https://www.youtube.com/watch?v=m2ECiVxILhU

India's Free Trade Agreements

Free trade agreement .

India stands for a transparent equitable , inclusive , predictable non-discriminatory and rules based international trading system .

In this context , India's free trade agreements , F S and preferential trade agreements .

PS may be seen as a measured and calibrated exposure of the Indian economy to international competition .

Here N B will explain to NIU some details about F T A S .

What are F T A S F T A has established a fair set of rules for trade between the agreeing countries .

They provide each other favorable treatment by reducing trade barriers .

Firstly , they cut down the duties on imports of goods to and from the agreeing countries .

Besides , they also work on easing out non tariff barriers to exports like easing quantitative import restrictions , easing customs procedures , improving market access for service exports and better investment rules .

Why do countries sign F T A S help in trade creation , job creation and economic growth ?

They are also a diplomatic tool for improving international relations .

How does it affect Indian exporters and importers ?

If India has an F T A with the trading country and if the goods being traded is covered by the tariff reductions under the F T A , then the importer or exporter has to pay a reduced import duty and not the standard duty that is applied to other countries .

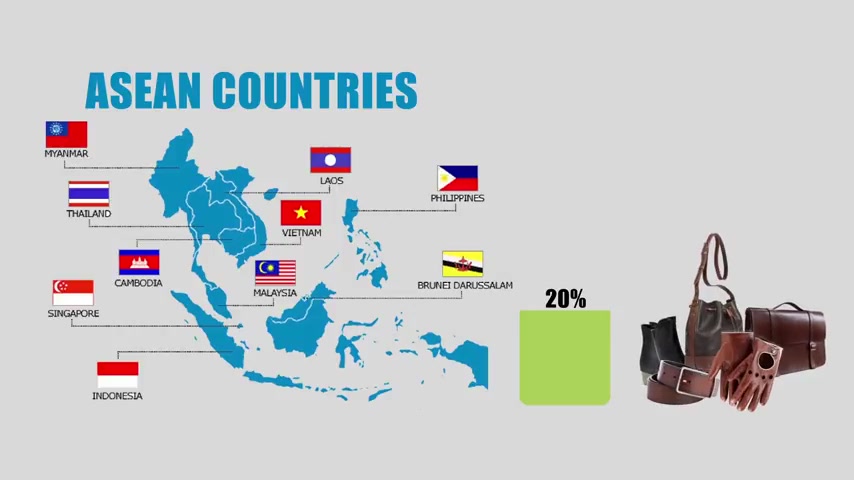

Here is an example , the Asian countries impose an import duty of 20% on leather goods .

However , under India , Asian F T A , the duty for India is 0% .

This means that an Indian leather exporter like Nikko can sell its goods to Asian countries at a 20% price advantage .

What are the different nomenclatures for F T A S F T A arrangements are known by various nomenclatures such as preferential trade agreement , P T A free Trade Agreement , F T A regional Trade Agreement , RT A Comprehensive Economic Cooperation Agreement , CE C A Comprehensive Economic Partnership Agreement , C EPA and Broad based Trade and Investment Agreement .

BT I A .

The difference amongst them is in their coverage ce C AC EPA BT I A cover an integrated package of agreements on goods , services , investments and intellectual properties , et cetera .

While the more traditional FS are limited to trading goods only , which are the countries with which India has a free trade agreement .

As of 2017 , India has signed 10 F T A s and six limited preferential trade agreements that is P T A S .

The lists of the F T A s that have been signed by India are India Sri Lanka , F T A S A F T A agreement on South Asian free trade area .

The seven member countries are India , Pakistan , Sri Lanka , Bangladesh , Nepal , Bhutan and Maldives , India , Nepal Treaty of Trade .

India , an agreement on trade , commerce and transit .

India , Thailand FDA early harvest scheme that is E H S India Singapore ce C A .

India , Asian F T A Asian countries include 10 of the Southeast Asian countries .

That is Vietnam , Thailand , Singapore , Cambodia , Indonesia , Malaysia , Myanmar , Philippines , Laos and Bruni , India , South Korea C epa India , Japan , C , Epa India , Malaysia ce C A .

The list of preferential trade agreements that is P T A S signed by India are A P T A that is Asia Pacific trade agreement member states exchanging concessions are India , China , South Korea , Sri Lanka and Bangladesh G S T P Global system of trade preferences under WTO .

This is open to all the member countries under the group of 77 under the WTO India Afghanistan P T A , India , Marco P T A , India , Chile , P T A and AAA preferential trading agreement and agreement on trade in service .

What documents are required to avail duty concession under any of India's F T A s to take the advantage of tariff benefits given under an F T A .

The Indian exporter like NIU has to prove that her goods are made in India as per the rules of origin agreed under the given F T A .

This is proven by a document called the preferential certificate of origin .

The list of agencies in India , NIU can approach for such a certificate of origin is listed under appendix two B of the foreign trade policy .

However , in case of an Indian importer , the certificate of origin would be issued by the corresponding agencies in the seller's country .

You may see the video on certificates of origin .

For more details .

For more information on F T A S , please visit the Department of Commerce website .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.