https://www.youtube.com/watch?v=ANspVExK0PE

Trading TAXES in Canada - Sole proprietorship vs Incorporation (Tax deductions)

All the profits below $500,000 are taxed at only 11% .

Yes , you heard it right ?

1 1% .

So did you make a lot of money from day trading last year ?

You did ?

Ok , great .

Guess what you'll be getting in the beginning of the new year ?

A Lamborghini .

No , heavy tax .

That's right .

While a lot of traders are living the dream banking , Lamborghini money and YOLO calls , not a lot of people actually take into consideration how much they need to pay for taxes because guess what ?

The Cr a Canadian revenue Agency wants a piece of the pie too because sharing is caring , right ?

I've been a day trader for more than seven years now and I've learned so much along the way about optimizing tax deductions and saving money .

So that's why I'm making this video to help you better understand day trade in taxes in Canada and save more of your hard earned money .

I'll be covering some key topics such as business structures and tax deductibles and tax saving tips for active traders .

A lot of time research and of course , sharing from my own personal experience as a full time day trader went into this video .

So if you appreciate my efforts , please make sure to drop a like at the bottom of the video .

That'll tell me to make more videos like these in the future .

Like we mentioned earlier , there are two types of incomes that we are concerned about as active traders , capital gains and business income .

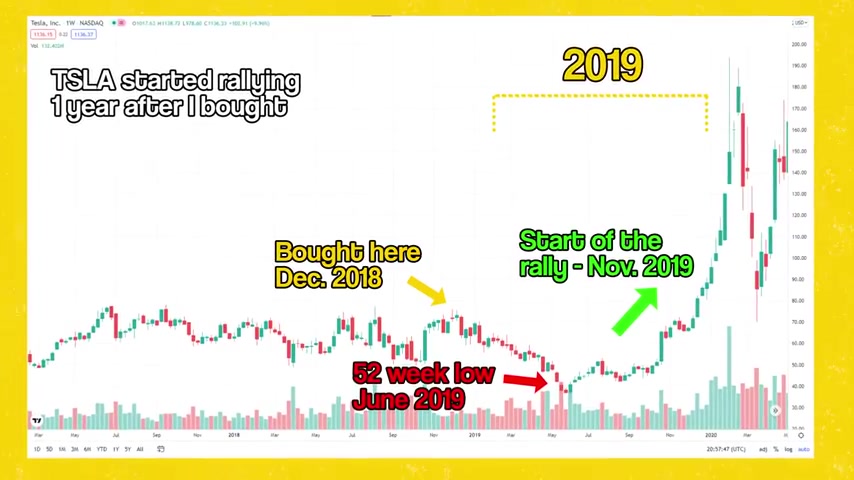

If you made $100,000 from investing , let's say you bought Tesla stock many years years ago .

Pres split and you held the position for more than three years and finally cashed out in 2021 for a handsome $100,000 profit , then that profit should be considered capital gains .

So you'd only need to pay tax on 50,000 of that income .

Essentially 50% of your profits are tax free .

However , if you were day trading Tesla stock instead , meaning you make multiple trades a week and some you hold the stock position for only a few minutes or a few hours .

Then that same $100,000 profit will be very likely to be considered as business income .

So that entire $100,000 is taxable at your full marginal tax rate .

And yes , this tax bill is definitely going to be a lot higher than you'd expect .

So we got the bad news out of the way , but don't worry , it gets so much better .

The sweet , sweet thing about filing your trading profit as business income are the tax deductions .

Basically , this means saving more money and keeping more profit in your pocket .

This brings us to the first key topic regarding day trading .

Taxes in Canada business structures and tax deductibles for day traders .

But before we go there , here's a quick mandatory disclaimer .

I am not a CPA nor financial advisor .

I don't know anything about taxes .

All I do is , hm .

Socks , yellow calls and Bitcoin .

This video is for informational purposes only what works for me personally here may not apply to you .

All right , with that aside , the two most applicable business structures for day traders are sole proprietorship , basically self-employment and incorporation .

If you just realize after watching the first part of this video that you should be reporting your profit as business income , then you will most likely be filing a sole proprietorship .

Sole proprietorship is the simplest business structure in Canada .

