https://youtu.be/xfoPdRmDUHA

Winning Strategies for a Falling Market - You're Doing It Wrong If...

Hello everyone .

Welcome to Friday morning .

I hope everyone's had a wonderful week .

It's been very profitable for those of you that have been along the Bay ETF S this week .

And that looks like it's going to continue on Friday .

Currently , the dow futures are down another just under 200 points .

Uh Looking at the Vix , uh the Vix made a new high , new closing high yesterday looking like it's going to break out and make a higher high on Friday .

Things would change on Friday if we closed below $15.10 we only had a couple of major trend changes this week .

But for the most part , things have been going in the previous direction , whether you're looking at the US dollar , it moved up again yesterday .

So the trend is still intact .

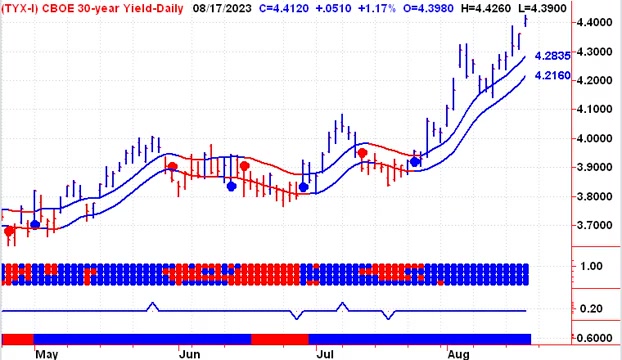

Bonds continued to move lower on Thursday .

Yields continue to move higher .

The price of gold continued to move lower on Thursday , crude oil has pulled back and is on a cell signal .

We are looking at resistance up here and it looks like it couldn't break out and make higher highs .

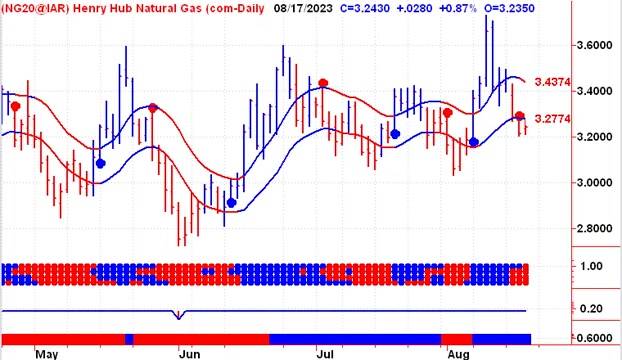

We also saw a natural gas pull back .

So that has very little to do with what happened to the TSX this week .

You look at the TSX 60 .

We made a new low .

Yesterday .

We moved up and filled the open gap and then pulled back fairly quickly .

And that had a lot more to do with financials and bank stocks than the energy sector .

And certainly the miners have been down this week as well .

If you've been following us , we've talked about the fact that the Bank of Nova Scotia looked like it was the weakest on the way up and it is the strongest on the way down .

And so the weakest stock has been taken to the woodshed as opposed to the strongest bank stock which has barely uh fallen so far .

So shorting the TD Bank , not a good thing .

Shorting Bank in Nova Scotia has been a good thing .

So what uh worked on the way up is also working on the way down .

Uh Looking at the dow the S and P 500 the NASDAQ and the semiconductors , they all made new lows on Thursday .

So no change in trend there .

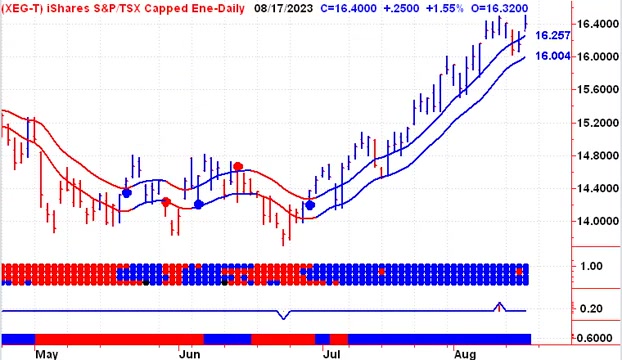

And then looking at commodity stocks , the Canadian energy sector is still holding up .

The US energy sector saw some weakness on Wednesday , generating a new cell signal and then a move up on Thursday .

So the market still loves energy stocks .

Certainly when you compare those to anything technology related and then gold stocks , gold stocks have been on a cell signal since July .

And that continues on Thursday where we made a lower low .

Now , if you're not playing the Barry ETF S right now .

Well , shame on you .

Anybody who's done a one on one tutorial with me .

I've walked through the importance of having a balanced portfolio .

So it's two X ETF S in Canada , three X ETF S in the US .

And they are working well at the moment .

Ok .

That's all I wanted to cover this morning .

Uh The webinar we did the other day .

I'm editing that video .

It'll probably be out by the end of the day .

Uh But otherwise , uh looking for lower stock prices and higher prices for our bare ETF S on Friday .

Enjoy the rest of the day , enjoy your weekend .

Next time you'll hear my voice is on Sunday .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.