https://www.youtube.com/watch?v=Cb21vgImtec

Apple Savings Account - Should YOU Get It _ How to Open, Setup & Full Review!

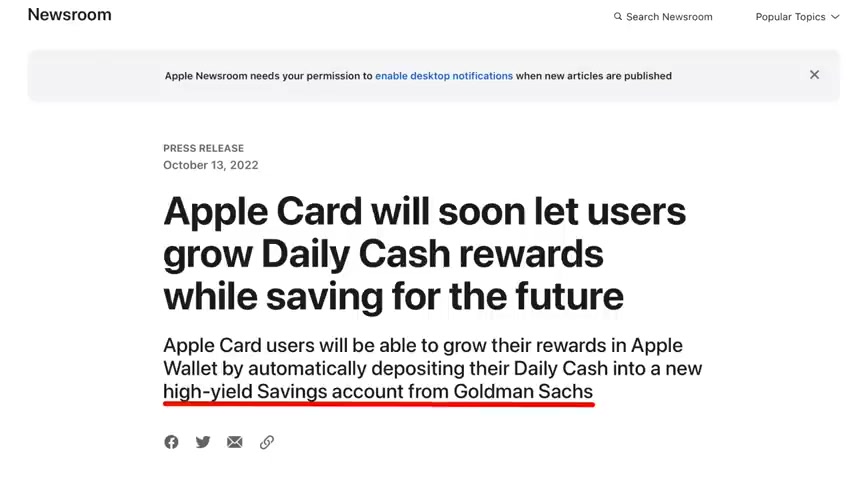

Back in October 2022 it was announced that Apple Card would soon let users grow their daily cash rewards while saving for the future .

All thanks to a new high yield savings account that will be forthcoming from Goldman Sachs .

And now roughly six months later , Apple has officially launched its savings account with a 4.15% interest rate and for everybody watching this video months or years from now and just realize those a pys or interest rates can fluctuate quite a bit .

So if it's much lower from now or even higher in the future , don't worry if you don't see 4.15% but for however long these rates last , it is an incredible deal .

So what we'll be doing in today's video is going over a very in depth review of this new savings account product .

I'll also be applying for it live on the screen for you all opening the account for the first time and showing you what the dashboards are like how to deposit funds into the account and all that good stuff plus all the eligibility requirements .

So that way you can see if you can go for it yourself .

So let's talk about it .

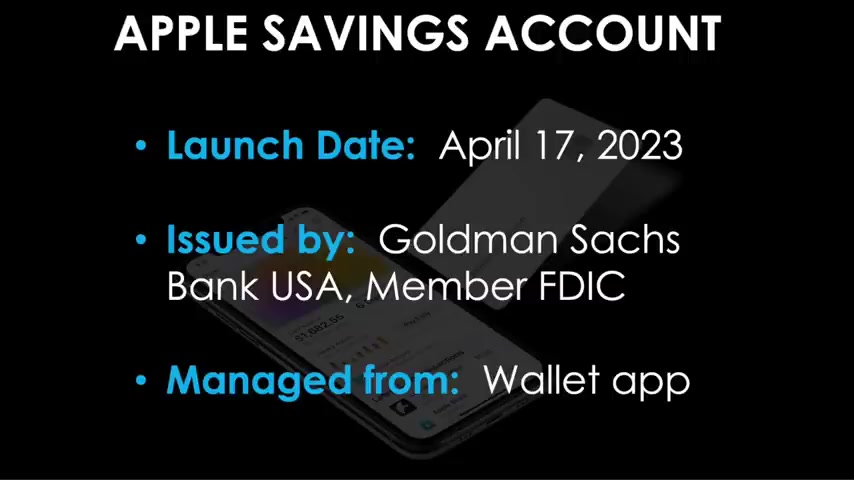

The Apple savings account first launched on April 17th , 2023 by Goldman Sachs Bank and it's managed from the wallet app on your IOS device .

And you can see it right there on my phone with that little wallet icon there in the middle of the screen .

As for the eligibility requirements , you must be an owner or co owner of an active Apple card account .

That is this beautiful piece of Titanium right here .

So yes , at this time , you must have an active Apple card account right now .

So it's four card members .

Maybe this will change in the future .

At this point .

I have no way of knowing that .

But if you don't have the Apple Cart , you will not be able to open an Apple savings at this time .

Furthermore , you must have that Apple card added to your iphone or ios device .

