children , etc .

1300 euros i put in the salary , 1500 , the profit is not enough , super , 1500 paid , i calculated , 1500 received .

everything is submitted to the report in three months , it was shown that the person received .

such a amount is not paid to her , that's all .

if she is paid , but you received it , she did not submit the declaration , that is , she did not close the report period .

everything is necessarily called to you , but believe me .

good , thank you .

look , i'll add right away that in this case , i will add that in this case , chanel just said that we pay 1200 euros , respectively , we do not pay the revenue , that is , there is no such tax .

so , if you ask how much you can divide 50 by 50 , 60 by 40 , if your wife pays more , pays the taxes , then this is a table of taxes that actually exists .

that is , if she was not paid , i'm sorry , i'm skipping , if she was not paid , then in fact you would go , for example , to your bank , pay taxes higher than 35,000 .

these are 37% that you paid .

if the wife has to pay money , then she can pay taxes , go , for example , to 19 or 24% .

if you pay a family , then you can pay a tax of 24% , but in any case , it is less than 37 .

in fact , you pay 24 instead of 37 .

here you have to calculate , because there are additional fears , but again there are additional advantages , as they say , that you can fall into the trap .

you need to understand what are the goals , what is the total amount , and just take and calculate .

or play with the calculation .

play for that amount .

i don't want to pay more than 5% of my income .

how much should i pay my wife ?

okay , for example , 1,700 euros .

okay , then i'm ready to pay with her salary .

she gets that percentage , and my income falls on that plan .

you just have to play .

thank you .

please .

if we talk about the questions i wanted to talk about , we've talked about the main issues .

the main goal was to tell the difference between autonomous , family autonomous , and sl , and the comparison of the taxes .

that's what i wanted to tell , because many people didn't understand .

i see that for the second or third time they asked a question , can you open a remote esl ?

so , look , to sign an esl , you are a must-have notary , because a statute is signed .

you are a military notary , because you are signed by the statute .

if , for example , you can make a request to a certain person in the country where you are , who will represent your interests , and sign this document for you , yes , you can .

just keep in mind that it is still temporary .

no , you have to do it .

you have to have a no to open the site .

but in general , it is possible .

in general , it is possible , as you understand .

now we will move on to questions .

i will make a video and we will publish it .

there will be information on telegram , we will also publish the contact details , especially for mariya .

if you can send information about the sailors in the vod telegram group , we will keep it for ourselves and who will ask will share this information .

i will send it , because it will be interesting to everyone .

absolutely everyone .

and i will say again , we want to make additional videos on other topics .

one of the topics that was asked here , but we did not discuss .

there are many questions about cryptocurrency .

i talked to her a little , said that we can make a separate video , to talk about how to legalize what to do with crypto .

this is one topic .

one topic that i also talked to her about and we want to talk about separately is the issue of the wnj .

because now there are such people asking , what is the minimum income ?

i heard about the autonomous , because it is not the case that the wnz will continue .

in fact , from what we have seen , if a family earns about 40-45 thousand a year , if we have a large amount of money , for example , we earn about 40-45 thousand rubles a year , then this amount will be sufficient , from the point of view of legislation , to then be given to the wnz .

but again , more in detail , i want to make a separate webinar and listen to all the nuances .

if , for example , considering our current state , people have the same condition , for example , they have a self-employed person , or there is a family of self-employed people , or there is something , or there is nothing , and they want to go to the unj in the spring of the next year , what should be the conditions ?

do you need to know the language ?

what should be the amount ?

how to show that ?

one of the requirements , as far as i remember , is to work at least half a year , and half a year will actually be , roughly speaking , from july to january , when you apply .

that is , not to waste time , but to apply for people to do their job .

also , look , there , during the change of residence , there were 45,000 in the nomad visa .

in the nomad visa , you have to confirm that you have 45,000 in the total of four members of the family .

if you apply for the change of residence as an autonomous person , i would do it that way .

i would first apply for an autonomous person , for example , a husband or wife , and then i would join a family with him .

this is also a cool residence , you can work and be an autonomous person .

we ask for one person first , and then we connect a wife to him .

there are a lot of options .

actually , yes , this is for another video , if not for more .

and a quick question , well , we didn't want to talk about the 720 model .

it's a declaration of real estate .

yes , look .

the 720 model is submitted until 31st of march .

what does this model indicate ?

usually , this model indicates the real estate that is located outside spain .

also , if you have accounts in banks , where the cash is .

again , come to this question creatively .

why ?

