https://www.youtube.com/watch?v=dJLbD7f5cDk

How to Finance your Export Business' Working Capital

Pre export and post export financing has got a confirmed export order and has now started manufacturing her export items .

However , there is considerable working capital cost involved in the process and NIU does not have enough money to cover all the costs .

Not to worry .

We explain here how the government of India and banks can help her cover her costs .

Finance can be extended to exporters at the pre shipment stage in rupees as well as foreign currency .

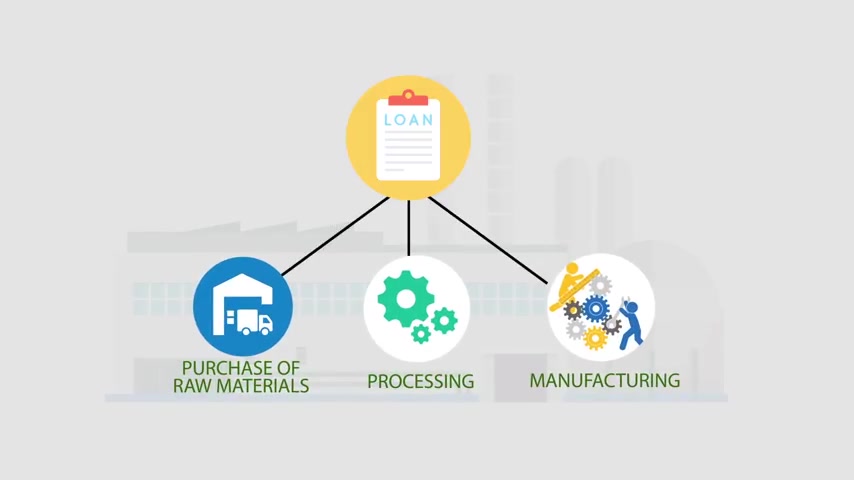

Here are some of the ways packing credit , working capital finance can be extended in anticipation that the borrower would receive payment on export of the goods .

This loan can be taken not just for packing but also for purchase processing and manufacturing of exports .

NIU needs to provide an export order or a letter of credit as proof .

There is an interest which is charged on the packing credit given further , the firm must pledge its stocks or other advances against the credit given shipment .

Finance , post shipment credit is an advance granted by a bank to an exporter like Nikko .

After export shipment , it is always given against the proof of shipment of exports like the export declaration forms prescribed by the R B I .

The advance is still the date of realization of the export proceeds , advance against duty .

Drawback duty drawback is a refund of duties like GST paid on inputs in the manufacture of export goods to the exporter .

Banks can grant advances to exporters against their entitlements of duty .

Drawback .

The period of such advances is up to 90 days shipping bill copies containing the E G M number needs to be produced to the banks for such advances .

Advance against scripts .

As explained in earlier video exporters are issued benefits by D G F T called A E I S and S C I S scripts under the export from India incentive scheme for their goods or service exports .

These scripts are freely transferable , they can be pledged to other parties in return for cash advances .

Such transactions involving scripts are usually between individual entities and not with banks .

Forfeiting a forfeit is a French term , meaning the right to relinquish here , Nikko can relinquish her right to a future cash receivable to a third party called the for in exchange .

The can provide her an immediate cash payment .

The disadvantage to Nikko here is that the value of this immediate cash payment would be at a discount to the actual receivable value .

The advantage here is that any risks and responsibilities for collecting the debt are passed on to the forfeit before forfeiting NIU should go through the specific R B A circulars on forfeiting and ensure compliance .

Factoring .

Factoring is similar to forfeiting in concept .

It differs from forfeiting in details as follows .

Firstly , factoring is done on trade receivables of short maturities .

Unlike forfeiting in factoring , the buyer has legal recourse in case of non payment and the entire risk and responsibilities are not transferred .

Thirdly in forfeiting , the export bill is purchased by the forfeit .

While in factoring , the invoice is purchased by the buyer at a discounted value .

There are specific R B I circulars on factoring that Nico should read through interest equalization scheme .

Lastly , the Department of Commerce or D G F T offers the interest equalization scheme under the scheme , the interest rate charged by banks on pre and post shipment credit finance is reduced by 3% per annum .

This reduction of 3% is covered by the government of India to support trade entrepreneurs like NIU .

For more details on packing credit , et cetera .

Nikko could approach a private or public sector bank .

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.