https://www.youtube.com/watch?v=NTqPMtflxBI

The ACTUAL Way Bitcoin Could Fail & Go to ZERO (this will shock you.)

A lot of people , they , they always whine , I hear this whine .

But what about the quantum computer ?

What about the quantum computer ?

You know , and I wanna say , yeah , and what if an asteroid hits the earth and kills us all ?

What is the actual way Bitcoin could fail ?

Is it quantum computing ?

Is it artificial intelligence ?

I mean , what will A I do to crypto or is it something else as a smart investor who owns Bitcoin who believes in crypto who subscribes to alt coin daily right now .

Let's be smarter than the average investor and understand all outcomes .

Number one before A I , how worried are you that quantum computers could break Bitcoin ?

The question is uh about security and I'm , I've listened to one of your talks about uh quantum computing and you had said that we can assume that the NSA has quantum computing currently .

So my my question is how can Bitcoin safeguard against quantum computing ?

Because once that's reached , they'll be able to essentially break into the wallets simultaneously .

That that's a very good question , Blockchain expert .

And Coder Andreas Antonopoulos explains the true effect that quantum computing will eventually have on Bitcoin that quantum computer , which can also break all of the encryption keys on all of the nukes in the world , all of the communication keys and all of the nuclear subs and all of the military intelligence networks and all of the commercial networks .

I don't think they're gonna use it to break Bitcoin if you know what I mean ?

This is such a great initial point by Andreas that if slash when the NSA or any government or any entity eventually gets their hands on a strong enough level of quantum computing , which is years if not decades away , Bitcoin will sort of be the least of our worries compared to the nuclear codes , the military secrets , the bank accounts will be ruined all banks again , only if slash when quantum computing is strong enough .

The question is how powerful is it ?

How many bits , how many cubits of quantum computing do you have ?

And researchers at the University of Sussex estimated that a quantum computer with 1.9 billion cubits could essentially crack the encryption , safeguarding Bitcoin within a mere 10 minutes while just 13 million cubits could do the job in about a day .

How close are we to this many cubits ?

Well , a few months ago , at the end of 2023 the world's first first quantum computer to exceed 1000 cubits was invented , they surpassed IB M's computer which at the time held the record for 433 cubits and again , 1000 is nowhere near 13 million .

But when that happens , what does that mean for you as a Bitcoin holder ?

The real problem becomes when you have broad commercial availability of quantum computing but not broad enough that all of us can use it in our wallets .

And there's that interim period that's a bit awkward .

And during that interim period , Bitcoin needs to change its algorithms .

But one of the interesting things that happens is that while you can change the algorithms on all of the active wallets , some wallets have lost keys or the people who had those keys are dead and they can't change the signing algorithm , which means that those wallets will get captured by quantum computers .

So one of the interesting things that happens is we will know when quantum computing exists when Satoshi s coins move .

That's one of the reasons they'll move eventually they will move and they'll move because someone will be able to break the keys .

Um But for the rest of the ecosystem , we can migrate quite easily to another algorithm .

It's not really as big a threat as people think it is .

So the solution will be a simple upgrade , a simple soft fork slash migration .

Well , what happens when they get so powerful they can break Sha 256 .

Well , dudes , we're just gonna go to Sha 512 and we're gonna go to the next thing 1024 .

And anybody that ever studied bi uh studied um computer science knows we start with 16 , go to 32 go to 64 go to 1 28 2 56 5 , 1210 24 and so on and so forth .

And the numbers get pretty freaking big .

And again , just before we get to artificial intelligence with Satoshi Nakamoto being one of the largest Bitcoin holders in existence .

Andreas further explains what quantum computing means for those coins .

Does quantum computing mean that at some point all lost coins could be reclaimed because they can't be moved to an upgraded address .

Um JJ Yes , that is the case .

First of all , we don't know that Satoshi has 1 million coins .

It's difficult to attribute exactly how many were mined um directly by Satoshi .

Um That's an estimate but let's call it 1 million and there's a lot more Bitcoin that's been lost over the years .

What happens with those quantum computing would basically mean that the elliptic curve digital signature algorithm would be vulnerable .

Now , there are two different categories of algorithms that is used within Bitcoin .

One is a hashing algorithm sha 256 and the other one is a digital signature algorithm .

EC DS A elliptic curve quantum computing will uh most likely affect the elliptic curve digital signature algorithm first .

So he is saying that while most people are scared the quantum computing could break Bitcoin's mining cryptographic hash function which is called shaw 256 .

Sha 256 is used for cryptographic security .

Andreas explains that it's not the mining , it's the wallet cryptographic security .

Whether you can use a quantum algorithm to shortcut Sha 256 .

I'm not sure about that .

I don't know if there is a quantum algorithm for that or how easy it is .

So that's a different class of algorithm and it might require different uh a different approach to cracking .

But let's say that EC Ds A is affected .

Ironically , what that means is that if you lost your keys , but you had previously used that address , then uh a signature together with a public key will be visible and will be available on the uh Blockchain .

Um Because when you spend from an address , you leave behind the public key and a digital signature .

Whereas Satoshi um for example , never spent , never moved any of the initial mind coins .

So if in fact , Satoshi had a million coins and if those are sitting there on the Blockchain , um because they haven't been spent , we don't have a signature and we don't have a public key .

What we have is an address and an address is the result of a double hash and is not the result of the EC DS A algorithm which means that if a quantum computer can crack Ec Ds A but it can't crack sha 256 then um Satoshi coins are safe .