because for the spanish tax office , the value of your property is the contract of the sales that you bought in 2012 , and there are 17 thousand or so dollars , it is re-calculated for the 31st of december 2022 , if we say that we will submit a model for 2022 .

but here again , come to this question .

if you positioned yourself in 2022 as non-residents , then i would not give this model until you are already unstable and can be submitted in 2023 .

it is purely informative , but you understand that each information gives additional resources to examine you .

certain tools to monitor you .

so , in principle , even an informative model can draw some attention to you , even though it is just informative .

yes ?

excuse me .

so , if , for example , you have not submitted it now and you are not an autonomous person , then you can open an autonomous ...

let's say , i'm going to gather next month , i'm sorry , if you haven't sold it yet and you're not an autonomous , you can open it next month , in may , and i can declare this model 720 next year .

and if the apartment is bought according to the contract for buying and selling with a payment line ?

the price is indicated in the purchase and sale contract .

if you want to declare a higher price , you need to make an official conclusion , an expert .

because the value of the property in ukraine is unknown .

and for the tax office , she asks for a document , and the document is the same as we have .

the sale contract is probably 70% of the value of the property .

we know how we live in ukraine .

can i ask you another question ?

yes .

if the property is you said that the property was mortgaged in 2009 .

at that time , there were mortgages , but the real estate was mortgaged .

there were three apartments , a but there was no value .

i would not give you any information at all .

if there is no value , then if ukrainians do not know the value of your apartment , then where to go with the pension to her ?

if you still want to declare , then i would make an official assessment of the expert and declare it according to the official documents .

so if the official documents are basically zero , then that's it .

and if you sell it , then first evaluate , declare , then sell and show the money , right ?

yes , of course .

you always compare the system .

you will understand that in spain , for example , when an apartment is bought , its value is clearly indicated in this writing , that is , the contract that our seller buys , which is signed , the notary , and everything .

and this value is always the most extracted from this document .

and for the spanish , it is so , no more , no less .

where can they extract the value of your apartment if you don't even know it ?

can i ask you one more question about the apartment ?

i understood correctly that in order to sell the apartment in ukraine and to legalize the money received here , first it must be declared here in this form of the model and after that only you can start the sale process in order to be able to start the day later .

if it costs more than 50 thousand , then yes , if it costs less than 50 thousand , then no .

well , it's not much , but it's worth it .

if you cross the border and declare money on the border , as cash , then it's also possible .

yes , of course .

now i think the border is still closed for the export of goods , but ...

no , it can be declared , it can be declared .

you can declare , but you have to pay taxes .

taxes have to be paid here .

how much will you pay taxes ?

will you pay taxes with all my sales and what has been declared ?

or how will taxes be paid ?

will you be a resident of spain ?

you will still pay the difference that you earned from the sale of the apartment .

if you declare these funds here , they should be compared with the value , again , to raise the law on avoiding double taxation and calculate the percentage that you will have to pay .

although , look at the territory of spain , there is such a very cool law .

if you sell property , this is your basic residence , if you sell it , then you get a year's time to reinvest the money .

if you don't reinvest it , that is , if you don't buy other basic housing , we are talking only about basic housing .

if you reinvest , the tax office will not take your tax .

but again , you need to take the law on the eviction of double tax .

it will affect it .

let's see , if this is a resident of spain , and he lives here in spain , we understand that his basic housing will probably be here in spain .

he has a registration and he is a resident of spain .

no , you have to have the ownership .

if you rent an apartment , it does not belong to it .

your main residence is in ukraine .

even if you rent an apartment here , the fact that you were forced to leave the country is even ...

but still , your main residence is in ukraine .

please tell us about the exchange rate .

if we don't sell these models now , what are the fines for not selling this model ?

from 5,000 to 10,000 , if the amount is quite high , then even 150% of the cost can be applied .

then they can even get a 150% fine for the value .

i had a consultation on the 720 model today .

i will tell you one thing .

the 720 model is probably the most popular in the tax office .

they know little .

do you know why ?

because practically no one is selling it in spain .

i mean , we sold it during this month , i don't know how many models , 280 , 300 , 400 models .

i have never sold it in my life .

i think they are sitting in the tax office , listening , thinking how to sort it out .

does each person have to sell a model once a year ?

yes , for example , if you and your husband have a 50% ownership , so 50% is for you , 50% is for your husband , and the value of this apartment is 120,000 , then you both need to submit this model , just to indicate , for example , that your value is 50% and your husband's 50% .

but each one has a different value .

excuse me , one more time about the sea .

do you have to go to the sea on your own or not ?