You must be at least 18 years old , have an SSN or ITIN must be a US resident with a physical US address and you must have two factor authentication set up for your Apple ID with the latest version of IOS installed .

And for all of you out there , familiar with traditional savings accounts from the of the big banks out there that pay very little interest and have tons of minimum deposits and fee requirements and all that stuff .

Fortunately , this one by Apple and Goldman Sachs is very straightforward .

And for the most part fee free , that's due to some awesome main benefits .

First of all , there is no minimum opening balance requirement so you can open it just with $0 .

No problem .

Also , there is no minimum balance requirement to maintain month , over month and also no monthly maintenance .

Usually I don't like it when people tell me no .

But in this case , I'm loving it .

It also has seamless integration with the Apple card and wallet app .

It gives you high yield a py rates and it's also FDIC insured up to $250,000 which also represents the maximum deposit limit .

And in terms of how to sign up , there's some very easy steps to follow .

First , just open the wallet app on your phone , tap on the Apple card , then tap the more icon in the top , right .

That's the three icon , by the way , select daily cash , choose set up nets two savings and then follow the on screen instructions from there .

How about we do that ?

Here's my phone shared with you all on the screen .

I'm going to go over to my money bag icon and then go over to the wall app right there in the middle and right there at the top of the screen , you see two cards , one says cash , it's black in color and the one below that is orange , that's the Apple card itself .

It changes colors when you put transactions on it .

What we're going to do is click on my orange apple card .

Once that comes up here , it'll show you your dashboard of your stats .

Then at the top right , you'll see that three dot icon , which is more in apple's world tap there .

And then you'll see the second option down says daily cash .

I'll click on daily cash .

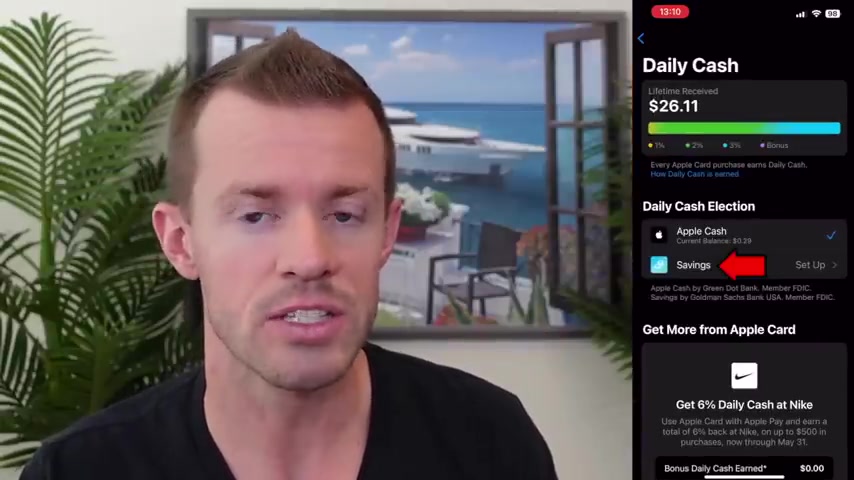

And then right there in the center of the screen , we see the option for savings with that blue icon , it says set up .

So I'm going to tap right there and then here we go , earn 4.15% a py or whatever the is at the time you apply on your daily cash .

So how about we click on , continue , confirm your info because your savings account will earn interest .

The IRS and some state tax agencies require your social security number for tax purposes type in your full SSN here , which is typically required of any savings account that you do open with other banks .

So let me do that off camera and then I'll show you what the next step is all about savings account terms and conditions .

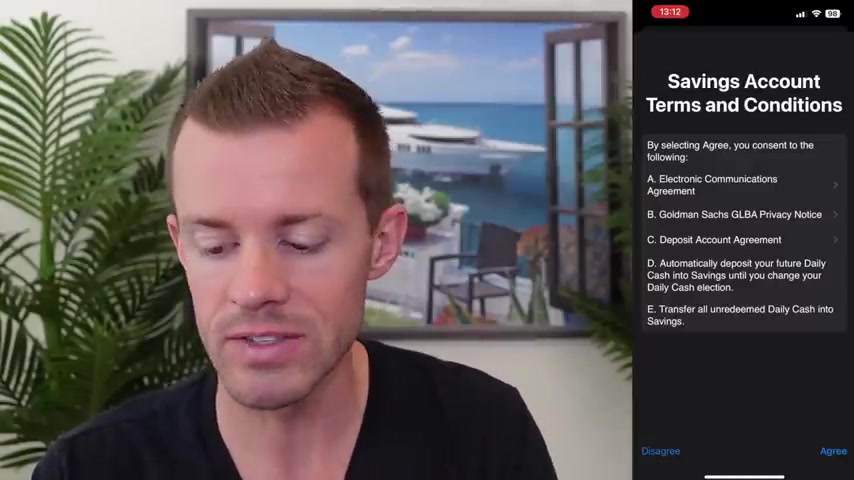

By selecting great you can send to the following .

