https://www.youtube.com/watch?v=QcIV5pLuZe4

Cathie Wood - The Crypto Bull Run Is About To Go F_king Crazy (8 Day Warning)

The health of the network is almost as good as it gets .

And it seems like this is a bull market , famed investor , Kathy Wood Ceo of Arkin Invests just went on C NBC this morning and confirmed a few things .

This is a global , if anyone owning Bitcoin knows this is global , this is not just a us opportunity and it's big .

And you know , if you look at , if you look at uh both Ether and Bitcoin , our expectation is well that the crypto asset ecosystem will be dominated by those two and that it is going to scale from a little more than a trillion dollars today to $25 trillion in 2030 .

As this new world builds out .

This is almost , I mean , I was at the beginning of the internet , not really that was DARPA and everything , but as we were studying it in the market in the nineties , this feels like that again .

And what she says next will shock you .

The reason we have focused as much on Ether Ethereum as we have is we think .

But if you hold crypto important the eight day window for the approval of 12 Bitcoin Spot Etfs is closing soon .

Kathy Wood owns one of them .

If you look at the pecking order , our filing is next in line .

No , I know you , you're on the list .

This will lead to huge demand for actual Bitcoin in the space , meaning these funds will be forced to buy Bitcoin .

But if they aren't accepted within the next four days , then we may have to wait until January 2024 .

Can we talk about spot Bitcoin though ?

What is the current timeline ?

I know that you and some others have been tweeting about windows .

Apparently , we're in one of them in terms of when we could see the 19 B fours approved .

What's going on .

Yeah .

So there's no four , you've got to walk us through that kind of jargon .

Yeah , 19 B four is basically it's uh you file for a rule change proposal to and in this case , the rule change proposal is to list Bitcoin Bitcoin ETF , spot Bitcoin ETF .

Uh And so there's all these deadlines and clocks , but all you really need to know is right now , there's a window , there's 12 different Spot Bitcoin ETF applications right now out there , there's a window right now where there's no comment periods , there's nothing that he has to do in all of them .

So theoretically , if they really wanted , they could approve all of them at once .

We also don't like we're not as tied up on that window .

Yes , that's possible .

But also like I said , there's 12 filings , nine of them , it doesn't matter anytime from now to January 10th , they can be approved and theoretically list at some point within that time range .

There's two processes that need to go on here .

There needs to be an S one approval and a 19 before approval 19 before is the one that everyone's been watching .

The one we've been watching closely and the one that we think is going to happen by January .

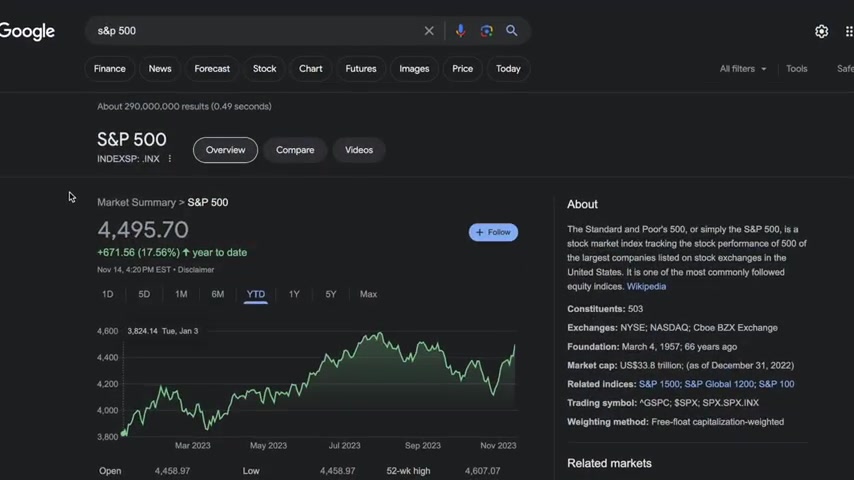

So looking at the Bitcoin price since the start of the year , start of 2023 Bitcoin has been rallying into the expectation of an approval .

Is this all just hype or is there some clear substance , some change in the SEC where they would approve ?

And the question is actually at $36,000 .

Do you think that the move that we've seen in Bitcoin over the last ?

I don't know what two months now , how much of that is a function of sort of a pent up demand or an anticipation that the SEC ?

Because folks like Blackrock and Fidelity and you and others have made these applications have the sense that it's more likely to happen now than it was a year or two ago .