no , you don't need to .

if you want to have a pension , you can find yourself an autonomous person .

i'm a self-taught engineer .

i'm telling you , what kind of self-taught engineer are you , when you've been in the sea for almost a year ?

there was a mechanic , an electrician , something else .

you have to behave like a worker who works abroad .

of course , you have to behave like a sailor .

if you are interested in an autonomous person who does nothing but exists , then this option is possible .

but if you work with big money , you have declared it , then it's great .

if you are only interested in social insurance , your medical experience , then it's worth thinking about .

it's interesting because it's the maintenance of five people .

a wife , many children , people of the same age .

i propose what anelia said , with this particular question , everyone will have their own story , you have to come and talk and think .

one wants to open up here , somehow legalize , the other does not want to pay taxes .

this is the first goal , what contracts , what conditions , everyone will have their own story .

well , okay , okay .

it's good to know how much , how to do , what for .

the procedure is also very interesting .

okay , please contact us , we will help you .

please tell us , what is the rate of the declared cash income received last year ?

i'm always transferring money to the bank of spain .

when i receive income ...

where ?

on the last day of the year ?

no , i , for example , if someone gets dollars for the invoice , i transfer it at the time of the invoice .

and , probably , if i transferred your money , i would do the same .

i wouldn't do any average .

of course , if you have to pay 20 hryvnias a day , then there is no sense .

then you probably need to take some average for a year , because sitting there and transferring every 20 hryvnias is just a stupid job , you need to look for some practical side .

but in spain , for example , when i declare my income in dollars , i transfer every invested investment in the bank of spain .

thank you .

i think the question was , if you said you had asked for money , and if you earned money , then what question was asked ?

yes , i asked this question .

if i have declared a million hryvnias in the ukrainian fop , if i had a million hryvnias declared in the ukrainian fop , how much money should i declare this year ?

if you say last year , then it is counted on the last day of the year , from what i read .

this is the 720 model .

720 , no , if i give a river declaration about the declaration .

well , here you can take or take by each exposure , transfer it to the invoice .

you can take , for example , the declarations submitted , when the person submitted the declaration , take it that day .

she paid taxes that day , transfer it .

there are a lot of them here .

if i tell you frankly , in spain , it's clear here .

i would , for example , think about you , how best to it best .

but any option can be suitable .

thank you .

please , tell us , should the autonomous person set up accounts with vat or form an intracommunitary ?

this is exactly what i was asking for .

this is exactly the same .

the only thing that vat is actually vat.id , it's english , and intracommunitary is actually the intracommunitary register .

this is the same .

it's vat.id , it's english , and the intercommunity registry is the same .

it's a release from tax payments between companies in europe .

that is , between companies and autonomous .

between companies in europe ?

between companies and autonomous companies ?

do you mean that i put out a invoice and calculate the vat , and then my customer pays vat instead of me ?

with a larger amount of invoice for vat ?

or do i interpret it ?

no , no , no , it's not quite like that .

well , a little bit , look .

oleksiy , explain .

look , if you work as an it employee , you work in spain , you are an autonomous employee , you provide it services to companies that are outside spain , then in this case you can set up accounts without the vat .

what is needed for this ?

inter-community must be registered .

after the auto-new is opened , when there are contracts with the company , the inter-community is registered .

in the middle , the management is 3 weeks , sometimes it takes 1 week , sometimes 2 months , when you are given this number , that you can then issue a account without vat .

and after that , you set up a account without vat , the company pays you without vat .

that is , without iv .

and plus , if you actually have an inter-community number , the costs you pay as an autonomous , for example , the history fee , or you bought some goods , or where there is a vat , at the end of the year you can actually return this vat back from the state .

this is only a case if you have a contract with a company that is located outside of spain .

this company must be registered in the intercommunity .

and you register in the intercommunity , and then you can set up accounts without a barrier .

this is interesting to sailors .

some sailors pay , pay , buy tickets against the customs commission in romania , for example .

pay , pay and buy tickets , to pass a commission in romania , for example , to receive money for a forum in greece .

such things happen .

the thing is that these tickets will not be used , they are not autonomous .

so you can write to us , for example , when you are going to give a declaration , you will not be treated , you are not autonomous .

you can write down , for example , when you submit a declaration , you can write down that your wife does not work there , that you have children going to school , etc .

you are not autonomous , you do not lead the way , so you will not be treated .

you don't have an autonomous , you don't have a license , so you won't be able to sign these expenses .

they won't be able to contact you .

they will be more likely to contact the autonomous , this is the first time .