You can tap on each one of these , for example , the electronic Communications Agreement and then uh that will load , you can then view the PDF and read that info uh to make sure that you agree to all their terms .

Once you have , they're at the bottom , right ?

We have the agree button .

So I will tap that .

Oh , you know , actually I'll point out first that uh look at letter D there , you are agreeing by opening this account to automatically deposit your future daily cash from your Apple card into your savings account until you change your daily cash election and basically where you want it to go .

So by default , all the cash back you earned from this guy right here will be now going to your savings account unless you alter those settings yourself .

Also letter E , you're agreeing to transfer all un redeemed daily cash into savings .

Meaning your current balance of daily cash on your cash card will then be going over your savings account .

So I will agree to all that .

Let's move forward .

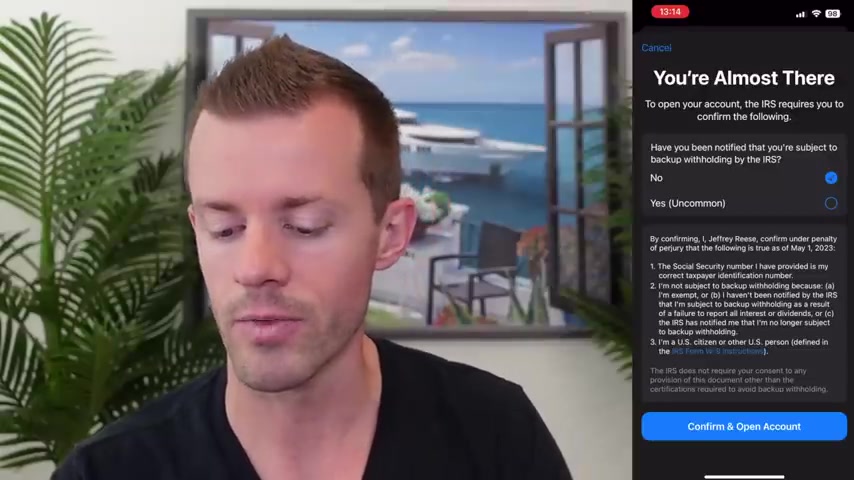

You're almost there to open your account .

The IRS requires you to confirm the following .

Have you been notified that you're subject to backup withholding by the IRS choose whatever it is for you ?

Mine is ?

No .

So I have that selected there then by confirming I Jeffrey Mark Rees confirm under penalty of perjury that the following is true as of May 1st 2023 when I'm recording this video .

So uh three things there .

Uh Yes , I do agree to all those confirm and open account .

Here we go , opening account , submitting your application to Goldman Sachs Bank USA account created and apparently that's all there is to it .

That's got to be the easiest bank account I've ever opened with any financial institution .

So that was fantastic .

So , how about I take you off for a little tour of this product here and we'll see what the menus have to option , how we transfer money in and out and all that type of stuff here .

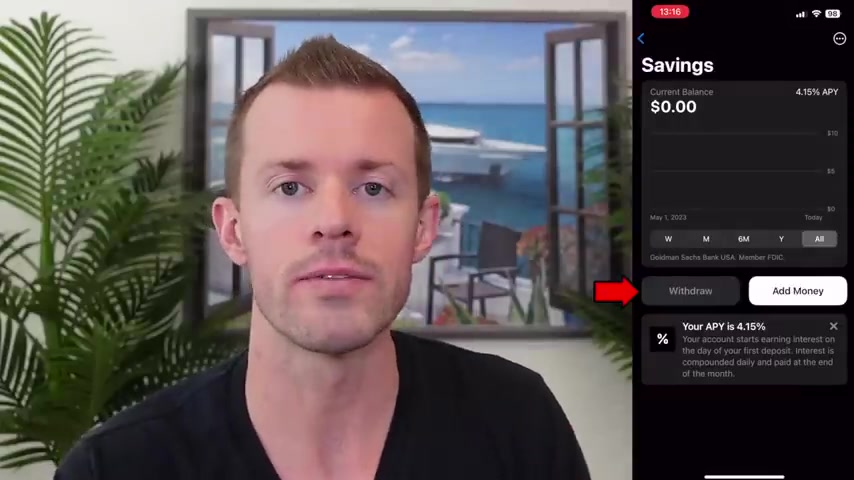

So apparently here's the dashboard .

