https://www.youtube.com/watch?v=8lFONvL41GE

2 Bitcoin ETFs DELAYED! BlackRock (& Fidelity) move forward with Ethereum ETF! (Do Not Be Fooled)

Breaking news , smash the like button .

If you appreciate us coming at you on a Friday to clue you into this .

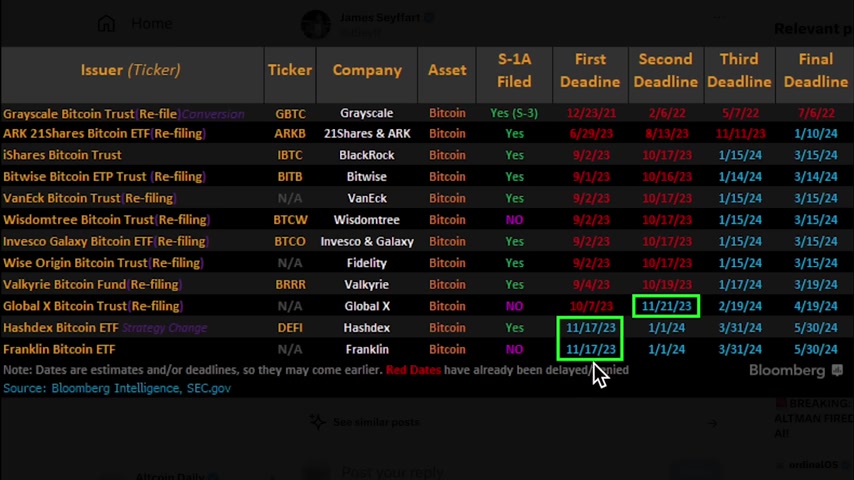

The SEC has officially delayed the 1.5 trillion asset manager , Franklin Templeton's spot Bitcoin ETF application .

This date was marked on our calendars .

You can see Franklin Bitcoin ETF .

You can see this date marked on our calendars here .

In addition , look at this global X's Spot Bitcoin ETF application delayed as well .

A comment period is beginning on this one .

They have 35 days taking us into late December for the SEC to review comments .

You can see that this one was marked on our calendars as well and actually the SEC ended up delaying it a few days early .

In addition , Bitcoin daily momentum is drying up .

Analyst crypto Rover says , I think we remain trade between $38,000 and $35,000 for the coming two months after the news hits the market that the ETF S get accepted .

We will enter the next range .

And that's the question .

And this is my question to you .

Do you think there's still a 90% chance that spot Bitcoin ETF S will get accepted by January 10th .

January 10th is the final deadline for ARC invests spot Bitcoin ETF .

Now the analysts have been saying for days and subscribe to our channel , we show you this kind of stuff .

They've been saying , ok , we're nearing in on deadline dates for three spot Bitcoin ETF applications .

I want to get ahead of it because there's a pretty good chance we'll see delay orders from the SEC .

This is what we saw .

This is what we saw .

What's the takeaway delays would not , will not change anything about our views .

90% chance spot Bitcoin ETF applications are accepted by January 10th , the big 1 1020 24 .

I see so many people being fooled .

I hope it's not you because I've been seeing many comments in our comment section on our videos saying that a spot Bitcoin ETF will do nothing for price .

This is Michael Sonnenschein , he him CEO at Greyscale Investments .

Greyscale is one of the big ones .

Waiting spot .

ETF approval is a Bitcoin spot ETF really the savior for price that we all think it is .

What if no new money enters ?

Isn't that a possibility ?

He really spells it out here .

Listen , I wish more people under stood this the premise behind the rise of Bitcoin is that ETF is going to be approved by the SEC and all of a sudden everybody's going to want to be in it .

There's gonna be a lot of buying Bitcoin that .

Why should we believe that new money will be attracted into Bitcoin once is approved as opposed to capital being reallocate within the Bitcoin Universe .

It's a great question , you know , today without having spot Bitcoin Etfs in the market , there are nearly $30 trillion of advised wealth in the US , just alone that needs access to crypto , that needs access to Bitcoin and by and large hasn't had access to it .

So the onset of Bitcoin ETF spot Bitcoin ETF really opened the door to financial advisors advised wealth really to have the opportunity to participate in Bitcoin in a way that they , they haven't had before .

And he was just speaking about the wealth markets .

What about the institutions ?

Surely institutions prefer ETFS too , right .

So you talked a little bit about the wealth market and the interest there .

What are you seeing from the institutional market ?

Are you seeing continued demand ?

Especially given what we just talked about with rates ?

I think that the introduction of the spot Bitcoin ETF will allow for institutions to participate as well .

What's been interesting about crypto as opposed other asset classes that came along before it , it was usually institutions who had access first and then it eventually trickled its way down to retail .

In the case of Crypt .

In the case of crypto , it went to retail first and institutions by and large haven't been able to participate and certainly having regulated instruments like ETF S will allow them to participate .