we were also asked , if , for example , it is an esl , it doesn't matter .

this number , intracommunitarial , it only works between the autonomous and esls that are located in europe .

in that case , you have to submit this number , you have to be in this register , and this number will actually be revoked from the payment of the pda .

if you issue an invoice to a ukrainian or american company , you do not need vat.id .

why ?

because it's an export service .

it has a completely different look .

you don't need vat.id .

it doesn't affect you .

if you're a sailor and you buy some things , i'm a private person , you still have to show the iwa or pwa of the country where you buy things .

for example .

if it's autonomous , it's completely different .

i already have a question here .

let's have one more question .

if you work from home and pay as an autonomous person , you provide services and rent an apartment .

can you include the expenses of the autonomous person in the expenses of rent and housing ?

i am very upset with you , unfortunately .

why ?

because there are two types of real estate in the territory of spain .

this is commercial and private .

when you are given an apartment as private property , that is , for your apartment you do not have a p.d.v .

or so on .

no one will issue you an invoice officially .

unfortunately , an invoice is simply necessary in such a case .

you can add 10 square meters to the area where you work , and to write down the proportion of light , water , etc .

if you have this invoice for you , you can write down these 10 square meters and put them on your expenses only if the owner gives you a fine of 10 square meters .

the fact that they lose 20% at this , i have not seen anyone want to expose such a factor .

thank you very much .

can i ask a question ?

is it legal to work as a ukrainian in pobzhev or in spain ?

is it a violation of the law ?

no , it is not legal .

if your business is physically located in ukraine , then it is correct .

if your business is physically in ukraine , it's correct .

if you have an online store in ukraine , if you do services , if you provide services to foreign countries , like programmers , like it people , etc .

if you do services , you serve the country as a programmer , as an it person , etc .

you do services here , you are forced to register as an autonomous person and work here as an autonomous person .

do you have a commission on ukrainian accounts ?

even if you have a ukrainian payment ?

unfortunately , you are in the territory of spain , this is the main legal area of spain .

if you perform services in the territory of spain , you will have to be registered as an autonomous person .

that is , you are an official unit .

yes , you will receive money on the ukrainian account , and you will have to pay taxes , register and report the apartment .

these are the rules .

can i ask you to be a full-time employee of the company ?

of course .

and so on , like companies .

yes , of course .

we are in valencia , and it is very important , in this case , that you are one , well , there is not enough spanish to have a conversation with hester .

of course , no problem .

please contact me , i will be glad to help .

now we are starting the echo of the presentation .

the salary , that is , everything else .

online you can contact me for this service .

of course , of course .

yes , yes , no problem .

i have more of such clients who are outside of madrid than in madrid .

thank you very much .

nelly , i want to thank you again for an interesting meeting .

please .

i was very interested in talking to you again .

i think the people who joined were also interested .

i remind you again that i will send both video and contacts to the sender .

you can contact them for consultation .

if you have any questions , you can contact me .

we will continue to make such videos , we will answer questions that interest many ukrainians .

thank you very much .

we have a meeting on schedule , so i apologize for the start .

i am also very pleased to meet you .

i will be very glad to help and , in principle , it is pleasant to talk to you .

thank you very much .

have a nice evening .

goodbye .

goodbye .

goodbye .

thank you .

if there are any questions , let's have a moment .

alexey , can i raise my hand ?

i'm sorry .

alexey , please tell me , i work for a large ukrainian company , i pay taxes , i'm sorry , i have everything officially , but i have already spent a year , almost a few days , a year has passed .

here in spain , but i have a husband and two children .

my husband can't work here now , he can't find a job .

i get a higher salary than here in spain , let's say .

but i have two children and a husband who doesn't work .

so i need to be independent , or what should i do ?

no , look , if you work and continue to work for a company in ukraine , then it's not entirely autonomous .

you don't set up accounts , the company doesn't pay you for your work , so you actually work .

the only thing i would advise is that after april 15 , the annual declaration will be issued .

officially on april 1 , but on april 15 , the portal closes , and on january 15 , the annual declarations will be issued for the past year .

and here you just have to talk to the history again in the same way , in your own way , what to do .

the fact that there are these percentages that are paid , depending on the income .

if you work officially in ukraine , pay the tax already in ukraine , there is a contract for evasion of double taxation , you can also write it down .

here you need to look at the case by case , as they say , and see what you can do .

thank you very much .

one more question , please tell me , if in this case my husband will help , for example , and i work , then is this a problem ?

me and my children get help ?

well , i'll tell you more .

you can also apply for help .