We've got the A py 4.15% there at the bottom at the moment .

Uh interest is compounded daily and paid at the end of the month , then they are in the middle of the screen currently grayed out .

I have the withdrawal button to withdraw funds out of my Apple savings account and then send them off to another external accountant that I'll link to this or even to my cash card itself .

I can then add money .

We'll do that in just a moment .

But I also want to see here in the top right with the three dots icon .

We have account details , documents and notifications .

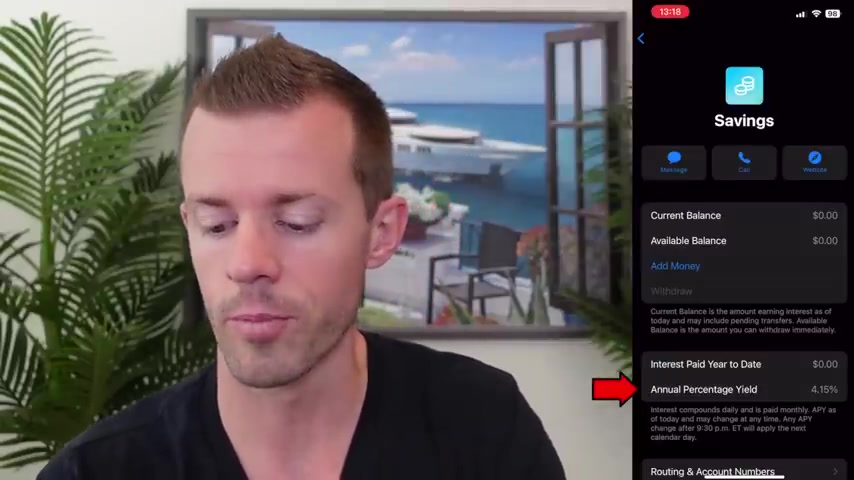

So if I click on account details first , here's what we've got .

First is the option to message Goldman Sachs .

If you have have support questions and you prefer to chat right now , maybe you can't talk on the phone if you're in an environment where you can't do so or right in the middle a button to call .

If you prefer to speak with a live representative over the phone , then the website itself let's see where that goes right over to the Apple card support page .

So you can probably look at FQ and stuff like that over there .

Back on over to the wall app .

We can see the current and available balance $0 looks pretty grim right now .

So we will fix that soon enough .

Also the same features again to add money or withdraw a bit further down .

We can see the interest paid year to date .

So every time like once a month when you receive your interest payment , that number will accrue over time .

The A py at that moment in time , still currently 4.15% scrolling down further here .

We can see the routing and account numbers .

So you'll need those to link with other external accounts from Chase Bank of America Wells Fargo , whatever else you have , then the middle option for bank accounts will give you a list of all your linked accounts once you've linked them .

So if I tap on bank accounts , I can then see my Ally bank account , which is my checking account right now .

I've already linked it because that's the account .

I used to pay off my Apple card whenever I have a balance on it .

So that one's linked by default and then I can add more from there .

Then we've got account information .

That's where we would go to see and or edit your email address , your physical address and any beneficiaries that you want to add or take away from your account and then we have the privacy policy and terms and conditions .

So overall scrolling back to the top here .

Super simple layout .

Nothing's really confusing at all , which is great back to the top here in the three dot icon .

Let's see what document says .

Uh So this is where you'll view all your statements that you'll receive every month as well as your tax documents .

Uh probably around January ish whenever Goldman decides to have those ready for you for tax purposes , uh That way we can report your interest earned and stuff like that to your tax accountant .