Yes .

And is that misguided ?

Is that realistic ?

What is that ?

I think what has happened ?

The change is that the SEC actually asked us questions , I think , asked us questions , asked Blackrock probably has asked a lot , whereas before our filings were just rejected out of hand .

Ok .

So that is movement that is significant .

And , you know , over the years , I've gotten to know the research people at the SEC .

And I'm very impressed and I was impressed by the questions they asked us too .

So what were the kinds of questions they asked ?

A lot of them were very technical .

They're all about protecting the consumer .

And now we may have that clarity by the head of the Sec Gary Gensler who was hand picked back in the day by Elizabeth Warren .

Why ?

Even though Gary Gensler clearly understands the technology behind Bitcoin extremely well , why she believes he may be holding the spot et hostage he taught at MIT about .

So he understands that it's not a Ponzi scheme or a beanie baby .

So there has to be something else .

Well , I don't know what it is .

I have wondered there's speculation that he's interested in the treasury secretary position at some point .

What does the Treasury secretary fiat for the government ?

I mean , very focused on , I don't know and while we will talk about traditional markets , well as the latest CP I inflation data , which just came out today , let's just be very clear .

Is this a case of buy the rumor , then maybe sell the news .

How much do you account for the move in Bitcoin as speculation on an ETF being approved ?

And is it a buy the rumor , sell the news kind of situation or is it just a straight shot if in fact , that were to come to be , I am sure there is some anticipation and there could even be a sell on the news .

But the fundamentals , we put out a Bitcoin monthly piece every month and you can see the health of the network using our on chain metrics .

The health of the network is almost as good as it gets and it seems like this is a bull market .

Sure we'll have puts and takes nothing goes straight up .

But I think this flight to quality Larry Fink used that expression .

We call it flight to safety .

You look at what happened during the regional bank crisis .

Bitcoin went from 19,000 to nearly 30,000 as the Kr the bank , the regional bank stock index was imploding .

If you look at the bank stock index today , it is back down close to where it was in March .

Now , the latest results for inflation are in headline CP I came in at 3.2% lower than expectations .

And core CP I came in at 4% again , lower than expectations .

This is bullish , meaning you can see the effects of the FED starting to take hold .

Maybe disinflation is now more likely than hyper inflation .

And now that we know that this was better than expectations , maybe that means now the FED can lighten up even more on suppressing markets notice what fundstrat Global Advisors , managing partner , Tom Lee said yesterday .

So this was a day before the results .

He'll talk about how the SNP .

This is the month chart on the SNP rallied into this news , meaning the market expected favorable results .

And if the results would have been higher , more heated , what would that mean ?

Or lower , less heated closer to what we got ?

What does that mean ?

Brian ?

You might be surprised but I think institutional investors and retail have been fighting this rally .

Um You can see it in the put ratio .

Yes , the put call ratio today hit 1.26 .

That's an extremely elevated reading .

It's been rising the last two weeks .

And if you look since the October 27th rally every time an intra day , 1.2 is or higher has been hit , we've rallied hard the next day .

So I think into this print , if it's a little hot , I think people end up having to buy this dip because hedge funds have been shorting this rally .

I know sentiments negative , but I actually think that probabilities favor a slightly softer reading .

The skew is for a hot reading and I think we could get something that could feel like a face ripper like we had in July .

So there's a possibility of of quite a positive move tomorrow if it's a soft reading .

So basically markets are likely to go up if it's hot and markets are likely to go up a lot more if it's cold .

That's right .

Core CP I year over year , anything under 4.2 is bullish for him .

So you're looking at the month over month , not the year over year that I referenced .

Yes , the year over year matters on the core , it's still 42 year over year .

So something below 42 would be considered a soft side face ripper , possibly face ripper if you're invested in Cryptocurrency , make sure you subscribe .

We drop one video per day , keeping you informed .

People are worried about a hard landing and inflation for 20 years .

Tom .

That's exactly the point .

Which is funny because everybody knocks C NBC .

They're always like you guys are always pumping the market .

It's like everybody I know is bearish constantly , you know .

That's right .

I think and wrong .

Correct .

I think people forget that stocks tend to surprise us against what consensus is thinking .

And I would say put call doesn't lie , prime brokerage position doesn't lie .

The CT A chart shows the constellation of data shows .

People are still net short , not a believer in a seasonal year end rally .

That's non consensus view .

Like all we see tomorrow .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.