It's not that complicated .

You don't need a lawyer or even set up a company name .

It just means you are self employed , you own your own business of trading and you are the only employee .

For example , if my ex-husband , Mike bag holder , it's about drive .

It's about is filing for day trading profit this year .

His sole proprietorship is just under his personal name , Mike back holder .

That's it easy .

Peasy .

Lemon short squeezy for most traders in Canada , you'll be filing your day trading profit .

A self employment income and you'll pay the same personal tax rates just like all the normal people working 9 to 5 .

However , the big difference is that since you own your own business of day trading or swing trading , you now have a variety of deductions that are not available to regular 9 to 5 employees .

As traders filing a sole proprietorship , you get to write off your trading commissions platform fees , locate fees , scanner fees or even day trading education programs .

And since you most likely trade from home , just like I do , then you can write off part of your utility bills , mortgage interest , internet and the phone bills and the list just goes on and on really quick .

Here .

Let me show you how to calculate how much you can write off for home expenses .

If you live in a 1000 square feet home and your home office for trading occupies 200 square feet , that means you can write off 1/5 of your mortgage interest only the interest , not the principal and the maintenance fees and any home repairs essentially deduct all the expenses you spent to generate your business income .

So if you made $100,000 in 2021 and spent $20,000 on business expenses , then that means only 80,000 of the profit is taxable income .

I made a video on this channel going over all of my day trading expenses and the total comes out to be more than $79,000 a year .

So all of these are tax tax deductions for my personal trading income .

Again , make sure to consult with a tax professional about this .

If you are indeed making a substantial income from day trading or swing trading , it's very much worth spending the 3 to $500 to have a CPA do all the proper calculations and write offs for you .

This is even more important if you are considering the next business structure for even more tax savings and that is incorporation .

There are many benefits of why people choose to incorporate their business .

But the one benefit that applies to us traders is the small business tax rate .

And here in British Columbia where I live , all the profits below $500,000 are taxed at only 11% .

Yes , you heard it right .

1 1% .

Also , that's the grade I got for my math exam .

Essentially incorporating your trading business means you the owner becomes a separate legal entity from your business and the two entities are taxed separately .

Now , we're going to dive into all the nitty gritty details that could save you a lot of money .

These are all the lessons I've learned reporting day trading taxes over the years .

Many mistakes in the past have cost me a lot of money .

So if you're learning from this video , remember to drop a like and subscribe .

It's easy and free to do .

Unlike paying for your taxes , share this with another friend and pay it forward .

I would really appreciate it under this corporate structure .

Your trading profit under $500,000 is taxed at 11% in BC and anything above $500,000 is taxed at 26% .

And you , the owner of this business can choose to pay yourself a salary from your trading corporation and only that salary is taxed at your personal tax rate .

Ok .

Bear with me .

Let's dive into an example here .

Let's say my ex-husband , my bag holder .

It's about , it's about power .

We made $400,000 in trading last year and had $50,000 in expenses .

If he was filing a sole proprietor , he would pay $148,000 in taxes , which is 40 0.82% tax rate .

His take home would only be $202,000 .

0 my God , just thinking about this makes me want to cry .

However , if Mike had been incorporated as Bag holder Trading limited , he can still write off that 50,000 in expenses .

But now the corporation only needs to pay 11% tax rate which equates to only $38,000 to the cr A .

And the company gets to keep 311,000 in profits .

I mean , 38,000 versus 148,000 in taxes .

That's a pretty big difference .

But wait , don't forget that Mike Bag Holder himself needs to use the trade in profit to pay the bills too .

Since he owns bag holder trading limited , he can pay himself $90,000 in salary and he would only need to pay $18,000 in personal taxes to the CR A and he gets to keep $67,000 in his personal bank account .

The rest of the money , he does not draw out a salary .

Stays in his corporation B holder trading limited until he chooses to draw out more next year .

Or maybe he just reinvest that capital into his trading account .

So as you can see , this is the reason many high income traders may be interested in incorporating their trading business .

You essentially could keep more of those profits , but just in a separate entity that you fully control , the tax advantages are quite astonishing .

Now hold up before all of you watching this video , just hop on to your Lamborghinis and straight to your closest lawyer's office .