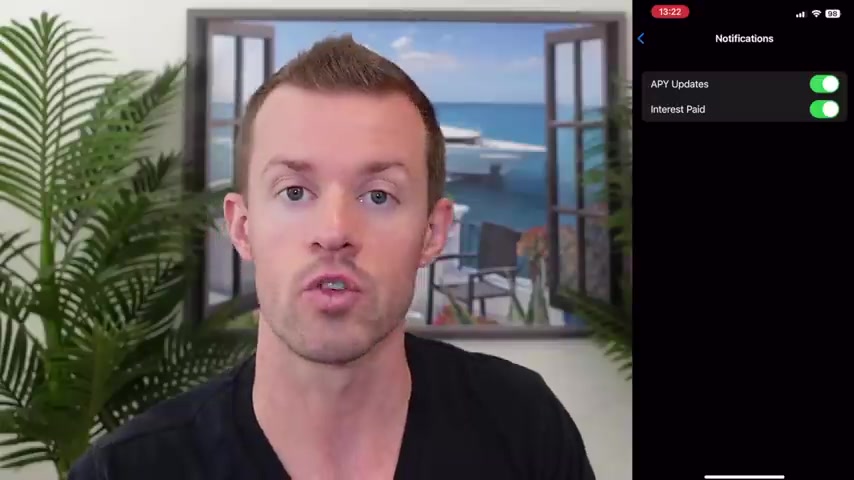

So let's go back and the last option was notifications .

Here's where we can toggle on or off any push notifications about a py updates probably when the rates change over time also for the interest paid notifications .

Meaning when Goldman does pay out on their monthly interest that you've earned , you'll probably receive an alert about that .

So , you know , when it hits your account and going back to the main dashboard here , how about we add some funds ?

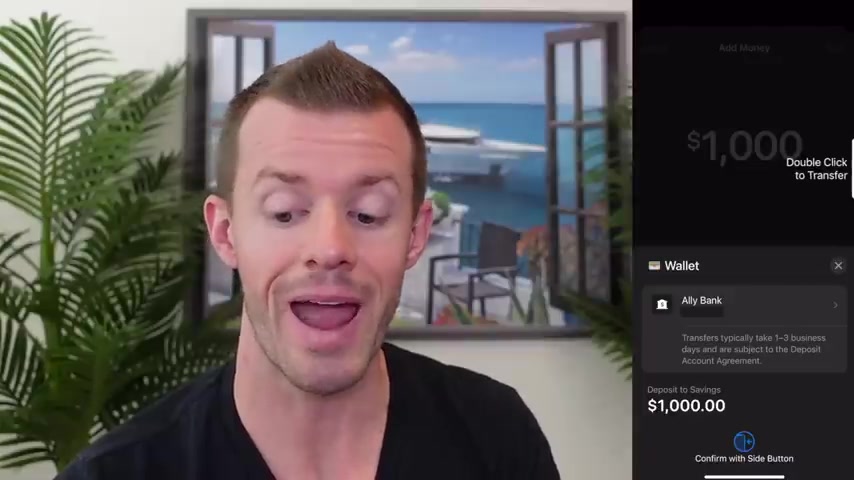

So I'm gonna click on the add money button and ok , we type in the amount next , I'll do $1000 .

That'll be from Discover savings account right now .

Next .

Uh interesting .

So this is where you have to have your account linked already apparently .

So it says my Ally bank account , uh transfers typically take 1 to 3 business days and are subject to the deposit account agreement .

So , uh , I don't want to pull from Ally , as I mentioned , I want to pull from my Discover account .

So if I click on the little arrow on the right hand side of Ally , well , let's see what we get .

Ah , ok , so just my Apple cash card , which is where my daily cash goes .

That's where I have my 29 cents bid money right there .

And also just my Ally Bank with no option to add any additional accounts from this dashboard .

So it seems like what we want to do here is definitely add a bank account first before you go through the flow to add funds .

So I'm going to cancel out of all of this here , go back to that three dot icon in the top right , click on account details and then go to a little bit further down where we saw bank accounts .

