https://www.youtube.com/watch?v=St82Nm1dVHo

Union Budget 2023 - Big Relief For Middle-Class, No Income Tax Till ₹7 Lakh _ CNBC-TV18

� ਸੳੳੲ ੂੁੁੋੋੂੁੁ੍ੋੀ ੀੀੀੀੀੋੂੋੋੁੁੈੋੁ੍ੋੀ ੀੀੈੀੀੋੋ ੀੁੀੈੈੁੁੀੁੂੋੂੈੁੂੀ ੀੈੂੈੈੈੁ� �n 54 and section 54 f to 10 crows .

another proposal with similar intent is to limit income tax exemption from proceeds of insurance policies with very high value .

rationalization .

64.32 --> 131.32

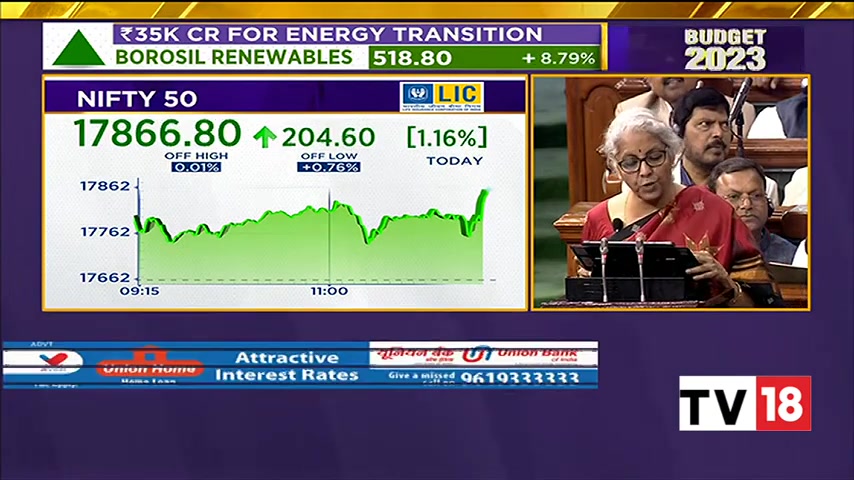

other major proposals in the financial to the following extension of period of tax benefits to funds relocating to ifsc , give city till 31-3-2025 .

decriminalization under section 276a of the income tax act , allowing carry forward of losses on strategic disinvestment , including that of idbi bank and providing eee status to adnibir fund .

� personal income tax now i come to what everyone is waiting for personal income tax i have five major announcements to make in this regard .

these primarily benefit our hard working middle class .

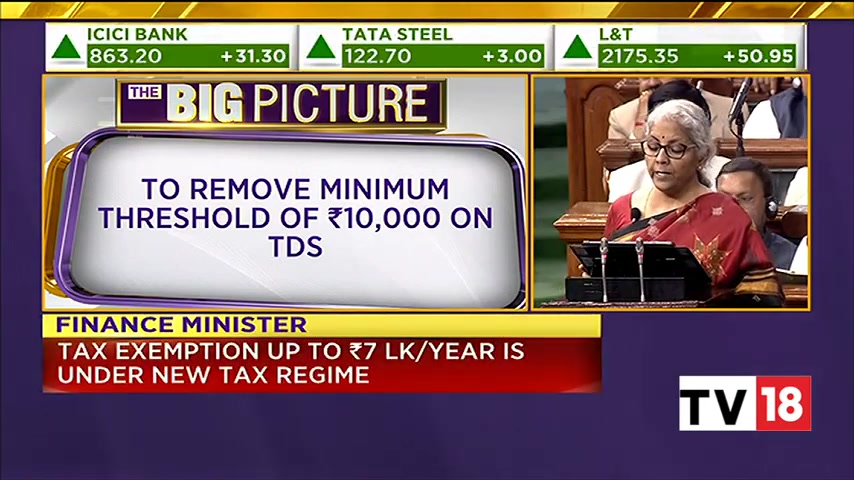

the first one concerns rebate .

currenly those with income up to 5 lakh do not pay any tax , do not pay any income tax in both old and new regimes .

i propose to increase the rebate limit to 7 lakhs in the new tax regime .

thus , persons in the new tax regime with income up to 7 lakhs will not have to pay any tax at all .

the second proposal relates to middle class individuals .

i had introduced in the year 2020 the new personal income tax regime , with 6 income slabs starting from $2,500,000 .

i propose to change the tax structure in this regime by reducing the number of slabs to 5 , and increasing the tax exemption limit to 3 lakhs .

the new tax rates are 0 to 3 lakh nil , 3 to 6 lakhs 5% , 6 to 9 lakhs 10% , 9 to 12 lakhs 15% , 12 to 15 lakhs 20% and above 15 lakhs 30% .

this will provide major relief to all taxpayers in the new regime by choosing an individual , an individual with an annual income of 9 lakhs will be required to pay only 45 thousand rupees .

this is only five percent of his or her income .

it is a reduction of 25 percent on what he or she is required to pay now .

that is 60 thousand .

so in the place of 60,000 , it is now only 45,000 .

343.88 --> 404.1524

my 4th announcement in personal income tax is regarding the highest tax rate , which in our country is 42.74% .

this is among the highest in the world .

i propose to reduce the highest surcharge rate from 37.2% to 40.8% .

� to 25% in the new tax regime .

this would result in reduction of the maximum rate to 39% .

lastly , the limit of 3 lakh rupees for tax exemption on leave and cashment on retirement of non-government salaried employees was last fixed in the year 2002 , when the highest basic pay in the government was only 30,000 rupees per month .

� in line with the increase in the government salaries , i am proposing to increase this limit to 25 lakh rupees .

we are also making the new income tax regime as the default tax regime .

however , citizens will continue to have the option to avail the benefit of the old tax regime .

apart from these , i am also making some other changes as given in the annexure .

as a result of these proposals , revenue of about �' 37 000 in direct taxes and rupees 1000 crore in indirect taxes will be foregone while revenue of about 3000 crore will be additionally mobilised thus the total revenue foregone is about 35 000 crore annually honourable speaker sir with these words i commend the budget to the saugus house

Are you looking for a way to reach a wider audience and get more views on your videos?

Our innovative video to text transcribing service can help you do just that.

We provide accurate transcriptions of your videos along with visual content that will help you attract new viewers and keep them engaged. Plus, our data analytics and ad campaign tools can help you monetize your content and maximize your revenue.

Let's partner up and take your video content to the next level!

Contact us today to learn more.