By the way , make sure you subscribe to our channel daily videos just like this , keeping you informed on the entire Cryptocurrency .

If you're interested in making money in Cryptocurrency , subscribe to our channel daily videos .

Now it's important to note and again , most people aren't talking about this .

We are Blackrock is continuing their application process to get that spot .

Ethereum ETF as well .

So one week ago , Blackrock registered its ishares Ethereum Trust with Delaware's division of corporations .

Today , we have a continuation .

Blackrock filed a form S one with us sec again for their spot Ethereum ETF in 2024 .

Do you think Bitcoin's ETF gets approved and Ethereum ETF gets approved or do you think one or the other or what are you thinking ?

This is how I see it , in my opinion .

This is a realistic scenario .

Now , the bullish scenario would be that it plays out just like Canada E ETF gets approved shortly after Bitcoin ETF is approved just like with Canada .

But this is my realistic scenario .

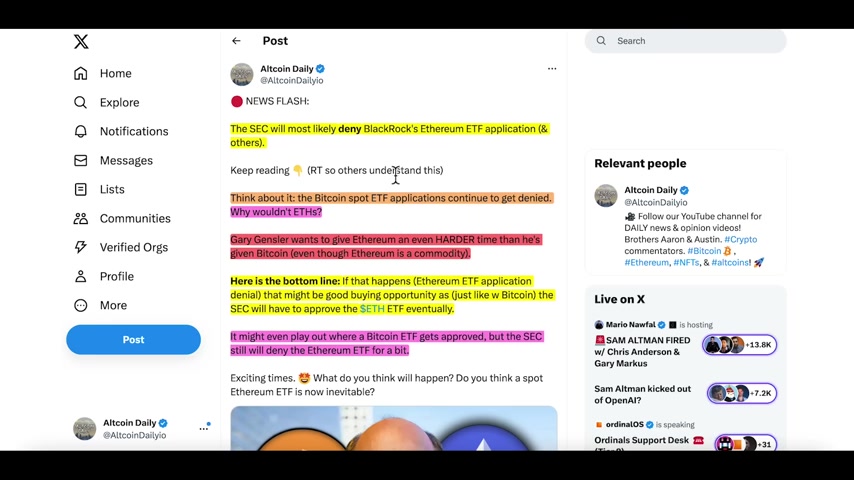

The SEC will most likely deny Blackrock's Ethereum ETF application and others keep reading like retweets .

So others understand this .

Think about it .

The Bitcoin spot ETF applications continue to get denied .

Why wouldn't es Gary Gensler wants to give Ethereum an even harder time than he's given Bitcoin even though Ethereum is a commodity .

Here's the bottom line .

If that happens , the ETF application denial that might be a good buying opportunity .

As just like with Bitcoin , the SEC will have to approve the E ETF .

Eventually , it might even play out where the Bitcoin ETF gets approved in 2024 .

But the SEC still continues to deny an Ethereum ETF for a bit .

Certainly exciting times .

What do you think will happen ?

Do you think a spot Ethereum ETF is inevitable or how do you think about it ?

If Blackrock's Spot Bitcoin ETF gets approved first , I could easily see something like this happening .

Blockchain boy , his analysis here .

I think this is a likely possibility if the Bitcoin Spot ETF gets approved first and we have to wait for the Ethereum ETF going forward into the next bull run .

I think that Bitcoin is going to lead the charge by a large wide majority because right now you have the spot ETF pending approval , Blackrock pretty much is gonna get that your odds for a Bitcoin Spot ETF to pass is 575 to 1 odds .

It's 99.9% chance of passing .

One thing I want to talk about with the spot .

ETF is the effect that this is going to have on the actual supply and demand of Bitcoin .

They're going to be removing a massive amount of the supply off of exchanges .

New Bitcoins being minted .

A spot ETF is going to be essentially like having 5 to 6 Hs at one time .

Sparking what could be the largest Bitcoin bull run by volume that we've ever seen .

And so that much volume could impact the price of Bitcoin in a way we've never seen .

Now , we did just get some breaking news .

I don't know .

Does this change your thesis fidelity ?

Like Blackrock is doubling down on crypto .

They just filed for an Ethereum .

ETF needless to say this is bullish for Ethereum .

Fidelity wants to create an Ethereum ETF joining Blackrock in doubling down on crypto .

Both Fidelity and Blackrock want to list both Bitcoin and Ethereum .

ETF S again , I remind you that spot ETF S in this case , holding Bitcoin and Ethereum , the biggest cryptocurrencies in the world , according to analysts , according to optimists will dramatically shake up the Cryptocurrency space in theory , will bring a flood of new investment money into digital assets , particularly with the market heft of famous firms like Fidelity and Blackrock .

My friends subscribe to the channel .

Feel free to watch these four you type videos that pop up on our home page here on youtube .

It's going to be a fantastic Thanksgiving and Christmas and we're really preparing for an epic 2024 .

See you guys tomorrow .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.