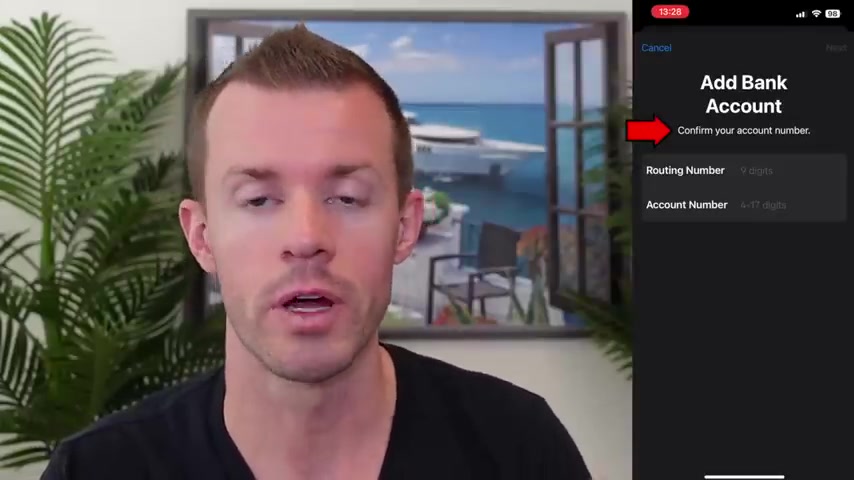

I tap on bank accounts and here it prompts me for the routing number and account number of that account .

So let me go grab that from my Discover account , type those two numbers in and then we'll go to the next step .

All right , I just did that and now it's having me do it one more time just to confirm and check for any typos .

So just be aware that you have to do it twice and there we go .

So now I've got two linked accounts .

Allies still on the top .

And then my new Discover bank account there in the second place slot .

So let me go back one level and back again to the main dashboard .

We'll go to add money now , same amount we'll do $1000 next .

There we go .

So now it's got my Discover bank account right there .

I can also select the arrow again and this time select either of the two accounts .

So you know , basically link multiple if you have multiple money sources and they can choose the account you want .

I'll leave it at Discover for now and then pulse in there on the right hand side as you can all see , it says double click to transfer .

That's basically my side button here on the phone .

So I'll double tap that processing little ding effect and there we go .

Wow .

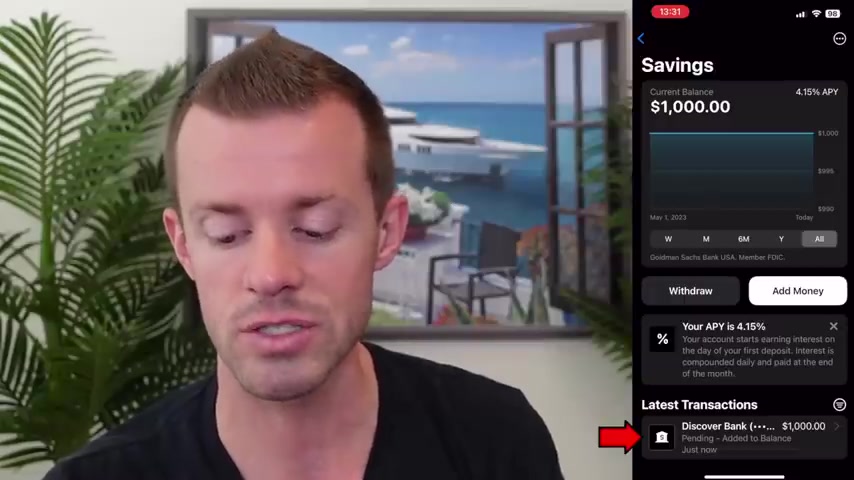

So apparently the dashboard here updates like instantly pretty cool .

So my graph , that little blue line that you see is for the line graph now showing the balance of $1000 at the very bottom .

It says the latest transactions from Discover Bank 1000 bucks pending added to balance just now .

So tapping on that , I can then see some more information about the transaction and including the small gray font at the fine print you see on the screen which says deposits start earning interest the day they're initiated .

So today funds are typically available for withdrawal by the fifth business day .

So they'll be pending for several days available probably by the end of this week .

But the cool thing is that I'm already earning interest and that concludes our tour of the Apple savings account .

So what do you all think ?

I've got to say from my first impressions here using it for the first time with all of you on camera here .

It was very straightforward and Apple does a great job of delivering on the message of simplicity with its products and services .

And they definitely did so here with their new savings account and with all that said , if you enjoyed today's video and believe it could benefit other people , then please help me get in front of them by liking this video , subscribing to the channel and turning on those notifications .

Also check out the links down below in the description area to earn some more cash back when you shop online through Rag 10 and to view my site with some great credit card offers that I've organized into different categories to help you find the cards that you like best .

I thank you all for watching today's video .

I hope it brought you some great value .

I look forward to seeing you in the next video and while you're waiting for it to be uploaded to this channel , always remember that you are great .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.