https://www.youtube.com/watch?v=2vICxnmFBEU

Bombshell Updates In Bitcoin & Crypto TODAY (Vivek Policy, BlackRock Ethereum News, SHIB, & MORE!!)

Looking at the Bitcoin price as we rally higher .

Yes , we took a dip today .

But as crypto adoption continues to happen , there is a frenzy of international interest in this asset class .

If you want to talk about is this entire bunch of cryptocurrencies ?

Manisha is here to tell us more .

Manisha , what's going on ?

I have also been seeing some reports which have completely crazy target prices on Bitcoin .

And while the bigger news is probably what just happened with Blackrock , a new filing with Ethereum as well as why is avalanche pumping ?

Why is polygon pumping ?

Why are alt coins pumping ?

This is international interest Bitcoin as we've been talking about is trading at the highest since May 2022 .

But the last 24 hours absolutely belong to Solana which gained up by nearly 11 to 18% .

On the higher side .

It is now the sixth largest crypto incentive market capital there .

And Solana of course , is seen as more efficient cost effective even more than Ethereum .

And that clearly has been the major favorite within the old coins .

But the revolution that is happening today on American soil with this upcoming US presidential election .

This is becoming mass marketing for Cryptocurrency as all these different candidates are forced to take a stance on the policy .

My view on the promise of Bitcoin though is deeper than that .

It is an opt out from the broken financial architecture created .

I have an update from the video we put out about five months ago .

What every single presidential candidate their stance on Bitcoin just in presidential candidate , Vivek Ramaswamy lays out his three freedoms of crypto policy framework .

I got to ask you if you become president of the United States , what changes from a crypto perspective ?

I think what changes is that regulation by enforcement ends ?

What does that mean that the rules are delineated clearly in advance rather than you having to wait for an enforcement action for the SEC to figure out whether or not a given coin was a security or not .

That Gary Gensler refuses to say today , for example , about Ethereum , what also changes is that any unconstitutional regulation , not just as it affects crypto .

This is part of a broader administrative state reform for me , but any regulation that Congress did not expressly give an agency , the power to pass is null and void .

It turns out that applies to most regulations governing the crypto industry .

So first and foremost , clear regulations which I like and I'll get to other candidates in a minute again , we'll cover everything .

So you have all the information .

But number one , Vivek says he will protect code as freedom of speech .

And I've put these into three categories for the areas of reform that I've laid out .

One is the freedom to code .

It's my view that code is speech and while it's perfectly appropriate for the government to go after bad actors , if you take the tornado cash example , going upstream for the actual developers of the code , that's wrong , you got to draw the distinction between the code itself , which is protected versus people who misuse it to steal .

That's something that's not happening today .

That's freedom of speech is , is principle .

Number one , it's the freedom to code .

Principle .

Number two is financial self reliance .

I'll give you the punch line here .

There's a lot that that's behind it , but the punch line is self hosted wallets should not be touched .

I mean , that's part of the Jeffersonian Jacksonian vision of financial self reliance and independence .

We can't have a regulatory apparatus that effectively creates self hosted wallets and prevents them from actually being able to exist .

So that's point number two .

So self hosted wallets are just regular defi crypto wallets .

Now there's custodial and non custodial , non custodial like a meta mask , like anything you control are self hosted while custodial would be like the coin base or an exchange where they hold your keys .

They say it's yours , but they're really in control .

And then point number three is just the freedom to innovate and I say this as somebody who comes from multiple different regulated industries in the past , the wet blanket on American innovation isn't even Congress .

It's the regulatory state that's making up its own rules regardless of the laws that actually exist in this country .

And so we'll rescind all of those unconstitutional federal regulations .

We'll downsize the federal employee headcount by 75% which I think is a good thing .

A lot of these toxic regulation and enforcement action come from the fact that if you have a bunch of people showing up to work who shouldn't have had that job in the first place , they find things to do .

We'll put an end to that and , and the good news about all of this is these are things I can get done as the US president without asking Congress for permission or for forgiveness because this relates to the executive branch .

Many people do not know this , that the United States is one of the largest Bitcoin holders in the world .

So obviously Satoshi owns a lot .

The Winkle V Twins on a lot exchanges are big holders , but because of criminal confiscations and hacks the US Department of Justice and public wallets which we can check have been quietly accumulating and holding Bitcoin .

So it's no wonder after all the rumors .

All the speculation Blackrock officially files for a spot .

Ethereum ETF with the SEC .

The form S one comes a week after Blackrock registered their ishares , Ethereum trust entity with the Delaware state .

That's exactly what Larry Fink did before he registered his Bitcoin ETF .

And if slash when approved , this will be listed on NASDAQ .

If you hold Ethereum , you'll like this .

According to James Siefert , who is a lead analyst at Bloomberg Intelligence , Ethereum has achieved commodity status but the SEC won't admit it .

The SEC and chair Gary Gensler won't publicly acknowledge that A thee is a commodity but multiple actions since 2018 show they implicitly accept its commodity status .

He lists multiple examples why and then how this affects you .

