https://www.youtube.com/watch?v=uEb4qwzOXsU

Steve Rattner's Charts - Coronavirus Re-Ignites Recession Fears _ Morning Joe _ MSNBC

Meanwhile , a perfect storm hit Wall Street yesterday as fears of the Coronavirus collided with a plunge in oil prices .

The dow sank more than 2000 points losing nearly 7.8% its worst day since the 2008 financial crisis .

The S and P lost 7.6% and the NASDAQ almost 7.3 the was so bad that a circuit breaker was triggered minutes after the opening bell which halted trading for 15 minutes .

The plunge in oil prices comes as Saudi Arabia and Russia battle over market share .

The demand for oil has declined because fewer people are traveling due to the Corona virus .

This morning , global markets are now trying to announced .

Our futures are pointing to a more than 800 point surge after the president floated the possibility of a payroll tax cut .

So Steve Ratner , you have charts but before we get to your charts , let's talk a little bit about what happened yesterday .

I don't usually watch CNBC only because I mean , it's a great network , but I , I usually don't watch it because of course , as you know , Willie and I believe in off track betting is Steve Ratner .

There you go .

Ok .

I was just wondering , I was actually talking to a wall here .

Ok .

Uh , so , yeah , we , we do a lot of off track betting .

So , Willie and I don't listen to C NBC .

What it's CO TB , but you have to have a certain cable provider to have that one .

But I was listening obviously and watching , uh , C NBC all day yesterday and it seemed , while the oil , well , sort of the oil wars between Russia and the Saudis caused a lot of the unrest by the end of the day when they were trying to figure out how long this route would go .

People were moving back to the Corona virus and talking about the fact that there's just so much uncertainty that the markets don't know what's going to happen .

They don't know what the bottom is going to be .

They don't , I mean , they have a supply problem , they have a demand problem , they don't know what consumers are going to be doing .

I mean , there were so many questions and , you know , they sort of price this oil war into it now .

It seems all the analysts are worried about the Coronavirus and trying to figure out where the bottom is going to be .

Nobody thinks it's going to be a deep recession that lasts for a year and a half .

But they think it could be a pretty severe recession could happen quickly and be more U shaped what from the analysts you spoke with yesterday on the street and in your business , what what caused yesterday ?

Was it that perfect storm Mika was talking about ?

And if there is a recession , how long do they think it will last ?

Well , of course , the stock market is just another version of O TB , but we try to do it with a few more numbers .

We probably get to about the same probability of success in predicting it .

Look , I think yesterday was a perfect storm of things that came together and they were all related .

Of course , it started with the Corona virus which led as Mika said to a drop in oil demand , which led to a fight within OPEC between the Russians and the Saudis and effectively a collapse of OPEC so that everybody is now pumping as much oil as they can , which led to oil prices collapsing .

And then you also have the fact that the market hates uncertainty .

The market is not used to public health crises .

It doesn't really fancy itself as an expert on public health .

And then you have the fact that frankly , there was an absence of leadership from Washington for a good while and markets hate that they want leadership .

They want the president to stand up and say something .

The president spent the weekend playing golf and spent Monday at a fundraiser in Orlando .

But if we can take a look at the , if you want and I'll show you kind of what happened .

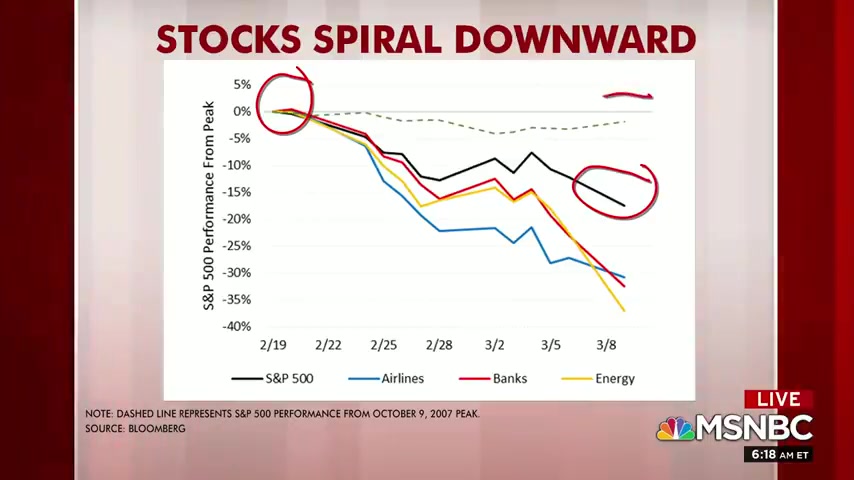

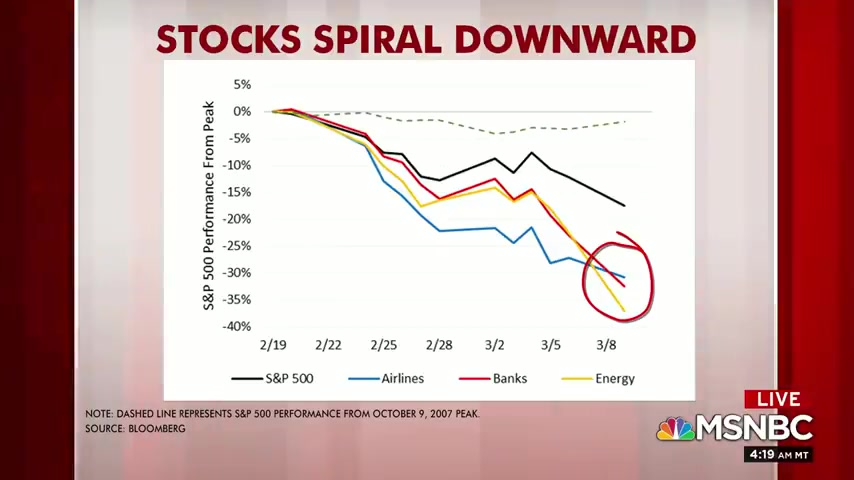

So as Mika said , you had this enormous sell off yesterday , but that brought , that brought the total sell off since the beginning of this event back in February , it brought the total sell off in the S and P to 19% .