Make sure to call me first .

Just kidding .

I have to explain .

Incorporating a day trading business is not for everyone .

The biggest disadvantage is the cost .

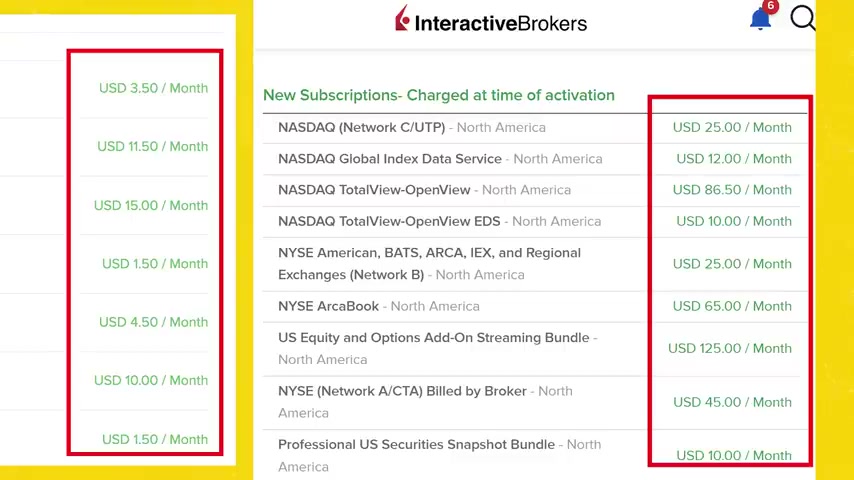

Since you are trading now as an incorporated company , you will need to open a corporate trading account with your broker and for most brokers and platforms , that means higher monthly data fees .

Just a quick example , if a sole proprietorship day trader subscribes to an interactive brokers market data , it will be around 20 to $30 a month .

However , as a corporate trader , that means the same subscription is now going to be around 300 to $500 a month .

Big difference here .

In addition , since you're now running a corporation , you have to hire corporate accountant , which could mean 3 to $5000 each year .

Potentially lawyers too slack on another $1000 and other super annoying things like record keeping and um doing math .

So , in my opinion , once again , please talk to your own CPA and assess your own situation here .

I think it's only worth incorporating your trading business once you are consistently making six figures and you are near the top of the tax brackets .

Otherwise filing a sole proprietorship will be more than just fine and you still get the benefit of deducting all the trading expenses .

Again , I think it's only worth incorporating your trading business once you're consistently making six figures .

And another aspect many people don't consider is real estate purchasing for your own residents with inflation rising after 2020 .

1 of the best places for traders to put their trading profit is in real estate properties .

Many are upgrading their whole homes to a bigger space so they can trade and enjoy working from home .

And this is the reason I've done a substantial of day trading as my personal income .

Instead of incorporation , I've been planning to purchase a new home to live in for a few years and to qualify for low interest , conventional mortgage loans .

A self employee traders , we will need to have at least two years of consistent personal income .

Yes , it would have to be personal income that's taxed as a sole proprietor at your full marginal tax rate because you cannot use your corporate funds to purchase a home for yourself to live in .

The cr A would definitely come after your , if you are trading under a corporation and looking to purchase your own home in Vancouver or Toronto , you would probably need to take out at least $100,000 in salary from your business for a down payment .

That means your business will be taxed on a corporate tax rate and you again would have to pay the personal tax rate on that salary .

I don't know about you , but I don't want to pay any more taxes than I have to legally .

Of course , the CR A is always watching everyone pay your taxes .

Ok .

Make sure to speak to a tax professional and assess your current and future financial needs and goals .

All of these little nuances should be taken into consideration when deciding whether sole proprietorship or incorporation is right for your trading business .

If you are worried about taxes , that means you've made some money from trading .

That's a good thing if you are still on sure whether your profits should be capital gains or business income .

Check out this other video I've made previously on that topic if you enjoyed this video , please remember to drop a like and subscribe if you're interested in learning more of my day trading strategies , especially risk management .

Feel free to check out the Humble Trader Academy on my website .

Thank you guys so much for watching .

As always , I'm the humble trader and I'll see you guys next time .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.