He says that if the SEC officially declared Ethereum a security that would likely lead to a duel with the CFTC , which the SEC doesn't want Bloomberg intelligence expects the SEC to treat Ethereum more like Bitcoin and approve a spot Ethereum ETF in 2024 .

Hey , why is polygon pumping ?

Well , you can always tune in to alt coin daily and find out just in yesterday .

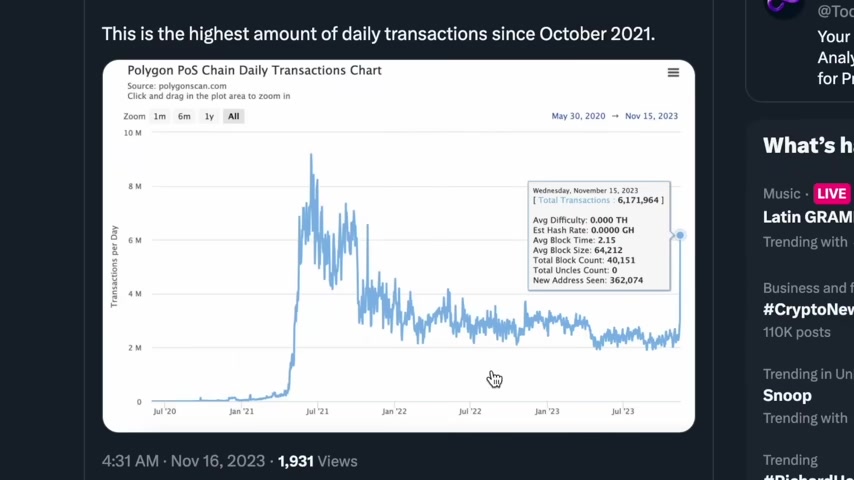

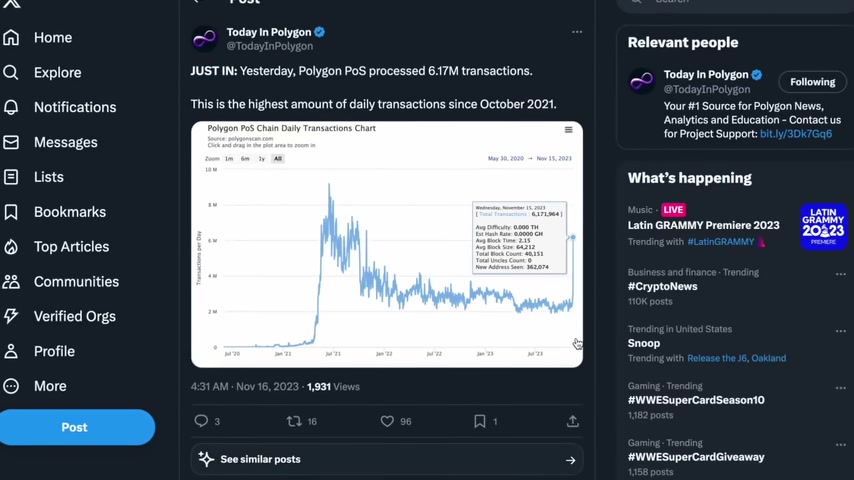

Polygon proof of stake chain processed 6.71 million transactions .

That's the highest amount of daily transactions for polygon since October 2021 .

Also looking at net inflows when compared to the other major blockchains new compared to all blockchains .

Polygon P OS and Polygon Zkevm have recorded the highest net inflow over the last 24 hours , beating avalanche , beating optimism coming in a one and two and also major news as we shared in yesterday's video polygon deck volumes .

Are up over 200% in the last 30 days .

Now , why is this happening ?

Well , as explained by one of the founders of Polygon Sandeep , he says , I hear there's some game baby shark launching .

Could that be the reason someone told me just now that the minting stopped and we might go back to less crazy levels .

So just understand that metrics like this will probably level off but also understand this represents actual building development use on boarding onto the network .

Due to specific depths .

And big announcement , Tether plans major expansion into BT C mining with a $500 million investment .

So this is tether , the stablecoin company and they have ambitions to reach 1% of BT C mining computing power under their new CEO and their new facilities in South Africa will be part of the push .

The company will build mining facilities in Uruguay , Paraguay and El Salvador as it grows its computing power to 1% of the BT C network .

So they will not let price go down .

Bitcoin's network will only get stronger .

And if you're asking why is avalanche pumping avalanche pumps 14% after JP Morgan adoption .

So banking giant JP Morgan will be using the Blockchain to tokenize their portfolios .

JP Morgan's Onyx has tapped an avalanche subnet or a dedicated version of the Blockchain and a proof of concept of Apollo global , meaning this is just sort of a trial run right now , but this proof of concept illustrates the potential of Blockchain smart contracts and tokenization to stream portfolio management .

Boxing legend Manny Pacquiao announces a partnership with Shiba Inu .

Thank you s community for supporting the Manny Pacquiao Foundation .

We are excited about this partnership , godless .

All right , nothing more to say .

Pretty cool .

If you hold ship .

If I missed anything , comment down below reading now , like always see you tomorrow .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.