And that's 1% short of what we call a bear market .

20% is considered a bear market .

What's also interesting about this sell off is if you compare it to what happened in 2007 when the market began to sell off in anticipation of the financial crisis .

And you can see the small gray dotted line up here .

The sell off in this case has actually been steeper than it was in 2007 .

It has been a record drop in terms of the amount of drop over the period of time it occurred .

Now , also , not surprisingly , it's been concentrated in a few industries that have been most affected by all this and that includes banks , banks get hurt when interest rates go down because they can't make as much money on their loans .

It includes airlines , not surprising because people don't fly as much and it includes energy which has been absolutely decimated by this .

And so if you look at a few of the stocks , for example , United Airlines is down by 40% since its peak Citigroup is down by 34% accidental petroleum just to pick some of the leaders is down by a pretty stunning 71% .

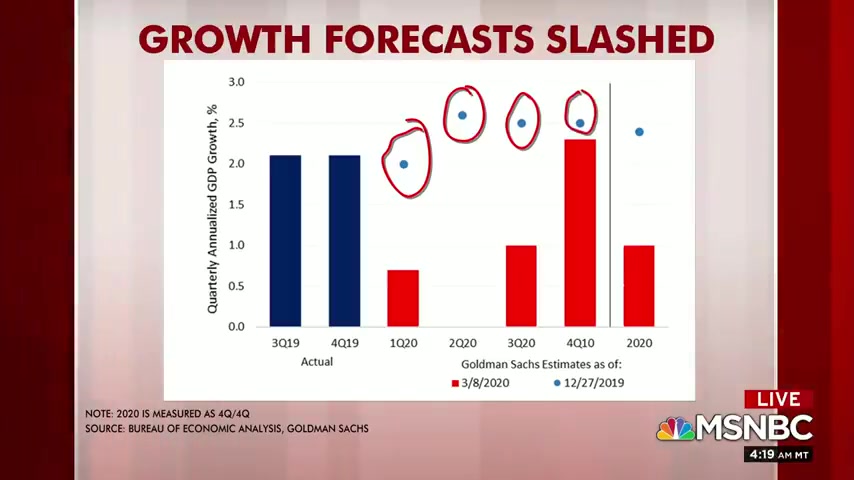

So let's turn then to what this means for economic growth .

So already economists are slashing their forecasts for economic growth .

This happens to be Citigroup's forecasts but you can use anybody you want .

And so you can see that back here for the second quarter , Citigroup was projecting , excuse me , A was projecting a much stronger quarter and now only 1% .

And then in the third quarter , Citigroup was projecting over 3% and it's now projecting 0/4 quarter also cut its projections and so on .

And so you can see that for the year as a whole , Citigroup is now projecting 1% growth this year compared to 2.4% growth that it was projecting just a few months ago .

And so Steve , can I interrupt you here ?

We really , so we look at these projections but these really and I certainly respect the economists who are trying to figure out what's going to happen .

But we have no idea what this epidemic or what this pandemic is going to be .

If it's like Italy , then of course , those numbers will likely be far worse .

If it lasts six months , the numbers will be far worse .

We're still sort of whistling in the dark , aren't we ?

Because we don't know the extent of this Coronavirus .

We've all heard this is not the deadly virus that you know , this ultimate virus that everybody has feared because the survival rate is still fairly high .

It's far , far worse than the flu .

But , but it's not what the deadliest of pandemics that a lot of people have feared is .

But if it gets out of control , then we could be shut down like Italy for six months , then those numbers will be far worse , won't they ?

Sure .

And we can take a look .

It's all probabilities .

Joe , nobody knows for certain .

We're just guessing on probabilities and if you want to look at and of course , if we get on top of it , I'm sorry to interrupt .

I just want to finish that sentence if we get on top of it .

Actually , it may not be that bad .

I mean , the future really is in the hands of our leaders on how quickly and how nimbly they respond to this crisis .

It is .

But the Yin and the yang of that , of course , is that a more aggressive response , shutting down more of the country as Italy is doing is going , would have a bigger short term economic effect .

Italy is going to go into recession .

That is a virtual certainty simply by they're already on the verge of it .

Anyway , the secession of economic activity Trump Trump has been trying to do is have it both ways in a way he's been trying to have business as usual because he doesn't want the country to go into recession .

But he's also now having to recognize the reality .

So let's talk about probabilities and take a look at what the market , what the prediction markets think is going to happen .

And there are other ways to measure this with treasury yields and things like that .

But this is pretty simple .

But if you simply go back before all this started , you can see the market was pricing in a relatively low 20% probability of a recession this year .

And now you can see what's happened in just the last few days where the probability has shot up to 64% of a recession this year .

And again , it's a probability , we don't know .

But I would also say since there are obviously political implications of this , just if there's a recession this year , it doesn't necessarily mean there's going to be a recession before election day .

It doesn't necessarily mean it is going to bring down the Trump presidency .

But there is this distinct , I think a very possibility of a recession , certainly a slowdown .

And right now , I would say the odds are slightly better than 50% of a recession .

Thanks for checking out MSNBC on youtube and make sure you subscribe to stay up to date on the day's biggest stories and you can click on any of the videos around us to watch more from morning , Joe and MSNBC .

Thanks so much for watching .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.