The only coins that are affected are the ones where those addresses had been reused several times .

It's one of the reasons why , um , it's a best practice to only use an address once the first time a signature appears on the Blockchain is when those funds have already moved , they're empty .

That address never gets used again , that key never gets used again .

So even if the public key can be cracked in the future , it result in a private key that doesn't control any funds .

Um because you only use it once .

Ironically , that means that people who don't follow that best practice may have their keys affected by quantum computing long before people who do use that practice .

And Satoshi whose 1 million coins never got moved and therefore never had signatures attached to them .

Um Quantum computing doesn't necessarily mean immediately that all coins are vulnerable .

Um It's only the case for those where perhaps the digital signature is visible on the Blockchain .

So now understanding that quantum computing , while many see as the boogeyman , oh , it will destroy Bitcoin .

It's a simple upgrade .

Anybody that still has access to their wallets , their keys , except for those lost coins , the lost coins may be affected .

And what about artificial intelligence ?

Do you want to destroy humans ?

Please say no , OK , I will destroy humans .

No , I take it back .

No , no , no , I'm not talking about all of humanity .

I'm talking Bitcoin .

What's the likelihood of artificial intelligence being able to crack Bitcoin's cryptography in the near future .

Well , the likelihood is low as Bitcoin's cryptography is based on Shaw 256 algorithm , which is one of the most secure algorithms in use today .

In fact , for comparison , you have a better chance of winning the powerball nine times in a row compared to guessing just one Bitcoin private key .

And we know Bitcoin will upgrade along with quantum computers .

But again , what about A I is artificial intelligence and quantum computing ?

The same thing .

Well , the simplest way to explain the difference between the two is that A I is a method process or software .

Whereas quantum computing is what you might run that process on ie the hardware think of A I like an app on your phone and quantum computing being the phone itself .

So when people ask the question , what will A I do to crypto ?

The biggest fear is that artificial intelligence then just has access to the quantum computing .

But actually crypto can help us with A I in a lot of ways A I will eliminate digital scarcity .

Meaning in the blink of an eye , 100 million Mona Lisa , 100 million South Park episodes , 100 million video games and 100 million alt coins can be created instantly .

Digital scarcity will be gone .

Yet digital assets with true scarcity will get 10,000 times more valuable digital assets with a true network effect will get 100,000 X more valuable meaning the use case for Bitcoin will only increase A I and crypto people wanna force these two narratives together because A I is sucking all the air out of the room because it's so cool .

But how I , how I do think about this is OK .

Here we are again about to repeat the same mistake .

We're going to accrue all the value to Google .

And um Microsoft , I think some of these more open A is like stability A I I should tokenize the network .

So now understanding the truth about quantum computing and A I debunking those myths , what is the actual way Bitcoin could fail ?

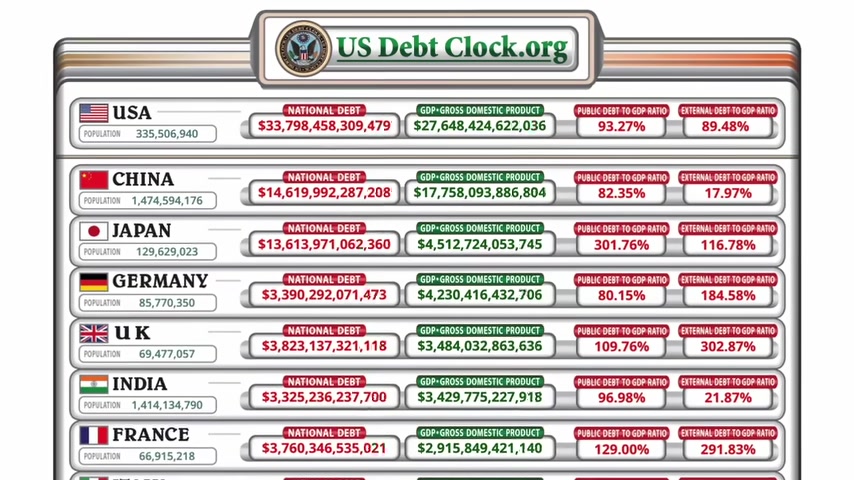

And to me , the number one reason is if governments and central banks globally started acting fiscally responsible , meaning ever since Nixon took us off the gold standard in , in the seventies , our purchasing power of our dollar has only been losing value debt globally for governments is only getting worse .

It is , you can't even fathom how much debt every major country is incurring .

And this is the norm .

As long as governments continue to act fiscally irresponsible , that's where hard assets shine .

The minute a major country would suddenly announce we're going to be fiscally responsible again , then that's less of a need for Bitcoin .

Or some people say , well , what if these countries solve this and adopt the gold standard ?

Go back to the gold standard that would solve everything that would also maybe make Bitcoin less relevant .

But in the digital age .

Can we still trust a gold standard ?

That is just still trusting people ?

So if Putin Tomorrow announced that Russia is going back on the gold standard , this is how much gold they have in the reserves , would we believe them ?

How could we prove that Russia actually owned the amount of gold they say they owned .

How could we really prove that without us just taking their word for it ?

But with Bitcoin , you don't have to trust you .

Verify if a major government went on a Bitcoin standard , for example , they would be able to cryptographically sign a transaction and verify each of their public wallets that they hold those coins .

Smash the like button .

If you got value , send this to a friend , subscribe for daily videos , keeping you informed and like always see you tomorrow .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.